TVL in Crypto: Understanding Total Value Locked

📋 En bref (TL;DR)

- TVL (Total Value Locked): measures the total value of cryptocurrencies locked in a DeFi protocol

- Trust indicator: the higher the TVL, the more users trust the project

- Simple calculation: add up the value of all deposited assets and convert to dollars

- Limitations: TVL can be artificially inflated and says nothing about code quality or governance

- Tools: DeFiLlama, CoinMarketCap, and Dune Analytics let you track TVL in real time

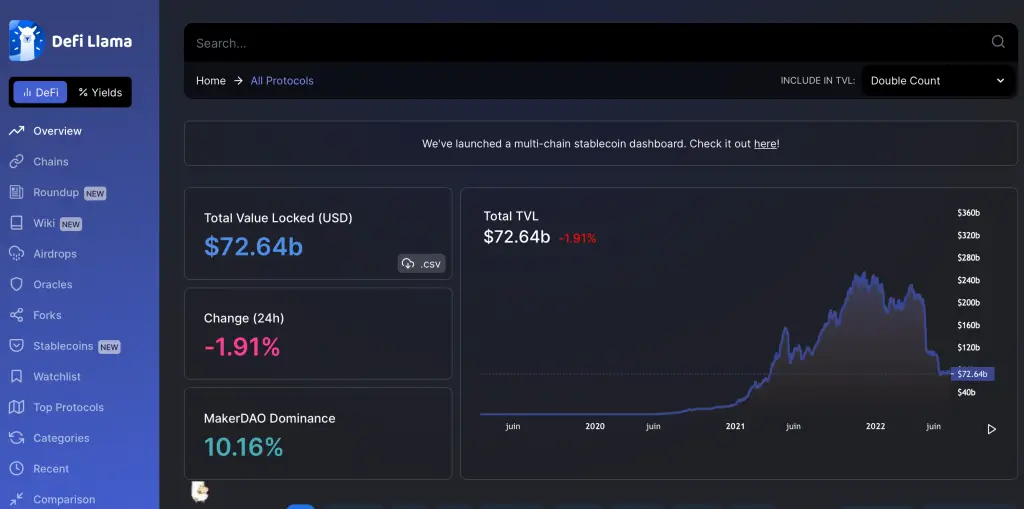

TVL, or “Total Value Locked,” measures the sum of all cryptocurrencies locked in the smart contracts of a DeFi platform. It’s the equivalent of the total money deposited in a bank, but for decentralized applications. The higher the TVL, the more users seem to trust the project. This reflects its popularity and the strength of its ecosystem. For a crypto beginner, it’s a simple indicator to understand. It helps identify serious projects. In short, TVL gives a first overview of a platform’s attractiveness.

And since the blockchain is transparent, this data is public and easily accessible on websites that track it.

How to Calculate TVL

Calculating TVL is straightforward. You add up the value of all assets deposited in a protocol, such as ETH, SOL, or USDT. Then, everything is converted to dollars to have a common base. For example, if a platform holds $100 million in ETH, $50 million in SOL, and $5 million in USDT (a stablecoin), its TVL would be $155 million. There is also an indicator called the TVL ratio: you divide the project’s market capitalization by its TVL. If the ratio is below 1, this may indicate undervaluation. Thus, this ratio can complement crypto analysis.

Why Is TVL Useful in Crypto?

TVL is a key tool for understanding a DeFi project. A high TVL means many users are locking their funds in the protocol. This can be for staking, farming, or lending. Therefore, the higher the TVL, the more the project inspires confidence. Moreover, it attracts promising altcoins, which strengthens crypto diversification. But beware: an artificially inflated TVL can hide low activity. Some projects attract users with high yields but don’t offer real value. Thus, you should always cross-reference this indicator with other data.

DeFi Projects with High TVL

Ethereum remains the dominant blockchain in terms of TVL. It concentrates the majority of locked funds. Following it are projects like Aave, Lido, MakerDAO, and Curve. These protocols show significant TVL thanks to their longevity and security. Tron, Avalanche, and Binance Smart Chain follow closely with significant volumes. Although Bitcoin is not DeFi, it is often used through bridge solutions. For example, Ethereum is a major altcoin with very high TVL. But note that some promising altcoins have lower TVL. This doesn’t mean they’re useless, but that they’re still young.

Rankings as of June 22, 2025

Aave

Aave is currently the protocol with the highest TVL. It offers decentralized lending and borrowing, allowing users to earn interest or borrow without going through a bank. It operates on 18 blockchains, giving it broad reach.

Lido

In second place is Lido, a liquid staking protocol. It allows users to stake cryptos (like ETH) while keeping a liquid version they can use elsewhere. It’s very popular among Ethereum users.

EigenLayer

EigenLayer, in third place, offers a feature called restaking. This means people can redeploy their staked ETH to secure other projects and earn additional yields.

Spark

Spark is linked to MakerDAO and the stablecoin DAI. It allows users to borrow at a fixed rate, making it attractive during volatile periods.

Ether.fi

ether.fi, in fifth place, is also based on ETH. It offers a decentralized version of liquid staking where users retain control of their funds.

Binance Staked ETH

Binance Staked ETH is a staking solution offered by Binance but available across multiple blockchains. It attracts users thanks to the platform’s reputation.

