What is an NFT? Complete Guide to Understanding Non-Fungible Tokens

📋 En bref (TL;DR)

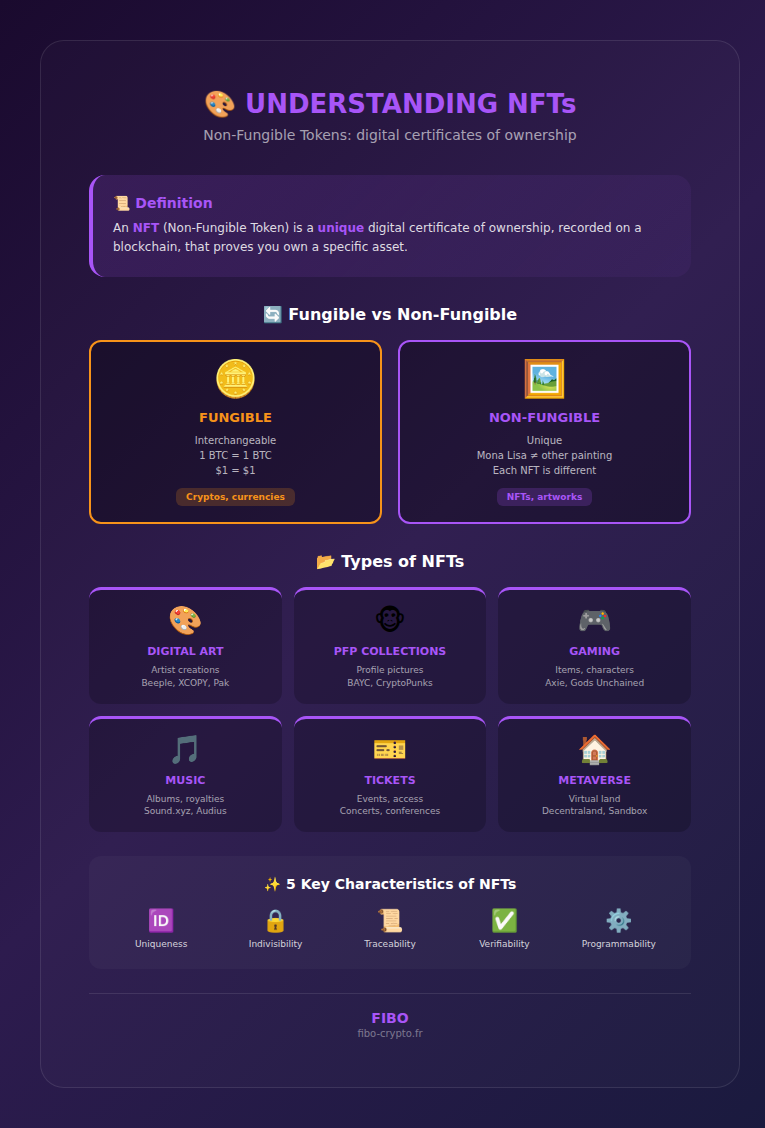

- Definition: An NFT (Non-Fungible Token) is a unique digital certificate of ownership, recorded on a blockchain, that proves you own a specific asset

- Non-fungible: Unlike crypto (1 BTC = 1 BTC), each NFT is unique and non-interchangeable — like the Mona Lisa can’t be swapped for another painting

- Use cases: Digital art, PFP collections (profile pictures), gaming, music, event tickets, certificates of authenticity, virtual land (metaverse)

- How it works: Blockchain (ownership registry) + Smart contracts (automatic rules) + IPFS (decentralized file storage)

- Risks: Extreme volatility, frequent scams, storage issues if centralized servers, unclear regulations

- Key takeaway: An NFT proves ownership, not value — do your own research (DYOR) before buying

NFTs (Non-Fungible Tokens) have revolutionized our concept of digital ownership. From artworks selling for millions of dollars to video game items and unforgeable concert tickets, this technology opens unprecedented possibilities.

What Is an NFT? Simple Definition

An NFT (Non-Fungible Token) is a unique digital certificate of ownership, recorded on a blockchain, that proves you own a specific asset — whether digital (image, video, music) or physical (artwork, luxury watch).

The term breaks down as follows:

- Non-Fungible: Unique and non-interchangeable. The Mona Lisa is non-fungible — you can’t exchange it for another painting and get “the same thing”

- Token: A digital asset recorded on a blockchain, representing a right of ownership

Imagine a property deed for a house, but in digital form, unforgeable and verifiable by everyone. That’s exactly what an NFT does.

5 Key Characteristics of an NFT

- Uniqueness: Each NFT has a unique identifier (Token ID) that distinguishes it from all others

- Indivisibility: An NFT generally cannot be divided into fractions

- Traceability: The complete history of owners and transactions is public and permanent

- Verifiability: Anyone can verify authenticity and current owner on the blockchain

- Programmability: NFTs can include automatic functions (royalties on each resale, access to services…)

How Do NFTs Work?

