Complete Guide to Crypto Taxation in France (Updated 2026)

📋 En bref (TL;DR)

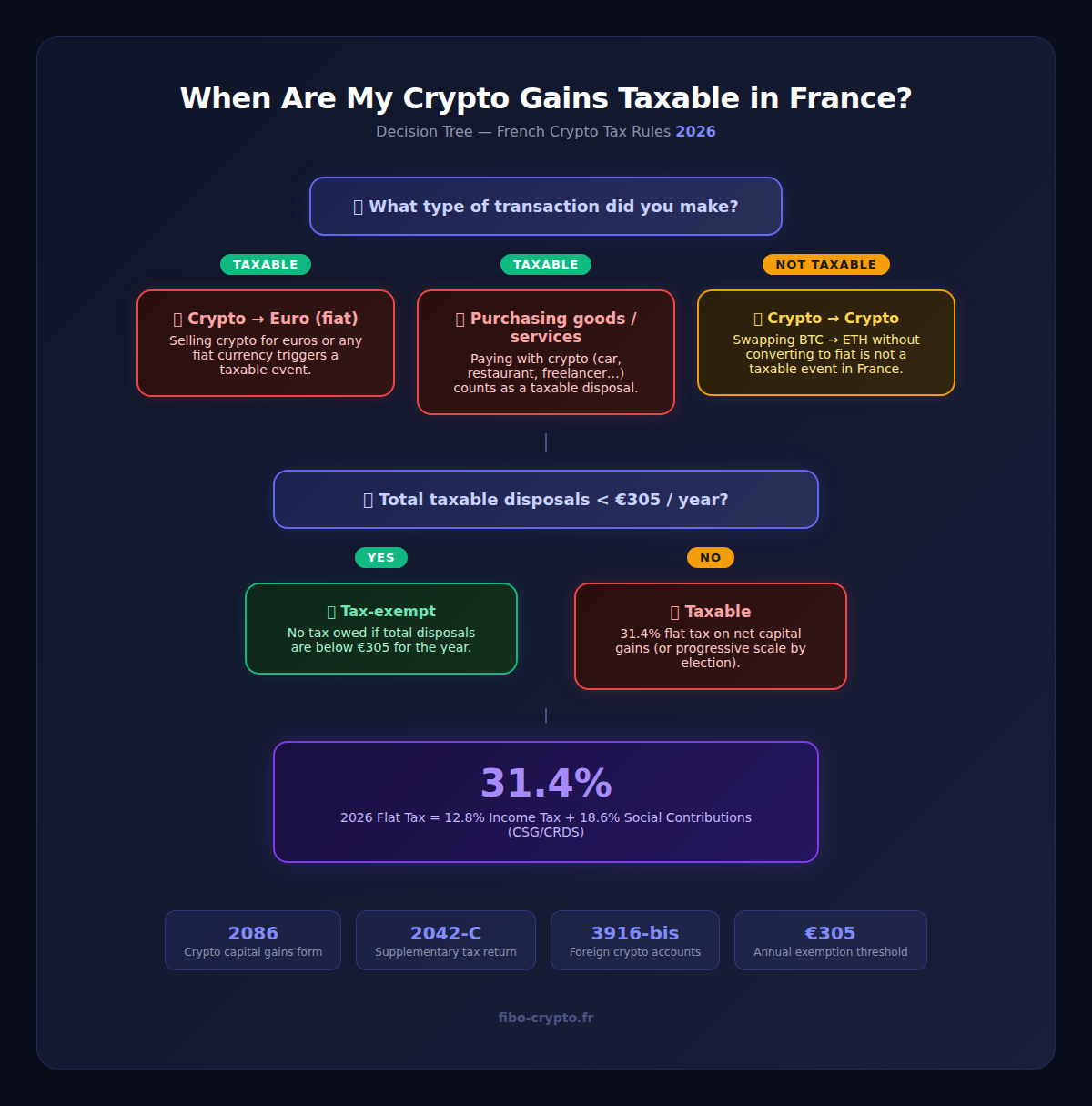

- Flat tax at 31.4%: since 2026, French crypto capital gains are taxed at 31.4% (12.8% income tax + 18.6% social contributions), up from 30%.

