Why investing in crypto through a PSAN registered with France’s AMF matters

📋 En bref (TL;DR)

- PSAN : France’s mandatory crypto license (Prestataire de Services sur Actifs Numériques), created by the 2019 Pacte Act

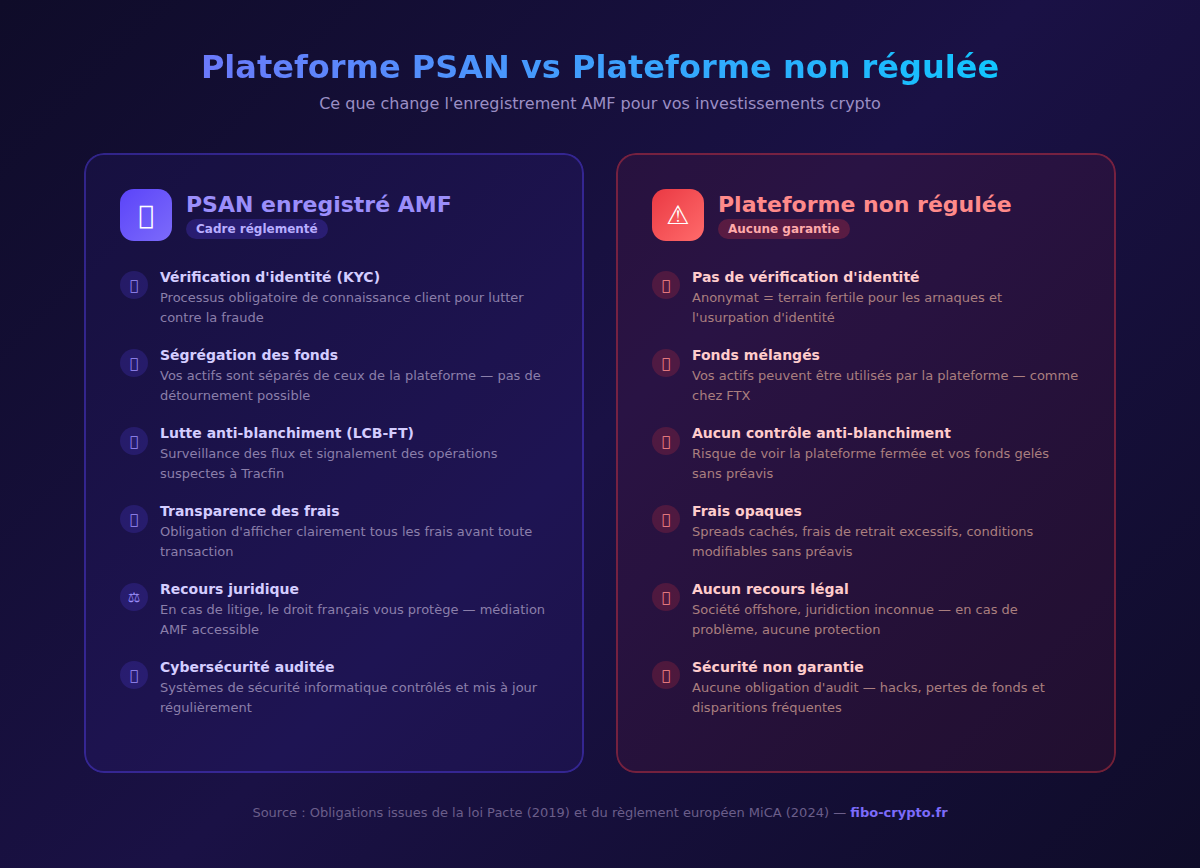

- Protection : PSAN requires identity verification (KYC), anti-money laundering compliance, fund segregation, and fee transparency

- 117 licensed platforms registered with France’s AMF by late 2025 — only a fraction of applicants are approved

- Preventing disasters : Scandals like FTX ($8 billion lost) and Mt. Gox (850,000 BTC) would have been impossible under PSAN rules

- Easy verification : Check the AMF’s public whitelist before investing on any platform

- MiCA : The EU-wide regulation (2024) is gradually replacing France’s PSAN with a pan-European CASP license — transition until June 30, 2026

- Registered vs. approved : Registration is mandatory; full approval (agrément) is a voluntary higher tier with stricter requirements

In November 2022, FTX — then the world’s third-largest crypto exchange — collapsed within days. Eight billion dollars in customer funds vanished. Its founder, Sam Bankman-Fried, was sentenced to 25 years in prison for fraud. This wasn’t a Bitcoin volatility problem — it was an unregulated platform that misappropriated user funds with zero oversight.

