What Is Crypto Lending? Complete Guide

📋 En bref (TL;DR)

- Definition: crypto lending allows you to lend or borrow cryptocurrencies for interest, without going through a bank

- How it works: lenders deposit their crypto into a protocol, borrowers use collateral to obtain a loan

- Yields: rates range from 1% to over 15% APY depending on assets and protocols

- Risks: vulnerable smart contracts, collateral liquidation, counterparty risk on centralized platforms

- Key takeaway: lending is a DeFi pillar but requires a solid understanding of the mechanics before getting started

What is crypto lending?

Crypto lending is a mechanism that allows cryptocurrency holders to lend their digital assets to other users in exchange for interest, or to borrow crypto by providing collateral. This system replicates the operation of traditional bank loans, but in a decentralized manner without financial intermediaries.

Unlike staking, which involves locking your crypto to secure a blockchain network, lending involves a temporary transfer of assets to a protocol or platform that redistributes them to borrowers. This fundamental distinction explains why the two mechanisms offer different risk and return profiles.

Crypto lending has grown massively since 2020 with the rise of decentralized finance (DeFi). Today, billions of dollars are locked in lending protocols, making lending one of the most popular use cases for blockchain technology.

How does crypto lending work?

Crypto lending relies on three fundamental mechanisms: asset deposits (supply), borrowing with collateral (borrow), and variable interest rates determined by supply and demand. These elements combine to create a decentralized money market.

Supply: depositing your crypto

The lender (or “supplier”) deposits their cryptocurrencies into a liquidity pool. In return, they receive tokens representing their deposit (aTokens on Aave, cTokens on Compound). These tokens automatically appreciate over time thanks to the interest generated.

The most commonly lent assets are stablecoins (USDC, USDT, DAI) because they offer stable returns without exposure to price volatility. Major cryptocurrencies like ETH and BTC (in wrapped form) can also be lent.

Borrow: borrowing with collateral

To borrow, the user must first deposit collateral worth more than the borrowed amount. This “over-collateralization” system protects the protocol against defaults. Typically, the collateralization ratio varies between 125% and 150% depending on the assets.

Example: to borrow $1,000 in USDC, you’ll need to deposit approximately $1,500 worth of ETH as collateral. If the value of your collateral falls below a critical threshold, your position will be automatically liquidated.

Interest rates: supply and demand

Interest rates on lending protocols are determined algorithmically based on the utilization rate of the pool. The more an asset is borrowed (high utilization), the more rates increase to attract new lenders. Conversely, if few users borrow, rates decrease.

Most protocols use variable rates that can change with each block. Some, like Aave, also offer fixed rates for borrowers seeking more predictability.

Major DeFi lending protocols

Three protocols dominate the decentralized lending market: Aave, Compound, and MakerDAO. Each brings specific innovations and targets different user profiles.

Aave: the DeFi lending leader

Aave is the most widely used lending protocol with over $10 billion in TVL (Total Value Locked). Launched in 2020, it stands out through several innovations:

- Flash loans: instant loans without collateral, repaid within the same transaction

- Stable rates: fixed rate option for borrowers

- Multi-chain: available on Ethereum, Polygon, Avalanche, Arbitrum and more

- Safety Module: insurance fund to protect depositors

Compound: the pioneer

Compound popularized the concept of algorithmic money markets as early as 2018. Its simple and audited operation makes it a reference for developers. The protocol introduced the concept of “cTokens” that represent deposits and automatically accumulate interest.

Compound V3 (also called Compound III) has simplified the architecture to focus on more secure isolated markets, with USDC as the primary borrowing asset.

MakerDAO: the creator of DAI

MakerDAO works differently: rather than lending existing cryptos, it allows users to create (or “mint”) DAI, a decentralized stablecoin, by depositing collateral. This “Vaults” system (formerly CDPs) was the first major DeFi protocol on Ethereum.

The borrowing rate on Maker is called the “Stability Fee” and is set by governance rather than the market. This particularity makes DAI less volatile than rates on other protocols.

Centralized vs decentralized lending

Crypto lending exists in two forms: centralized platforms (CeFi) like Nexo or BlockFi, and decentralized protocols (DeFi) like Aave. Each approach has specific advantages and risks.

Centralized lending (CeFi)

Centralized platforms operate like crypto banks. You entrust them with your assets and they manage the loans on their end. Advantages:

- Simple interface, suitable for beginners

- Customer support and assistance if problems arise

- Sometimes attractive promotional rates

- No need to understand smart contracts

Major drawbacks: you don’t control your private keys (“not your keys, not your coins”), and the company can go bankrupt. The bankruptcies of Celsius, BlockFi, and Voyager in 2022 demonstrated the risks of this model.

