What is a DApp? Complete Guide to Decentralized Applications 2026

📋 En bref (TL;DR)

- Definition: A DApp (Decentralized Application) is an application whose backend runs on a blockchain via smart contracts, without any central server

- How it works: Users interact through a crypto wallet (MetaMask) that signs transactions sent to smart contracts

- Key difference: Unlike traditional apps, no one can censor or shut down a DApp — it’s governed by its code

- Main types: DeFi (Uniswap, Aave), NFT (OpenSea), Gaming (Axie Infinity), Social (Lens Protocol)

- Advantages: Full transparency, censorship resistance, no middleman, you control your data

- Disadvantages: Gas fees, learning curve, irreversibility of errors, sometimes less intuitive interfaces

- In 2026: Over 15,000 active DApps, $80B+ TVL in DeFi, mass adoption in progress

Decentralized applications — or DApps — represent a revolution in how we use software. Instead of trusting a company (Google, Facebook, your bank), you trust transparent code executed on a blockchain.

This architecture opens unprecedented possibilities: financial services accessible to everyone without intermediaries, censorship-resistant applications, and complete transparency on how the system works. In 2026, DApps are no longer a technical curiosity — they manage billions of dollars and have millions of daily users.

This comprehensive guide explains everything you need to know about DApps: their definition, how they work technically, the different types, popular examples, and how to use them in practice.

What is a DApp? Complete Definition

A DApp (short for “Decentralized Application”) is an application whose business logic is executed by smart contracts on a blockchain, rather than on servers controlled by a company.

Concretely, when you use a DApp:

- The frontend (user interface) often remains classic — a website or mobile app

- The backend (logic and data) is decentralized on the blockchain

- Transactions are signed by your wallet and recorded immutably

This architecture eliminates the need to trust a third party: the code serves as the rules, and anyone can verify how it works.

The 5 Characteristics of a True DApp

According to the crypto community’s established definition, a DApp must meet these criteria:

- Open source: the code is public and verifiable by anyone

- Decentralized: no single entity controls the backend

- Blockchain-based: data and logic are on-chain

- Uses tokens: often a native token for governance or transactions

- Censorship-resistant: as long as the blockchain runs, the DApp runs

How Does a DApp Work?

To understand how a DApp works, let’s follow a typical transaction journey — for example, swapping tokens on Uniswap.

Technical Architecture in Detail

1. Frontend (interface)

The user interface is typically a classic website built with React, Vue, or Angular. It can be hosted centrally (regular server) or decentrally (IPFS, Arweave). The frontend communicates with the blockchain via libraries like ethers.js or web3.js.

2. Wallet

MetaMask, Rabby, or any other crypto wallet bridges the user and the blockchain. It stores your private keys, signs transactions, and manages your permissions. Your wallet IS your identity on the blockchain — no need to create an account with email and password.

3. Smart contracts

The heart of the DApp. These are autonomous programs deployed on the blockchain that automatically execute the defined logic. Once deployed, a smart contract cannot be modified (unless designed that way). On Ethereum, they’re written in Solidity.

4. Blockchain

The decentralized network (Ethereum, Solana, Arbitrum…) that executes smart contracts and stores state immutably. Each transaction is validated by network nodes and recorded in a block.

DApp Transaction Process

- User connects their wallet to the DApp (“Connect Wallet” button)

- They initiate an action (token swap, deposit, NFT purchase…)