FTX wasn’t an isolated case. Back in 2014, Mt. Gox had already lost 850,000 BTC — worth billions at today’s prices. These disasters share a common thread: they happened on platforms with no meaningful regulatory framework. In France, a specific framework exists to prevent exactly this: the PSAN license, issued by the AMF (Autorité des Marchés Financiers), the French financial markets authority.

The Pacte Act and the birth of the PSAN framework

In May 2019, France passed the Pacte Act (Action Plan for Business Growth and Transformation). Among its many provisions, it created the PSAN status — Prestataire de Services sur Actifs Numériques, or Digital Asset Service Provider. The goal: regulate crypto activities in France and protect investors.

Since January 1, 2020, any company looking to offer the purchase, sale, custody, or exchange of cryptocurrencies in France must be registered with the AMF. It’s a legal requirement, not an option. Platforms operating without registration face criminal penalties — up to two years’ imprisonment and a €30,000 fine.

By the end of 2025, approximately 117 PSANs were registered in France. While that may sound like a lot, it represents only a fraction of total applications. The AMF rejects or requests additional documentation from many applicants, reflecting the rigor of the selection process.

What a PSAN license actually requires

PSAN registration isn’t just a rubber stamp. It commits the platform to specific, verifiable obligations:

Identity verification (KYC)

Every customer must be rigorously identified before using the platform’s services. This KYC (Know Your Customer) process includes verifying identity, address, and often the source of funds. It prevents fraudulent use and protects users against identity theft.

Anti-money laundering (AML)

PSANs must implement a comprehensive AML/CFT framework (Anti-Money Laundering / Combating the Financing of Terrorism). This means continuous transaction monitoring, reporting suspicious activity to Tracfin (France’s financial intelligence unit), and retaining data for at least five years.

Fund segregation

This is the direct lesson from FTX: a PSAN must keep client funds separate from its own operating funds. Your crypto and euros cannot be used by the platform for its own purposes. Had FTX been subject to this requirement, the $8 billion embezzlement would never have happened.

Transparency and disclosure

Fees must be clearly displayed before any transaction. The platform must also inform clients about risks associated with digital asset investments. No hidden fees, no disguised spreads, no quietly changing terms.

Cybersecurity

PSANs must maintain robust IT security systems, subject to regular audits. Client digital asset custody follows strict protocols to prevent hacking.

Registered vs. approved: what’s the difference?

The French framework distinguishes two levels of recognition:

PSAN registration is the mandatory baseline for operating. It verifies that the platform meets minimum requirements: KYC, AML, governance, and cybersecurity. This is the regulatory entry threshold.

PSAN approval (agrément) is a higher, voluntary tier. It imposes stricter requirements: professional liability insurance, minimum capital, enhanced internal controls, and additional client protection obligations. Very few providers have obtained this approval, which signals a deeper commitment to investor protection.

How to check if a platform is PSAN-registered

Before investing on any platform, there’s one simple reflex: verify its registration. The AMF maintains a public whitelist, freely accessible:

🔗 List of registered PSANs and CASPs — AMF Protect Épargne

On this page, you can search for a platform by name and check:

- Whether it’s registered (and the registration date)

- Which services are authorized (buy/sell, custody, exchange, etc.)

- The company’s exact legal name

Important note: PSAN registration is not an investment recommendation from the AMF. It guarantees compliance with a regulatory framework, but doesn’t protect against market volatility or poor investment decisions. The AMF consistently reminds investors that crypto-asset investments carry a risk of capital loss.

Volatility vs. insecurity: two different things

The cryptocurrency market is inherently volatile. Bitcoin can drop 20% in a week, then rebound the following month. That’s a characteristic of this asset class, not a flaw in the platform you’re using.

However, losing your funds because a platform went bankrupt, got hacked, or embezzled client money — that’s operational risk. And that’s precisely what the PSAN framework aims to eliminate.

With a PSAN, you accept market risk (volatility) while significantly reducing or eliminating counterparty risk (platform reliability).

Examples of registered PSANs in France

Here are some French platforms that have obtained PSAN registration from the AMF. Each offers different services tailored to various investor profiles:

Fibo

Registered as a PSAN since July 2024, Fibo takes a wealth management approach to crypto investing. The platform stands out with personalized guidance and allocation tools designed for investors looking to integrate digital assets into a long-term strategy.

StackInSat

Specializing in automated Bitcoin investing through the DCA (Dollar-Cost Averaging) method, StackInSat offers scheduled recurring purchases. The platform targets investors who want to smooth their market entry by investing regularly, regardless of short-term price swings.

Meria

Founded by Owen Simonin (InvestX), Meria offers buying, staking, and masternode services. The platform has been PSAN-registered since 2021 and caters to technically-minded investors looking to generate additional yield on their crypto holdings.