NFTs work through three technologies:

1. The Blockchain: The Inviolable Registry

Most NFTs are created on Ethereum, but other blockchains like Solana, Polygon, or Tezos are also used. The blockchain records:

- The unique NFT identifier (Token ID)

- The current owner (wallet address)

- The complete history of all transactions

- Metadata (link to file, attributes…)

2. Smart Contracts: Automatic Rules

NFTs are managed by smart contracts — autonomous programs deployed on the blockchain. They define the rules: who can transfer the NFT, royalties for the creator, terms of use…

3. File Storage

The file (image, video…) isn’t stored directly on the blockchain (too expensive). The NFT contains a link to the file, hosted on:

- IPFS (InterPlanetary File System): Decentralized storage, recommended for permanence

- Arweave: Permanent storage paid once

- Centralized servers: Less secure, risk of disappearing if the server closes

Different Types of NFTs

🎨 Digital Art

The most well-known type. Artists sell their digital works directly to collectors, with automatic royalties on each resale.

- Famous examples: Beeple (“Everydays” sold for $69M), XCOPY, Pak

- Platforms: SuperRare, Foundation, Art Blocks (generative art)

🐵 PFP Collections (Profile Picture)

Collections of thousands of algorithmically generated NFTs, used as profile pictures. They represent social status and grant access to exclusive communities.

- Examples: Bored Ape Yacht Club (BAYC), CryptoPunks, Azuki, Doodles

- Features: Random traits, variable rarity, commercial rights (sometimes)

🎮 Gaming and Metaverse

NFTs are revolutionizing gaming by allowing players to truly own their in-game items and resell them.

- Examples: Axie Infinity (creatures), Gods Unchained (cards), The Sandbox (land)

- Advantage: Potential interoperability between games

🎵 Music and Tickets

Artists use NFTs to sell directly to fans and receive royalties on each resale. NFT tickets are unforgeable and traceable.

- Music platforms: Sound.xyz, Audius, Royal

- Tickets: GET Protocol, YellowHeart

How to Buy an NFT?

1. Set Up Your Wallet

- Download a compatible wallet (MetaMask for Ethereum, Phantom for Solana)

- Buy the blockchain’s native crypto (ETH, SOL…)

- Secure your seed phrase

2. Choose a Marketplace

- OpenSea: The largest, multi-chain

- Blur: For active traders, 0% fees

- Magic Eden: Leader on Solana

- Foundation: Curated art, high quality

3. Do Your Research (DYOR)

- Verify the creator’s authenticity

- Analyze sales history

- Evaluate the community (Discord, Twitter)

- Beware of projects that seem too good to be true

NFT Risks

- Extreme volatility: Value can drop 90% in weeks

- Scams: Rug pulls, fake projects, phishing, malicious links

- Storage issues: If the file is on a centralized server that closes, you lose access to the image

- Unclear copyrights: Owning an NFT doesn’t always mean owning rights to the work

- Uncertain regulation: Laws are evolving and could impact the market

- Limited liquidity: Reselling an NFT can be difficult if no one wants it

The Future of NFTs

Beyond speculation, NFTs have concrete use cases that are developing:

- Certificates of authenticity: Luxury, art, collectibles

- Digital identity: Diplomas, certifications, badges

- Tickets and access: Events, exclusive memberships

- Tokenized real estate: Fractions of real properties

- Interoperable gaming: Items usable across multiple games

📚 Glossary

- NFT (Non-Fungible Token) : Unique digital certificate of ownership, recorded on a blockchain, proving possession of an asset.

- Non-fungible : Unique and non-interchangeable. Unlike $1 which always equals $1, each NFT is different.

- Blockchain : Decentralized and immutable digital ledger where all transactions and NFT ownership are recorded.

- Smart contract : Autonomous program deployed on a blockchain that automatically executes NFT rules (transfers, royalties…).

- Token ID : Unique identifier assigned to each NFT within a collection, distinguishing it from others.

- Metadata : Information associated with the NFT (name, description, attributes, link to file).

- IPFS : InterPlanetary File System — decentralized storage system used to permanently host NFT files.

- Royalties : Percentage automatically paid to the creator on each NFT resale (typically 2.5-10%).

- Mint : Action of creating an NFT on the blockchain. “Minting” is the initial registration process.

- Floor price : Lowest price at which an NFT from a collection is currently for sale.

- PFP : Profile Picture — NFT used as a profile photo on social networks.

- Rug pull : Scam where NFT project creators disappear with the money after the sale.

Frequently Asked Questions

Does an NFT have intrinsic value?

No, an NFT has no intrinsic value — its value depends on what someone is willing to pay. Like traditional art, value is subjective and depends on rarity, the artist, the community, and market demand.

Can you copy an NFT?

You can copy the image associated with an NFT (right-click, save), but you cannot copy the certificate of ownership on the blockchain. It’s like photocopying the Mona Lisa — you have a copy, not the authentic original.

Are NFTs bad for the environment?

NFTs on Ethereum used to consume a lot of energy before the switch to Proof of Stake (2022). Since then, the carbon footprint has been reduced by ~99%. Blockchains like Solana, Tezos, or Polygon are also energy-efficient.

What happens if the marketplace closes?

Your NFT exists on the blockchain, independent of the marketplace. You can still transfer or sell it on another platform. However, if the file was stored on centralized servers, it could disappear.

Are NFTs regulated?

Regulation varies by country and is evolving rapidly. In the US, the SEC is examining whether certain NFTs could be considered securities. In the EU, MiCA regulation provides some framework.

📰 Sources

This article is based on the following sources:

Comment citer cet article : Fibo Crypto. (2026). What is an NFT? Complete Guide to Understanding Non-Fungible Tokens. Consulté le 6 February 2026 sur https://fibo-crypto.fr/en/blog/what-is-an-nft-complete-guide