- The DApp prepares the transaction with necessary parameters

- The wallet displays details and asks for confirmation

- User signs the transaction with their private key

- Transaction is sent to the blockchain

- Validators execute it and include it in a block

- State is updated and the transaction becomes immutable

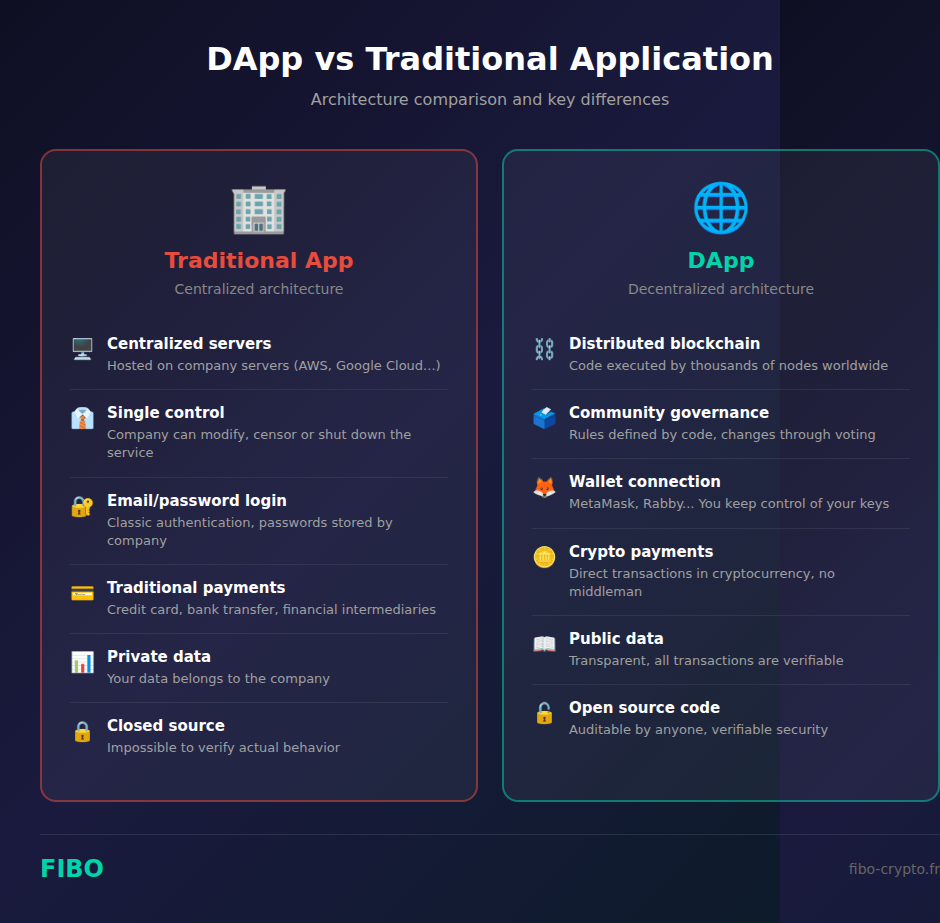

DApp vs Traditional Application: The Differences

To truly understand what makes DApps unique, let’s compare them with the applications you use every day.

Control and Governance

Traditional app: The owning company has all the power. They can change rules, censor users, shut down the service overnight. Your data belongs to them.

DApp: Rules are written in transparent, immutable code. Changes often go through community votes (DAO). No one can arbitrarily censor a user.

Authentication and Identity

Traditional app: Email + password. The company stores your credentials and can lose them (data breach) or lock you out.

DApp: Your wallet IS your identity. Your private key belongs to you. Impossible to “ban” you from a public blockchain.

Transactions and Payments

Traditional app: Credit card, bank transfer, PayPal… Multiple intermediaries taking fees who can block transactions.

DApp: Direct crypto payment. “Gas fees” go to network validators, not a private intermediary.

Transparency

Traditional app: Closed source (proprietary). Impossible to know exactly what the application does with your data.

DApp: Open source code. All transactions are public on the blockchain. Anyone can audit how it works.

Types of DApps: DeFi, NFT, Gaming, Social

DApps cover many domains, with decentralized finance (DeFi) dominating in terms of activity and locked value.

DeFi (Decentralized Finance)

The king category of DApps. DeFi replicates traditional financial services (exchange, lending, savings) without banks or intermediaries.

Sub-categories:

- DEX (decentralized exchanges): Uniswap, SushiSwap, Curve — swap tokens directly from your wallet

- Lending/Borrowing: Aave, Compound, MakerDAO — lend your crypto to earn interest, or borrow against collateral

- Liquid staking: Lido, Rocket Pool — stake your ETH while keeping liquidity via a derivative token

- Yield farming: Yearn Finance, Convex — automatic yield optimization

- Derivatives: dYdX, GMX — decentralized perpetuals and options trading

NFT and Collectibles

Marketplaces and platforms for creating, buying, and selling NFTs (non-fungible tokens).