Binance France

The world’s largest exchange has been PSAN-registered since May 2022 through its subsidiary Binance France SAS. The platform offers a vast catalog of 400+ cryptocurrencies and advanced features (trading, staking, derivatives). Its feature richness can, however, feel overwhelming for beginners.

The future: from PSAN to CASP under MiCA

The regulatory landscape is evolving. Since December 30, 2024, the European MiCA regulation (Markets in Crypto-Assets) has been in effect. It’s gradually replacing national frameworks — including France’s PSAN — with a harmonized EU-wide system.

The new designation is CASP (Crypto-Asset Service Provider), known in French as PSCA. Existing French PSANs benefit from a transitional period: they have until June 30, 2026 to obtain their CASP authorization and gain the ability to operate across the entire European Union through a passporting system.

For investors, MiCA strengthens protections further: higher capital requirements, stricter stablecoin rules, and mandatory white papers for each crypto-asset offered. It’s another step toward market maturity — and a model that could inspire similar frameworks worldwide.

Conclusion

Investing in crypto without verifying your platform’s regulatory status is an unnecessary risk. The FTX and Mt. Gox scandals proved that even the largest exchanges can collapse when operating without oversight. In France, the PSAN framework provides tangible safeguards: identity verification, fund segregation, transparency, and legal recourse.

Before opening an account on any crypto platform, take 30 seconds to check the AMF’s whitelist. That simple habit can make the difference between a controlled investment and a costly surprise.

📚 Glossary

- PSAN : Prestataire de Services sur Actifs Numériques (Digital Asset Service Provider). France’s mandatory crypto license created by the Pacte Act, required for any platform offering crypto services in France.

- AMF : Autorité des Marchés Financiers. France’s financial markets authority, responsible for investor protection and oversight of financial markets, including digital assets.

- KYC : Know Your Customer. Mandatory identity verification process before opening an account on a financial platform.

- AML/CFT : Anti-Money Laundering / Combating the Financing of Terrorism (LCB-FT in French). Mandatory measures to detect and report suspicious transactions.

- MiCA : Markets in Crypto-Assets. The EU-wide regulation harmonizing crypto-asset oversight across all member states, effective since December 2024.

- Fund segregation : The obligation to keep client assets separate from the platform’s own assets, ensuring funds cannot be misappropriated.

- Digital asset : A digital representation of value based on blockchain technology. The French legal term encompasses both cryptocurrencies and tokens.

- Pacte Act : French law of May 22, 2019 on business growth and transformation, which created the PSAN regulatory framework.

Frequently Asked Questions

What is a PSAN and why does it matter?

A PSAN (Prestataire de Services sur Actifs Numériques) is a company authorized by France’s AMF to offer crypto-related services. Registration ensures compliance with security, identity verification, anti-money laundering, and fee transparency requirements. It’s your first line of defense against scams and unreliable platforms.

How can I verify if a platform is PSAN-registered?

Visit the AMF Protect Épargne website (protectepargne.amf-france.org) and check the PSAN/CASP whitelist. Search for the platform by name to see whether it’s registered, its registration date, and which services it’s authorized to provide.

Does PSAN registration protect against capital loss?

No. PSAN protects against operational risks (fraud, fund misappropriation, hacking) but not against market volatility. You can still lose money if crypto prices decline. PSAN registration is not an investment recommendation.

What's the difference between PSAN registration and PSAN approval?

Registration is the mandatory baseline for operating in France. Approval (agrément) is a higher voluntary tier with stricter requirements: professional insurance, higher capital reserves, and enhanced internal controls. Very few providers have achieved full approval.

What does MiCA mean for investors using French platforms?

MiCA harmonizes crypto regulation across the EU. The French PSAN status is being replaced by CASP (Crypto-Asset Service Provider). Protections are strengthened and platforms will be able to operate EU-wide with a single license. Existing PSANs have until June 30, 2026 to complete the transition.

Can a PSAN-registered platform still go bankrupt?

Yes — PSAN registration doesn’t guarantee a platform’s financial viability. However, thanks to fund segregation, your assets remain yours even if the platform goes under. This is a major protection that unregulated platforms don’t offer.

📰 Sources

This article is based on the following sources:

- List of registered PSANs and CASPs — AMF Protect Épargne

- Pacte Act — Article L54-10-3 of the French Monetary and Financial Code (Legifrance)

- MiCA Regulation — Regulation (EU) 2023/1114 of the European Parliament

- Investing in crypto-assets — AMF

- PSAN to CASP transition — Boursorama

Comment citer cet article : Fibo Crypto. (2026). Why investing in crypto through a PSAN registered with France's AMF matters. Consulté le 6 February 2026 sur https://fibo-crypto.fr/en/blog/why-invest-crypto-regulated-psan-amf