- Crypto → fiat = taxable: only conversions to euros (or purchasing goods/services with crypto) trigger taxation. Crypto-to-crypto swaps remain tax-free.

- DAC8 is live: since January 1, 2026, crypto platforms automatically report your transaction data to tax authorities across 48 countries.

- €305 threshold: if your total taxable disposals don’t exceed €305 per year, you’re exempt from tax.

- Mandatory forms: Cerfa 2086 (capital gains), 2042-C (supplementary return), and 3916-bis (foreign crypto accounts).

- Progressive scale option: you can elect progressive income tax rates instead of the flat tax — advantageous if your marginal rate is below 12.8%.

- Get prepared: with DAC8, the tax office has your data — maintain accurate records of all transactions and use tax tracking tools.

France has one of the most structured crypto tax frameworks in Europe, established by the Pacte Act of 2019 and significantly updated in 2026. Two major changes have reshaped the landscape: the flat tax increase to 31.4% and the implementation of the European DAC8 directive, introducing unprecedented fiscal transparency for cryptocurrency transactions.

Whether you’re a French tax resident or an international investor with exposure to France, understanding these rules is essential. This guide covers everything you need to know about declaring, optimizing, and staying compliant with French crypto taxation.

The French flat tax on crypto in 2026: 31.4%

The Prélèvement Forfaitaire Unique (PFU) — France’s flat tax on capital income — is the default tax regime for individual crypto capital gains. Following the adoption of the PLFSS 2026 (Social Security Financing Act), the rate increased from 30% to 31.4%.

Breakdown of the new rate

- 12.8% income tax (unchanged)

- 18.6% social contributions (up from 17.2%), driven by a CSG increase from 9.2% to 10.6%

This 1.4-point increase applies to all capital income in France (dividends, interest, capital gains), not just crypto. It results from a budget measure aimed at strengthening Social Security funding.

Practical impact: worked example

Suppose you realized a net capital gain of €10,000 by selling Bitcoin for euros:

- Before 2026: €10,000 × 30% = €3,000 tax

- In 2026: €10,000 × 31.4% = €3,140 tax

The €140 difference may seem modest, but it scales with larger gains. On €100,000 in gains, the extra cost is €1,400. For high earners subject to the exceptional contribution on high incomes, the effective rate can reach 35.4%.

For comparison: in the US, long-term crypto gains are taxed at 0–20% depending on income bracket, plus a potential 3.8% Net Investment Income Tax. In the UK, crypto falls under Capital Gains Tax at 10–20%. France’s flat-rate approach is simpler but offers less flexibility for lower-income investors.

How to calculate taxable capital gains

The calculation of taxable crypto gains in France follows a specific formula defined in Article 150 VH bis of the General Tax Code. Unlike many countries, France doesn’t use simple cost-basis accounting — the formula considers the entire portfolio value.

The official formula

Capital gain = Disposal price − (Total acquisition cost × Disposal price ÷ Total portfolio value)

Worked example

You invested a total of €5,000 in crypto. Your portfolio is now worth €20,000. You sell €8,000 worth of Ethereum for euros.

- Taxable acquisition portion: €5,000 × (€8,000 ÷ €20,000) = €2,000

- Taxable capital gain: €8,000 − €2,000 = €6,000

- Tax owed (31.4% flat tax): €6,000 × 31.4% = €1,884

Important: “total portfolio value” includes all your crypto assets at the time of disposal, not just the ones you’re selling.

When are you taxed? The clear rules

The fundamental distinction in French crypto taxation depends on the nature of the transaction:

Taxable events

- Crypto → euro (or any fiat currency): this is the primary taxable event. Any conversion from crypto to traditional currency triggers taxation.

- Purchasing goods or services with crypto: paying for a car, a meal, or freelance services with crypto is treated as a taxable disposal.

Non-taxable events

- Crypto → crypto swaps: converting Bitcoin to Ethereum (without going through fiat) is not a taxable event in France — a significant advantage compared to countries like the US where this is taxable.

- Disposals under €305/year: if total taxable disposals don’t exceed €305 for the year, no tax is owed.

DAC8: crypto fiscal transparency in 2026

Since January 1, 2026, the European DAC8 directive (Directive on Administrative Cooperation No. 8) is in force. Transposed into French law via Article 54 of the 2025 Finance Act, it requires crypto service providers (PSCA, equivalent to CASPs under MiCA) to automatically report transaction data to tax authorities.