Examples:

- OpenSea: the largest multi-chain NFT marketplace

- Blur: trader-oriented marketplace with 0% fees

- Magic Eden: leader on Solana, multi-chain expansion

- Art Blocks: on-chain generative art

- Foundation: platform for digital artists

Gaming and Metaverse

Blockchain games where in-game items are NFTs you truly own, and decentralized virtual worlds.

Examples:

- Axie Infinity: the play-to-earn pioneer

- The Sandbox: metaverse where you create and monetize experiences

- Decentraland: virtual world governed by its users

- Illuvium: AAA RPG with blockchain economy

- Gods Unchained: collectible card game like Hearthstone

Social and DAO

Decentralized social networks and community governance tools.

Examples:

- Lens Protocol: decentralized social network protocol (your followers are an NFT)

- Farcaster: decentralized social network with portable identity

- Mirror: blogging platform with crypto monetization

- Snapshot: free off-chain governance votes

- ENS: decentralized domain names (.eth)

Popular DApp Examples

Let’s explore the most used DApps and their value proposition in detail.

Uniswap — The Reference DEX

Type: Decentralized Exchange (DEX)

Blockchain: Ethereum, Arbitrum, Polygon, Base, Optimism

TVL: ~$5 billion

Uniswap lets you swap any ERC-20 token without registration or identity verification. It uses an Automated Market Maker (AMM) system: instead of an order book, liquidity is provided by pools where anyone can deposit tokens and earn fees.

Why it’s revolutionary: Before DEXs, to swap tokens, you had to go through a centralized exchange (Binance, Coinbase) that holds your funds and can ban you. With Uniswap, your tokens stay in your wallet until the swap.

Aave — The #1 Lending Protocol

Type: Lending/Borrowing

Blockchain: Ethereum, Arbitrum, Polygon, Avalanche, Optimism

TVL: ~$12 billion

Aave lets you deposit crypto to earn interest, or borrow against collateral. Rates are algorithmically determined by supply and demand.

Use case: You have 10 ETH and need liquidity without selling? Deposit them on Aave and borrow stablecoins. As long as your collateral remains sufficient, you keep your ETH exposure.

OpenSea — The Giant NFT Marketplace

Type: NFT Marketplace

Blockchain: Ethereum, Polygon, Solana, Arbitrum, Avalanche, Base

Volume: ~$500M/month

OpenSea is the largest platform for buying and selling NFTs. Digital art, collectibles, domains, game items… everything can be found on OpenSea.

Lido — Liquid Staking

Type: Liquid Staking

Blockchain: Ethereum

TVL: ~$25 billion

Lido solves a major problem: ETH staking requires 32 ETH and locks your funds. With Lido, you can stake any amount and receive stETH in return — a liquid token usable in DeFi that accumulates staking rewards.

How to Use a DApp

Ready to get started? Here’s a step-by-step guide to using your first DApp.

Step 1: Install a Wallet

The wallet is your passport to the DApp world. Most popular ones:

- MetaMask: most widely used, browser extension + mobile app

- Rabby: excellent for security, shows transaction simulations

- Trust Wallet: multi-chain mobile wallet

- Coinbase Wallet: simple for beginners

Install the extension from the official website (beware of fakes!), create a new wallet, and write down your seed phrase on paper. This 12-24 word phrase is the only way to recover your funds if you lose access.

Step 2: Fund Your Wallet

To interact with DApps, you need crypto:

- ETH if using Ethereum/Arbitrum/Optimism/Base

- SOL for Solana

- The native crypto of whatever blockchain you’re using

Buy on an exchange (Binance, Coinbase) and send to your wallet address. Wait for confirmations before proceeding.

Step 3: Connect to a DApp

Go to the DApp’s website (e.g., app.uniswap.org). Click “Connect Wallet” and select your wallet. Your extension opens and asks you to confirm the connection.

Important: Always verify the URL! Phishing sites mimic popular DApps. Use bookmarks or links from DefiLlama/DappRadar.

Step 4: Interact

Each action (swap, deposit, purchase) generates a transaction you must sign. Your wallet displays:

- Estimated gas amount (network fees)

- Permissions requested

- Tokens involved

Read carefully before confirming. Once signed, the transaction is irreversible.

