Passive Crypto Investing: Complete DCA Guide and Dollar Cost Averaging Strategy 2026

📋 En bref (TL;DR)

- Passive crypto investing : long-term investment strategy of buying and holding a diversified portfolio without trying to time the market — ideal for 95% of investors

- DCA (Dollar Cost Averaging) : key technique of investing a fixed amount at regular intervals to smooth out volatility and eliminate market timing stress

- Proven performance : 92% of active traders underperform the market according to Binance Research 2024 — passive management statistically beats active trading

- Bitcoin ETFs : over $100 billion in spot Bitcoin ETFs by 2025, proving massive institutional adoption of the passive approach

- Full automation possible : platforms like Kraken, Binance, or Coinbase allow scheduled automatic purchases with zero manual intervention

- Tax advantages : fewer transactions = fewer taxable events and simplified accounting in most jurisdictions

- Mistake #1 to avoid : trying to “time the market” — studies show that missing the 10 best days reduces returns by 50%+

Passive investing has emerged as the most rational approach to cryptocurrency investment. In a market where 92% of active traders fail to beat a simple buy-and-hold strategy, DCA (Dollar Cost Averaging) and passive strategies offer a proven, accessible alternative for everyone. This comprehensive guide explains why and how to adopt this approach to build your crypto wealth with peace of mind.

What is passive investing in cryptocurrency?

Passive investing is an investment philosophy based on a simple principle: rather than trying to beat the market through frequent buying and selling, you choose to ride its natural long-term growth. In crypto, this means building a diversified portfolio of major cryptocurrencies (Bitcoin, Ethereum, and possibly a few solid altcoins) and holding them for several years.

This approach radically opposes active management, where investors try to profit from short-term fluctuations through trading. Passive investing is based on an undeniable statistical reality: over a 2+ year period, more than 90% of retail traders underperform a simple passive investment. This isn’t opinion — it’s what data from Binance Research and numerous academic studies demonstrate.

The concept has its roots in traditional finance with index funds (ETFs) popularized by Vanguard’s John Bogle. The idea? If even professional fund managers struggle to consistently beat market indices, why would an individual succeed? In crypto, where volatility is even more extreme and information more asymmetric, this reasoning is even more relevant.

Passive vs active management: the brutal comparison

Before choosing your crypto investment approach, let’s objectively compare both strategies on the criteria that truly matter:

Time and energy

Active management demands considerable commitment: monitoring markets several hours daily, technical analysis, following news… A serious active trader easily dedicates 20-40 hours weekly to this activity. Passive management? 1-2 hours per month is enough to check your portfolio and adjust your scheduled purchases if needed.

Fees and hidden costs

Every crypto transaction generates fees: platform fees (0.1% to 1%), spread, and potentially network fees. An active trader making 100 monthly transactions can easily lose 2-5% of their capital annually in fees. A passive investor with monthly purchases? Less than 0.5% per year.

Real performance

This is where the myth crumbles: according to Binance Research 2024, a 60% Bitcoin / 40% Ethereum portfolio held without intervention from January 2023 to December 2024 outperformed 92% of active traders on the platform. Vanguard studies on traditional markets show similar results for decades.

Psychological impact

Active trading is an emotional combat sport. Fear of missing out (FOMO), panic during corrections, euphoria from quick gains… These emotions are the primary cause of losses among retail traders. Passive management eliminates this stress: you know corrections are part of the game, and you’re not trying to avoid them.

DCA (Dollar Cost Averaging) explained in detail

DCA (Dollar Cost Averaging) is the fundamental technique of passive investing. The principle is disarmingly simple: invest a fixed amount at regular intervals, regardless of market price.

How does DCA work?

Imagine you decide to invest $200 monthly in Bitcoin. The first month, BTC is at $40,000: you buy 0.005 BTC. The next month, it drops to $30,000: you buy 0.0067 BTC. The third month, it rises to $50,000: you buy 0.004 BTC. Over these three months, your average purchase price is about $38,000, while the market’s average price was $40,000.

This smoothing mechanism is powerful: you automatically buy more when prices are low and less when they’re high. No need to predict the market — DCA does it mechanically for you.