What DAC8 changes in practice

- Automatic reporting: platforms report your identity, transactions (buys, sells, swaps), and portfolio value as of December 31.

- 48 participating countries: information is exchanged across EU member states and beyond, through the OECD’s CARF standard.

- First reporting in 2027: data for 2026 will be transmitted to tax administrations by September 2027.

What this means for you: the French tax authority will have detailed information about your crypto operations. Discrepancies between your declaration and platform-reported data will be flagged automatically. This is similar to how FATCA works for US persons with foreign accounts — but applied specifically to crypto across the EU.

Filing your crypto taxes: forms and deadlines

Each year, between April and June, French taxpayers must declare their crypto operations using three main forms:

Mandatory forms

- Cerfa 2086: the dedicated form for digital asset capital gains. You detail each taxable disposal (date, amount, gain/loss).

- Cerfa 2042-C: the supplementary income return, where you report the net result of your capital gains (box 3AN for gains, 3BN for losses).

- Cerfa 3916-bis: mandatory declaration of digital asset accounts held on foreign platforms (Binance, Kraken, Coinbase, etc.).

Tools to simplify the process

Manually calculating crypto capital gains using the French formula is complex, especially with numerous transactions. Specialized tools can help:

- Waltio: connects to your platforms, automatically calculates gains, and generates the required French tax forms.

- Coqonut: a French tax tracking solution with Cerfa export.

- CoinLedger / Blockpit: international alternatives compatible with French tax rules.

Foreign crypto accounts: don’t forget to declare

Any digital asset account held on a foreign platform must be declared using form 3916-bis, even if inactive or holding minimal funds. This applies to accounts that were opened, used, or closed during the tax year.

Penalties for non-declaration

- €750 fine per undeclared account (€1,500 if in a non-cooperative jurisdiction)

- Fine doubled if account values exceed €50,000

- With DAC8, the tax office will know which accounts you have — omissions carry much higher risk

French-based platforms (Coinhouse, StackinSat…) don’t need to be declared on the 3916-bis, as they’re already known to the French tax authority.

The progressive tax scale option

The 31.4% flat tax isn’t the only option. French taxpayers can elect the progressive income tax scale if it’s more advantageous.

When is the progressive scale beneficial?

This option works well if your marginal tax rate (TMI) is below 12.8% — meaning you’re in the 0% or 11% brackets:

- 0% bracket: you’d only pay social contributions (18.6%), for an effective rate of 18.6%

- 11% bracket: effective rate of 11% + 18.6% = 29.6%, lower than the flat tax

- 30% bracket or higher: the flat tax at 31.4% remains more favorable

Important caveat: the progressive scale election applies to all your capital income (dividends, interest included), not just crypto.

Special cases: staking, airdrops, mining, and NFTs

Certain crypto activities raise specific tax questions under French law:

Staking and lending

Staking rewards and lending interest are considered taxable income when received. Their euro value at the time of receipt forms the tax base, subject to the PFU or progressive scale.

Airdrops

Tokens received for free via airdrops become taxable upon subsequent disposal for fiat. The acquisition cost is considered zero (or at the declared value if included in your portfolio).

Mining

Mining income falls under the non-commercial profits (BNC) regime. Mined crypto is taxable at its value when received; subsequent gains follow the standard regime.

NFTs

NFT sales generally follow the same rules as other crypto assets. An NFT → fiat sale is taxable. An NFT → crypto exchange may be treated as a crypto-to-crypto swap (non-taxable).

Individual vs. professional: which regime applies?

The distinction between occasional and professional investors is critical, as the tax regimes differ substantially:

- Occasional investor (individual): taxed at the 31.4% PFU (or progressive scale by election) on capital gains.

- Professional investor: taxed at progressive income tax rates under the BNC (non-commercial profits) category, plus social security contributions.

What makes you a “professional”?

The French tax authority considers crypto activity as professional when the investor:

- Conducts frequent and sophisticated transactions

- Uses professional tools (trading bots, leverage, algorithms)

- Derives a significant portion of income from crypto trading

- Dedicates time comparable to a professional activity

If in doubt, consult a specialized tax attorney to determine your status.