Security Best Practices

- NEVER share your seed phrase — no legitimate support will ever ask for it

- Revoke unused approvals on revoke.cash

- Use a hardware wallet (Ledger, Trezor) for significant amounts

- Start small — test with small amounts before committing more

Advantages and Disadvantages of DApps

Advantages

✅ Complete transparency

Code is open source, all transactions are public. You know exactly what the application does.

✅ Censorship resistance

No one can shut down a DApp or block your access. As long as the blockchain runs, the DApp runs.

✅ No middleman

Traditional services (banks, brokers) take fees and can block your transactions. DApps eliminate these intermediaries.

✅ Control of your data

Your tokens and data belong to you. No account to create, no personal data to provide.

✅ Permissionless innovation

Anyone can create a DApp or build on top of an existing one. The ecosystem evolves rapidly.

✅ Global accessibility

An internet connection and a wallet are enough. No identity verification for decentralized DApps.

Disadvantages

❌ Gas fees

Every transaction costs network fees. On Ethereum mainnet, this can be high during congestion. L2s (Arbitrum, Base) reduce this problem.

❌ Irreversibility

A mistake (wrong address, scam) is final. No customer service to cancel a transaction.

❌ Complexity

The learning curve is real: understanding wallets, gas, approvals… UX is improving but remains more complex than traditional apps.

❌ Smart contract risks

Bugs or vulnerabilities in code can lead to losses. Favor audited and proven protocols.

❌ Volatility

DApp tokens (and crypto in general) are volatile. Your assets can lose significant value quickly.

The Future of Decentralized Applications

DApps in 2026 are at a turning point. After the hype and crashes, the ecosystem is maturing toward broader adoption.

Current Trends

Layer 2 and scalability

Arbitrum, Optimism, Base have solved the high fee problem on Ethereum. Transactions cost a few cents instead of several dollars.

Account abstraction

Smart wallets (ERC-4337) simplify the experience: account recovery, gas payment in stablecoins, batched transactions…

Institutional integration

BlackRock, Fidelity and other financial giants are integrating with DeFi. The boundaries between traditional and decentralized finance are blurring.

Real World Assets (RWA)

Tokenization of real assets (real estate, bonds, art) on blockchain is exploding. DApps are becoming the interface to these assets.

Challenges Ahead

Regulation

Governments are seeking to regulate DeFi. The balance between consumer protection and innovation remains to be found.

UX

For mass adoption, DApps must become as simple as traditional apps. Progress is real but there’s still work to do.

Security

Hacks and exploits remain frequent. Improving audits, DeFi insurance, and development practices is crucial.

Conclusion

DApps represent a paradigm shift in our relationship with digital services. Instead of entrusting your data and money to companies, you interact with transparent, verifiable, and censorship-resistant code.

In 2026, the ecosystem has over 15,000 active DApps managing more than $80 billion. From finance (Uniswap, Aave) to NFTs (OpenSea), gaming (Axie), and social networks (Lens), decentralized applications cover all domains.

The learning curve exists, but it’s decreasing. Layer 2s have made transactions affordable, wallets are becoming more intuitive, and new users join the ecosystem every day.

Ready to try? Install a wallet, explore DappRadar or DefiLlama to discover popular DApps, and start with small amounts. The future of the internet is being built now — and it’s decentralized.

📚 Glossary

- DApp (Decentralized Application) : An application whose backend runs on a blockchain via smart contracts, without a central server controlled by a company.

- Smart contract : An autonomous program deployed on a blockchain that automatically executes according to conditions defined in its code.

- Blockchain : A distributed and immutable ledger where all transactions are recorded, maintained by a decentralized network of nodes.

- Wallet : Software or hardware that stores your private keys and allows you to interact with blockchains and DApps.

- Gas : Unit of measurement for the computational cost of a transaction on Ethereum. Gas fees compensate validators.

- TVL (Total Value Locked) : Total value of assets deposited in a DeFi protocol. Indicator of trust and adoption.

- DEX (Decentralized Exchange) : Cryptocurrency exchange platform that operates without a centralized intermediary, via smart contracts.

- DeFi (Decentralized Finance) : Ecosystem of financial services (lending, exchange, savings) built on blockchain without banks.