Decentralized lending (DeFi)

DeFi protocols operate entirely on the blockchain via smart contracts. You maintain control of your assets (self-custody) and can withdraw at any time. Advantages:

- Total transparency: everything is verifiable on-chain

- No KYC or geographic restrictions

- Complete control of your funds

- Composability with other DeFi protocols

Drawbacks: technical complexity, smart contract risks, and gas fees on certain blockchains.

Crypto lending risks

Crypto lending is not without risk. Three main categories threaten users: technical vulnerabilities, liquidation mechanisms, and counterparty risk.

Smart contract risk

DeFi protocols rely on computer code. A flaw in a smart contract can allow hackers to drain funds. Even the most audited protocols have suffered exploits: Euler Finance lost $197 million in March 2023, later recovered through negotiations.

To limit this risk: favor established protocols with a long track record, verify security audits, and never put all your funds in a single protocol.

Liquidation risk

If you borrow, your collateral can be liquidated if its value drops too much. Liquidation is triggered automatically when the health factor falls below the minimum threshold. You then lose part of your collateral (typically 5 to 15% penalty).

Concrete example: you deposit $10,000 worth of ETH and borrow $6,000 in USDC (167% ratio). If ETH drops 30%, your collateral is only worth $7,000 and your ratio falls to 117%. You get liquidated, losing part of your ETH.

Counterparty risk

On centralized platforms, the main risk is company bankruptcy. Unlike traditional banks, crypto deposits are generally not guaranteed by a protection fund.

Even in DeFi, risk exists if the protocol uses faulty oracles or if governance makes detrimental decisions. Diversification remains the best protection.

Advanced lending strategies

Beyond simple deposits to generate interest, lending enables more sophisticated strategies like yield farming and leverage use.

Yield farming with lending

Yield farming involves optimizing returns by combining multiple protocols. A common strategy:

- Deposit ETH on Aave as collateral

- Borrow stablecoins against that ETH

- Deposit those stablecoins in another protocol offering returns higher than the borrowing cost

- Reinvest the gains

This strategy is profitable as long as the yield obtained exceeds the borrowing cost. Warning: it also amplifies risks.

Leverage

Lending allows leveraged exposure without going through margin trading. Example of a “loop”:

- Deposit $10,000 worth of ETH

- Borrow $6,000 in stablecoins

- Swap those stablecoins for more ETH

- Redeposit that ETH as collateral

- Repeat the process

This technique multiplies ETH exposure but considerably increases liquidation risk. It’s reserved for experienced users.

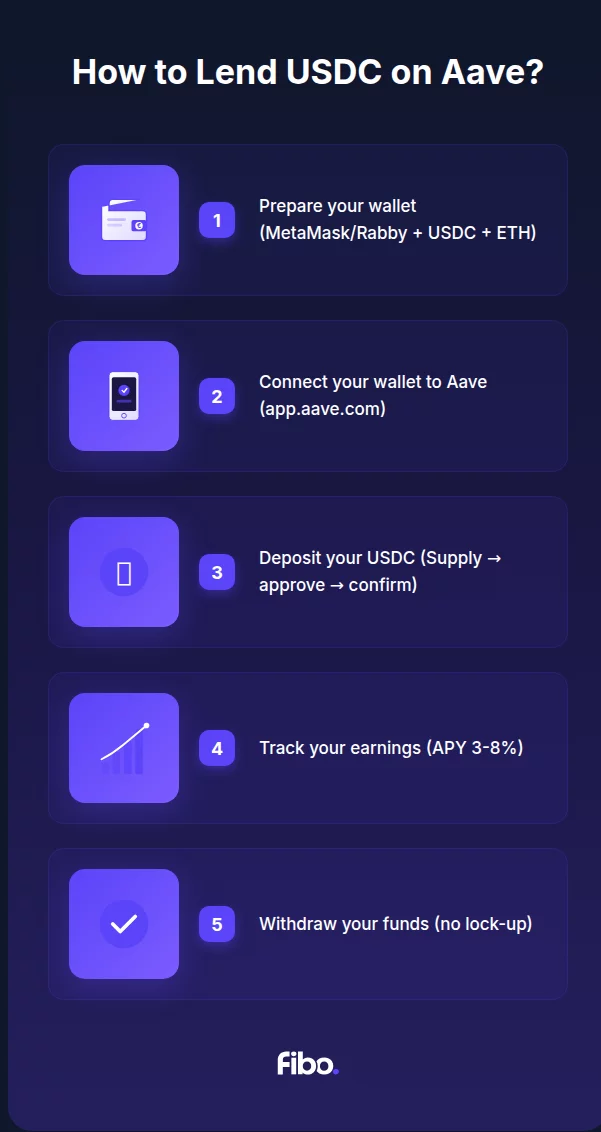

Practical example: lending USDC on Aave

Here’s a step-by-step guide to start generating returns by lending stablecoins on Aave, the most widely used lending protocol.