Ethena

Ethena, ranked 7th, offers a stablecoin backed by yield strategies. This protocol allows users to protect their capital while generating returns.

Pendle

Pendle, in eighth place, allows users to separate an asset’s yield from its value. You can thus trade or sell only the future interest, like a traditional financial product.

Sky

Sky is a multi-chain DeFi protocol that combines different yield sources for its users. It’s gaining visibility rapidly.

Babylon Protocol

Babylon Protocol also offers restaking, but with a different approach. It emphasizes security and transparency in fund management.

Uniswap

Uniswap, well known, is a decentralized exchange (DEX). It allows users to swap cryptos directly from a wallet, without registration. Despite its 11th position in TVL, it remains one of the most used.

Morpho

Morpho improves existing lending protocols by making them more efficient. It optimizes interest rates between lenders and borrowers.

Limitations of TVL in Crypto Analysis

TVL has its advantages but also its limitations. It’s a good indicator of trust. It shows user engagement and market size. However, it says nothing about code quality or project governance. A protocol can have a significant TVL but be poorly resilient against bugs. Additionally, large numbers attract hackers. Thus, the higher a TVL, the more attractive the target. Finally, TVL doesn’t account for crypto regulation or crypto taxation. Yet these factors can strongly influence a crypto investment.

Tracking TVL for Investment

To monitor TVL, you can use DeFiLlama, CoinMarketCap, or Dune Analytics. These sites update data in real time. They allow easy project comparisons. For a crypto beginner, TVL is a useful compass. But it’s not the only criterion to consider. You should also look at the code, the team, audits, the community, and overall crypto investment strategy. A good project combines stable TVL, good crypto yields, and good governance. For building solid crypto savings, it’s better to rely on multiple signals.

TVL and 2025 Crypto Trends

In 2025, TVL could continue to grow. Automated crypto investing, DeFi innovations, and restaking will likely reinforce this trend. However, TVL growth will come with increased oversight. Authorities are seeking to better regulate flows. This may slow some projects but also make the ecosystem safer. Good crypto wealth management will therefore factor in upcoming regulation. In short, TVL is an important indicator, but its context is evolving.

📚 Glossary

- TVL (Total Value Locked) : The total value of cryptocurrencies locked in a DeFi protocol’s smart contracts, expressed in dollars.

- DeFi : Decentralized Finance, a set of financial services operating on blockchain without traditional intermediaries.

- Staking : The act of locking your cryptocurrencies to participate in validating a network’s transactions and receive rewards in return.

- Smart Contract : A self-executing computer program deployed on a blockchain that automatically runs when predefined conditions are met.

- Altcoin : Any cryptocurrency other than Bitcoin. Ethereum, Solana, and Avalanche are examples.

- Stablecoin : A cryptocurrency whose value is pegged to a stable asset like the US dollar, to reduce volatility.

- Blockchain : A distributed and immutable digital ledger that records all transactions on a cryptocurrency network.

- Yield Farming : A strategy of moving cryptocurrencies between different DeFi protocols to maximize returns.

- DEX : Decentralized Exchange, a platform that allows trading cryptocurrencies without a central intermediary.

- Cryptocurrency : A digital currency that uses cryptography to secure transactions and operates on a blockchain.

Frequently Asked Questions

What is TVL in DeFi?

TVL (Total Value Locked) is the total value of cryptos locked in a DeFi protocol. This includes staking, lending, liquidity pools, etc. It reflects users’ confidence in a platform.

Why is TVL important for beginner crypto investors?

It helps identify solid projects. A high TVL can indicate a secure crypto with more liquidity and stability. It’s useful for beginners looking to limit risk.

How to use TVL in your crypto investment strategy?

TVL helps choose good projects for long-term crypto investing. It also enables smarter crypto diversification by avoiding platforms that are too new or underused.

Does TVL influence crypto yields?

Yes. Platforms with significant TVL often have more liquidity, therefore more regular yields from staking or farming. But beware, a high yield can also conceal greater crypto risk.

What are the risks of following only TVL?

TVL can be manipulated. Some projects artificially inflate their numbers. You should always cross-reference with other information: crypto analysis, reputation, open-source code, or security audits.

Where can you check a crypto project's TVL?

You can check TVL on specialized websites like DeFiLlama (the most widely used), CoinMarketCap, CoinGecko, or Dune Analytics. These platforms display real-time data and allow you to compare protocols.

Tips for using TVL effectively as a crypto beginner?

When starting out, it’s easy to be impressed by numbers. Don’t rely solely on TVL: cross-reference it with the project’s reputation, age, security audits, and community size. A high TVL is not a guarantee of reliability.

TVL in 2025: what can we expect?

The 2025 crypto trend shows a general rise in TVL, driven by the development of restaking (EigenLayer, Babylon), growing adoption of liquid staking (Lido, ether.fi), and the arrival of new innovative protocols. Increased regulation could, however, moderate this growth.

📰 Sources

This article is based on the following sources:

Comment citer cet article : Fibo Crypto. (2026). TVL in Crypto: Understanding Total Value Locked. Consulté le 6 February 2026 sur https://fibo-crypto.fr/en/blog/tvl-crypto-understanding-total-value-locked