- NFT (Non-Fungible Token) : Unique token on blockchain representing ownership of a digital asset (art, collectible, game item).

- DAO (Decentralized Autonomous Organization) : Organization managed by its members through on-chain votes, without traditional hierarchy.

- Layer 2 : Scalability solution built on top of a main blockchain (Arbitrum, Optimism on Ethereum) to reduce fees.

- Seed phrase : Series of 12-24 words that allows recovery of a crypto wallet. Keep it safe and never share.

- AMM (Automated Market Maker) : Trading mechanism used by DEXs where liquidity is provided by pools rather than an order book.

- Staking : Action of locking cryptocurrencies to participate in a blockchain’s consensus and receive rewards.

Frequently Asked Questions

What is a DApp exactly?

A DApp (Decentralized Application) is an application whose business logic executes on a blockchain via smart contracts, rather than on company servers. Concretely, the interface (website or app) remains classic, but the backend is decentralized: rules are in the code, transactions are public, and no one can censor or shut down the application. Examples: Uniswap for token swapping, Aave for crypto lending, OpenSea for NFTs.

How do I access a DApp?

To use a DApp, you need a crypto wallet (MetaMask, Rabby, Trust Wallet). Install the browser extension or mobile app, create a wallet by carefully noting your seed phrase, then fund it with crypto (ETH for Ethereum). Then go to the DApp’s website, click “Connect Wallet” and confirm the connection. Each action (swap, deposit) generates a transaction you must sign.

What's the difference between a DApp and a regular app?

A regular app is hosted on a company’s servers that controls everything: they can change rules, censor users, shut down the service, and own your data. A DApp runs on a decentralized blockchain: the code is transparent and immutable, no one can censor you, and your assets truly belong to you. In return, you’re responsible for your keys and mistakes are irreversible.

Are DApps secure?

DApps present different risks than traditional applications. Advantages: transparent and auditable code, no single point of failure, censorship resistance. Risks: smart contract bugs (hacks), phishing (fake sites), irreversible errors. To protect yourself: use audited and proven protocols, always verify URLs, never share your seed phrase, start with small amounts, and consider a hardware wallet for significant amounts.

What are the most popular DApp examples?

Most used DApps in 2026: DeFi — Uniswap (exchange), Aave (lending), Lido (liquid staking), Curve (stablecoin exchange). NFT — OpenSea, Blur, Magic Eden. Gaming — Axie Infinity, The Sandbox, Decentraland. Social — Lens Protocol, Farcaster, ENS. DeFi dominates in TVL (total value locked) with over $80 billion.

How much does it cost to use a DApp?

Every DApp transaction costs “gas fees” paid to network validators. On Ethereum mainnet, these fees can range from a few dollars to tens during congestion. Layer 2 solutions (Arbitrum, Optimism, Base) drastically reduce these costs to a few cents per transaction. Some DApps also charge protocol fees (e.g., 0.3% on Uniswap).

Can you make money with DApps?

Yes, several ways: Yield farming — deposit your crypto on DeFi protocols (Aave, Compound) to earn interest. Staking — stake your tokens to secure the network and receive rewards. Trading — use DEXs to trade. NFT — buy/sell NFTs. Warning: these activities carry risks (volatility, smart contract bugs, capital loss). Never invest more than you can afford to lose.

For beginners, MetaMask is the most popular wallet compatible with most DApps (Chrome/Firefox extension + mobile app). Rabby offers better security with transaction simulations. Trust Wallet is excellent on mobile. For securing significant amounts, use a hardware wallet (Ledger, Trezor) that stores your keys offline. Whatever you choose, write your seed phrase on paper and keep it safe.Which wallet should I choose for using DApps?

📰 Sources

This article is based on the following sources:

- State of the DApps

- DappRadar

- DefiLlama

- Ethereum.org – Introduction to DApps

- Mastering Ethereum – DApps

- L2Beat

Comment citer cet article : Fibo Crypto. (2026). What is a DApp? Complete Guide to Decentralized Applications 2026. Consulté le 13 February 2026 sur https://fibo-crypto.fr/en/blog/what-is-a-dapp-decentralized-applications-guide