Private Key vs Public Key: Understanding the Fundamentals of Cryptography

📋 En bref (TL;DR)

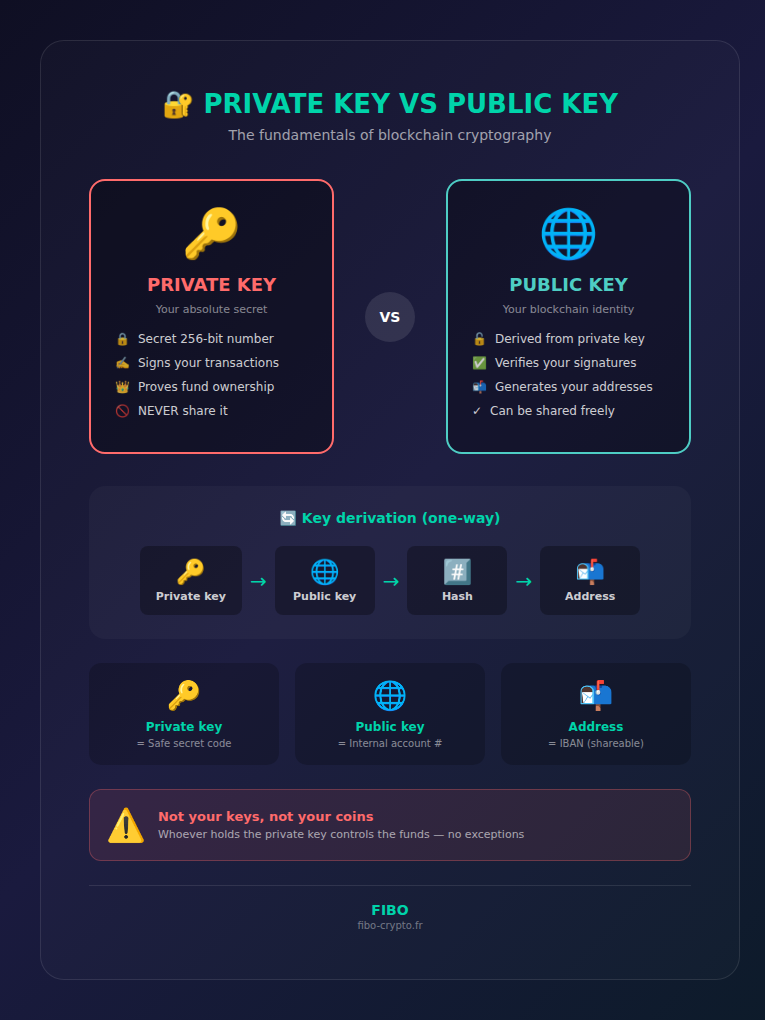

- Private key: Secret 256-bit number that proves ownership of your cryptos and allows signing transactions — never share it

- Public key: Mathematically derived from the private key, it generates your receiving addresses and can be shared freely

- One-way relationship: The public key can be calculated from the private key, but the reverse is mathematically impossible (2²⁵⁶ combinations)

- Banking analogy: Private key = safe secret code, public key = account number, address = IBAN

- Golden rule: “Not your keys, not your coins” — whoever holds the private key controls the funds, no exceptions

Behind every crypto transaction lies an elegant cryptographic system: asymmetric cryptography. This system relies on a pair of keys — private and public — that secures your funds without needing a bank or trusted intermediary.

Understanding the difference between these two keys is fundamental for any blockchain user. It’s the foundation of the financial sovereignty that cryptocurrencies promise.

What Is Asymmetric Cryptography?

Asymmetric cryptography is a system where two different keys are mathematically linked: what is encrypted with one can only be decrypted with the other. Unlike symmetric cryptography (a single shared key), it enables secure exchanges without ever revealing a common secret.

In the context of cryptocurrencies:

- The private key signs transactions (proves that you authorize the transfer)

- The public key allows anyone to verify this signature

This system was invented in the 1970s (Diffie-Hellman, RSA) and today forms the foundation of Internet security (HTTPS, encrypted emails) and blockchains.

The Private Key: Your Absolute Secret

A private key is a random 256-bit number that constitutes the ultimate proof of ownership of your cryptocurrencies. Whoever possesses the private key controls the associated funds — no exceptions, no recourse.

Private Key Format

A Bitcoin or Ethereum private key looks like this:

0x4c0883a69102937d6231471b5dbb6204fe512961708279b7d1e2b4df7c9b3e8aIt’s a 64-character hexadecimal number (256 bits). The space of possibilities is astronomical: 2²⁵⁶ combinations, more than the number of atoms in the observable universe.

What Is the Private Key Used For?

- Signing transactions: Proving that you authorize a transfer

- Proving ownership: Demonstrating that you control an address

- Deriving the public key: Mathematically generating your public identity

Absolute Security Rules

- 🚫 Never share it with anyone

- 🚫 Never store it online (cloud, email, photo)

- 🚫 Never enter it on a website or form

- ✅ Back it up via a seed phrase on physical media

The Public Key: Your Blockchain Identity

The public key is mathematically derived from the private key via a one-way function (elliptic curve ECDSA). It can be shared freely because it’s impossible to find the private key from it.