Step 1: Prepare your wallet

You’ll need a non-custodial wallet like MetaMask or Rabby, funded with USDC and ETH (for gas fees). For reduced fees, use Aave on Polygon or Arbitrum rather than Ethereum mainnet.

Step 2: Connect your wallet to Aave

Go to app.aave.com and connect your wallet. Select the network (Ethereum, Polygon, Arbitrum…) matching your funds.

Step 3: Deposit your USDC

In the “Supply” section, select USDC and enter the amount to deposit. First approve the contract (first transaction), then confirm the deposit (second transaction). You’ll receive aUSDC in return.

Step 4: Track your earnings

Your aUSDC automatically appreciates. The displayed yield is the APY (Annual Percentage Yield), the annualized rate including compound interest. In January 2026, USDC yields vary between 3% and 8% depending on the network and demand.

Step 5: Withdraw your funds

You can withdraw at any time via the “Withdraw” section. Funds are available instantly, with no lock-up period.

📚 Glossary

- APY (Annual Percentage Yield) : annualized return including compound interest. A 5% APY means your deposit increases by 5% over one year if rates remain constant.

- Collateral : asset deposited as security to obtain a loan. In crypto, loans are over-collateralized (collateral value greater than the loan).

- DeFi (Decentralized Finance) : ecosystem of financial services built on blockchain via smart contracts, without centralized intermediaries.

- Flash Loan : instant loan without collateral that must be repaid within the same blockchain transaction. Used for arbitrage and refinancing.

- Health Factor : indicator of a borrowing position’s health. Below 1, the position can be liquidated.

- Liquidation : forced sale of collateral when its value becomes insufficient to guarantee the loan.

- Liquidity Pool : reserve of assets supplied by depositors from which borrowers draw.

- LTV (Loan-to-Value) : ratio between the borrowed amount and collateral value. A 75% LTV means you can borrow up to 75% of your collateral’s value.

- Smart Contract : self-executing computer program deployed on a blockchain. Lending protocols operate through these contracts.

- Stablecoin : cryptocurrency whose value is pegged to a fiat currency (usually the US dollar). Examples: USDC, USDT, DAI.

- Staking : mechanism of locking cryptocurrencies to participate in validating a Proof of Stake network and receive rewards.

- TVL (Total Value Locked) : total value of assets deposited in a DeFi protocol. Indicator of a protocol’s size and trust.

- Utilization Rate : percentage of deposited funds currently borrowed. Directly influences interest rates.

- Variable Rate : interest rate that fluctuates in real-time based on supply and demand on the protocol.

- Yield Farming : strategy of moving crypto between different DeFi protocols to maximize returns.

Frequently Asked Questions

Is crypto lending profitable?

Returns vary from 1% to over 15% APY depending on assets and market conditions. Stablecoins generally offer between 3% and 8%, which remains higher than traditional bank savings accounts. However, returns must be weighed against risks (smart contracts, liquidation).

Can you lose money in lending?

Yes, several scenarios can lead to losses: a protocol hack, liquidation of your collateral if you borrow, or bankruptcy of a centralized platform. Diversification and choosing established protocols limit these risks.

What's the difference between lending and staking?

Staking involves locking your crypto to secure a blockchain network (Proof of Stake), while lending consists of lending your assets to other users. Both generate returns, but the mechanisms and risks are different.

Do I need to declare lending income for taxes?

Tax treatment of lending income varies by jurisdiction. In most countries, interest earned from crypto lending is taxable income. Consult a tax professional specializing in cryptocurrency for your specific situation.

What's the best lending protocol in 2026?

Aave remains the undisputed leader thanks to its liquidity, security, and multi-chain availability. For beginners, it’s the safest choice. Compound is also solid and simpler. Avoid new protocols offering excessively high yields.

Can you do lending without KYC?

Yes, DeFi protocols like Aave, Compound, or MakerDAO require no identity verification. Simply connect your wallet to get started. Centralized platforms (CeFi), however, generally require full KYC.

What's the minimum investment for lending?

Technically, there’s no minimum on DeFi protocols. However, gas fees on Ethereum can make small amounts unprofitable. On networks like Polygon or Arbitrum, you can start with a few dozen dollars efficiently.

📰 Sources

This article is based on the following sources:

Comment citer cet article : Fibo Crypto. (2026). What Is Crypto Lending? Complete Guide. Consulté le 7 February 2026 sur https://fibo-crypto.fr/en/blog/what-is-crypto-lending