Practical tips for 2026

1. Keep comprehensive records

With DAC8 in force, your declaration must be consistent with platform-reported data. Systematically maintain:

- Transaction histories from all platforms

- Proof of inter-wallet transfers

- Acquisition price documentation (statements, purchase confirmations)

2. Use a tax tracking tool

Software like Waltio or Coqonut automatically aggregates your transactions and calculates gains using the French legal formula. Essential once you have more than a handful of transactions per year.

3. Plan your disposals strategically

By timing your sales, you can optimize your tax burden: stay below the €305 threshold, spread gains across tax years, or choose the optimal moment to elect between flat tax and progressive scale.

4. Regularize if needed

If you’ve failed to declare foreign accounts or capital gains in previous years, voluntary regularization is advisable. With DAC8, automated cross-checking begins in 2027.

📚 Glossary

- Flat Tax (PFU) : France’s lump-sum tax on capital income. In 2026, the rate is 31.4% (12.8% income tax + 18.6% social contributions). Comparable to a fixed capital gains tax rate.

- Capital Gain (Plus-value) : The profit realized when disposing of a digital asset, calculated using the Article 150 VH bis formula that considers the entire portfolio value.

- PFU : Prélèvement Forfaitaire Unique — France’s flat tax system for capital income. The default tax regime for individual crypto gains.

- DAC8 : Directive on Administrative Cooperation No. 8 — an EU directive requiring crypto platforms to automatically report user transaction data to tax authorities. In force since January 1, 2026.

- Cerfa 2086 : The official French tax form for declaring capital gains on digital asset disposals. Must be filed for each taxable crypto transaction during the year.

- PSCA (CASP) : Prestataire de Services sur Crypto-Actifs — Crypto-Asset Service Provider under the EU MiCA regulation. Replaces the former PSAN status in France from mid-2026.

- Digital Asset : The legal French term for cryptocurrencies and tokens under Article L. 54-10-1 of the Monetary and Financial Code. Covers Bitcoin, Ethereum, and all crypto assets.

- Progressive Tax Scale : France’s graduated income tax system with brackets (0%, 11%, 30%, 41%, 45%). Can be elected instead of the flat tax when the marginal rate is below 12.8%.

Frequently Asked Questions

What is the crypto tax rate in France in 2026?

The default rate is the flat tax (PFU) of 31.4%, comprising 12.8% income tax and 18.6% social contributions. Taxpayers can elect the progressive income tax scale if their marginal rate is below 12.8%.

Are crypto-to-crypto trades taxable in France?

No. In France, swapping one cryptocurrency for another (e.g., BTC → ETH) without converting to fiat currency is not a taxable event. Only conversions to euros or purchasing goods/services triggers taxation.

What is DAC8 and how does it affect me?

DAC8 is an EU fiscal transparency directive that came into force on January 1, 2026. It requires crypto platforms to automatically report your transaction data to tax authorities. In practice, the French tax office will know your operations and can compare them against your declaration.

Do I need to declare my Binance or Kraken accounts?

Yes, if you’re a French tax resident. Any digital asset account on a foreign platform must be declared using form 3916-bis. Failure to declare carries a €750 fine per account, doubled if the account value exceeds €50,000.

Is crypto staking taxable in France?

Yes. Staking rewards are considered taxable income upon receipt, valued at their euro equivalent on the date received. They’re subject to the 31.4% PFU or progressive scale by election.

How can I reduce my crypto taxes in France?

Several legal strategies exist: stay below the €305 annual disposal threshold, elect the progressive scale if your marginal rate is low, plan the timing of your disposals to spread gains across years, and use tax software to accurately calculate your gains.

📰 Sources

This article is based on the following sources:

- Service-public.fr — Income tax: capital gains on digital assets

- Impots.gouv.fr — Digital asset disposal declaration (form 2086)

- AMF — Digital asset service providers

- BOFiP — Tax regime for digital asset disposals (art. 150 VH bis)

- European Commission — DAC8

Comment citer cet article : Fibo Crypto. (2026). Complete Guide to Crypto Taxation in France (Updated 2026). Consulté le 6 February 2026 sur https://fibo-crypto.fr/en/blog/guide-crypto-tax-france