From Public Key to Address

In practice, you don’t directly handle your public key. It undergoes transformations (hash SHA-256, RIPEMD-160) to become a shorter, more practical address:

Private Key → Public Key → Hash → AddressAddress examples:

- Bitcoin:

1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa - Ethereum:

0x742d35Cc6634C0532925a3b844Bc9e7595f...

Banking Analogy

| Crypto Concept | Banking Equivalent |

|---|---|

| Private key | Secret code + signature |

| Public key | Internal account number |

| Address | IBAN (what you share) |

The Mathematical Relationship Between Keys

The public key is calculated from the private key via multiplication on an elliptic curve (ECDSA secp256k1 for Bitcoin). This operation is easy in one direction but mathematically impossible to reverse with current technology.

One-Way Function

- Private Key → Public Key: instantaneous (milliseconds)

- Public Key → Private Key: impossible (would take billions of years)

This asymmetry is the foundation of all blockchain security. Even the most powerful quantum computers envisioned couldn’t break this protection in the foreseeable future (blockchains are nonetheless preparing “quantum-resistant” algorithms).

Signature Verification

When you sign a transaction with your private key, anyone can verify this signature with your public key:

- You create a transaction: “Send 1 BTC to address X”

- You sign with your private key (secret operation)

- The network verifies with your public key that the signature is valid

- If valid, the transaction is accepted and broadcast

The Role of the Wallet

A wallet is simply software that stores your private keys and facilitates their use for signing transactions. It doesn’t “contain” your cryptos — those remain on the blockchain.

Types of Wallets

- Hot wallets (MetaMask, Trust Wallet): keys stored on an Internet-connected device

- Cold wallets (Ledger, Trezor): keys stored on a disconnected device

- Paper wallets: keys printed on paper

- Custodial wallets (exchange): the company holds your keys (you’re not truly the owner)

The crypto saying “Not your keys, not your coins” summarizes the importance of controlling your own private keys.

Security Best Practices

Your crypto security depends entirely on protecting your private keys.

✅ What to Do

- Use a hardware wallet for significant amounts

- Back up your seed phrase on physical media (metal ideally)

- Verify addresses before each transaction

- Use strong, unique passwords

- Enable two-factor authentication (2FA)

🚫 What Never to Do

- Share your private key or seed phrase

- Store your keys in the cloud or via email

- Click on suspicious links asking to “connect” your wallet

- Sign transactions without understanding what they do

📚 Glossary

- Private key : Secret 256-bit number that proves ownership of your cryptocurrencies and allows signing transactions. Must never be shared.

- Public key : Key mathematically derived from the private key, used to generate addresses and verify signatures. Can be shared.

- Address : Short identifier derived from the public key, used to receive cryptocurrencies. Equivalent to an IBAN.

- Asymmetric cryptography : Cryptographic system using a pair of mathematically linked keys (private/public).

- ECDSA : Elliptic Curve Digital Signature Algorithm. Digital signature algorithm used by Bitcoin and Ethereum.

- Seed phrase : Series of 12 or 24 words allowing regeneration of all your private keys. Must be backed up on physical media.

- Wallet : Software or device that stores your private keys and facilitates transaction signing.

- Hot wallet : Internet-connected wallet (MetaMask, Trust Wallet). Convenient but more vulnerable.

- Cold wallet : Wallet disconnected from the Internet (Ledger, Trezor). More secure for large amounts.

- Custodial : Service where a third party (exchange) holds your private keys on your behalf. You’re not truly the owner.

Frequently Asked Questions

What's the difference between a private key and a seed phrase?

The seed phrase (recovery phrase) is a series of 12 or 24 words that allows regenerating all your private keys. It’s a human-readable representation of your master key. Protecting your seed phrase means protecting all your private keys.

Can you find a private key from the address?

No, it’s mathematically impossible with current technology. The address is derived from the public key via hash functions (SHA-256, RIPEMD-160) that are irreversible. Even future quantum computers shouldn’t be able to reverse this process.

What happens if I lose my private key?

If you lose your private key and have no backup (seed phrase), your funds are permanently lost. Nobody — not you, not tech support, not any government — can recover cryptos without the corresponding private key. That’s why backup is crucial.

Is it safe to share my public address?

Yes, that’s what it’s designed for. Your public address is like an IBAN: it allows receiving funds but gives no access to your cryptos. However, sharing your address makes your transactions traceable on the blockchain (pseudonymity, not anonymity).

Why do people say 'Not your keys, not your coins'?

This expression reminds us that if you leave your cryptos on an exchange (custodial wallet), the exchange holds your private keys. In case of bankruptcy, hack, or fund freeze, you could lose everything. Only possessing your own private keys makes you truly the owner.

📰 Sources

This article is based on the following sources:

- Bitcoin Developer Documentation – Keys

- Ethereum Yellow Paper

- NIST Digital Signature Standard (DSS)

- Mastering Bitcoin – Andreas Antonopoulos

Comment citer cet article : Fibo Crypto. (2026). Private Key vs Public Key: Understanding the Fundamentals of Cryptography. Consulté le 6 February 2026 sur https://fibo-crypto.fr/en/blog/private-key-vs-public-key-cryptography