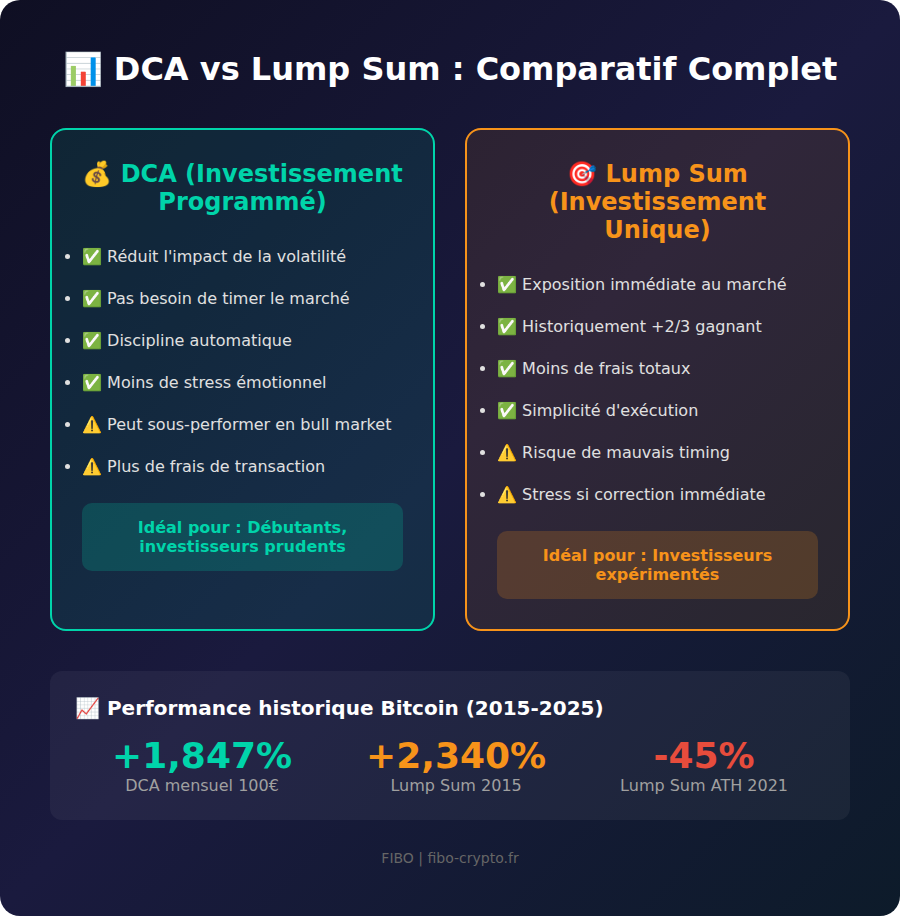

DCA vs Lump Sum: who wins?

A common question: is it better to invest everything at once (lump sum) or spread out purchases (DCA)? Vanguard studies on traditional markets show lump sum wins about 2/3 of the time long-term. But beware:

- Lump sum wins with perfect timing — which is rare

- DCA protects from disasters — investing everything at the 2021 peak would have been devastating

- DCA is psychologically sustainable — most investors abandon after a bad lump sum

Our recommendation? For most investors, DCA is superior in practice, even if theoretically suboptimal. The investment you hold for 10 years beats the investment you panic-sell after 6 months.

Proven benefits of passive crypto investing

Why is passive crypto investing attracting more investors, from beginners to institutions? Here are the concrete, measurable advantages:

1. Superior long-term performance

The data is clear: holding a diversified portfolio for 4+ years has historically beaten 90%+ of active trading strategies. Bitcoin has delivered an annualized return of ~100% since 2015 — hard to beat by frantically trading.

2. Drastic stress reduction

No more sleepless nights watching charts, impulsive 3 AM decisions, price obsession. You invest, live your life, and check your positions once a month. Your mental health will thank you.

3. Minimized fees

Fewer transactions = fewer fees. Over 10 years, the difference between 0.3% and 3% annual fees represents 30% more capital for the passive investor.

4. Automatic discipline

Automated DCA eliminates the most destructive human element in investing: emotion. You no longer need “courage” to buy when everyone panics — your scheduled order does it for you.

5. Total accessibility

No advanced technical knowledge needed, no sophisticated trading tools or certifications. Anyone can set up a DCA plan in 15 minutes.

Passive investing strategies (DCA, HODL, rebalancing)

Passive investing isn’t limited to DCA. Here are three complementary strategies that make up a complete passive approach:

1. Classic DCA

Investing a fixed amount at regular intervals. Recommended frequency: weekly or monthly depending on your budget. Higher frequency means better smoothing — but watch out for fixed transaction fees.

2. HODL (Hold On for Dear Life)

Pure hold strategy: you buy and keep, no matter what. The term comes from a legendary typo on Bitcoin Forum in 2013. HODL assumes strong conviction in the asset held and a truly long-term vision (5-10+ years).

3. Periodic rebalancing

You define a target allocation (e.g., 60% BTC, 30% ETH, 10% altcoins) and readjust your portfolio once or twice yearly to maintain these proportions. If Bitcoin has risen sharply, you sell some to buy underweighted assets. This method mechanically forces you to sell high and buy low.

Bitcoin ETFs and passive crypto products: the institutional revolution

The approval of spot Bitcoin ETFs in the United States in January 2024 marked a historic turning point for passive crypto investing. In less than a year, these products attracted over $100 billion in assets under management.

What is a Bitcoin ETF?

An ETF (Exchange-Traded Fund) is a publicly traded fund that replicates an underlying asset’s price. Spot Bitcoin ETFs actually hold bitcoins on behalf of investors. You can thus invest in Bitcoin through your regular brokerage account, without ever touching a crypto wallet.

Crypto ETF advantages

- Maximum simplicity: purchase through traditional broker

- Institutional security: no risk of losing private keys

- Tax integration: compatible with tax-advantaged accounts in some jurisdictions

- Liquidity: instant buy/sell during market hours

Main Bitcoin ETFs

In the US: iShares Bitcoin Trust (IBIT) from BlackRock, Fidelity Wise Origin Bitcoin Fund (FBTC), ARK 21Shares Bitcoin ETF (ARKB). In Europe: ETP products like CoinShares Physical Bitcoin (BITC) or 21Shares Bitcoin ETP.

How to build a passive crypto portfolio: step-by-step guide

Let’s get practical. Here’s how to build your passive crypto portfolio in 5 steps:

Step 1: Define your allocation

For beginners, we recommend starting simple:

- Conservative allocation: 70-80% Bitcoin, 20-30% Ethereum

- Balanced allocation: 50% Bitcoin, 30% Ethereum, 20% top altcoins (Solana, Cardano…)

- Aggressive allocation: 40% Bitcoin, 30% Ethereum, 30% diversified altcoins

Step 2: Choose your platform

Essential criteria: security, competitive fees, recurring purchase feature. Current best options: Kraken (low fees, automated DCA), Coinbase (simplicity, regulated), Binance (wide selection, advanced features).

Step 3: Schedule automatic purchases

Set up an automatic monthly transfer to your platform, then a recurring buy order. Example: $300 transfer on the 1st, automatic purchase of $100 BTC + $50 ETH + $50 SOL on the 2nd.

Step 4: Secure your crypto

For significant amounts (>$5,000), transfer your crypto to a personal wallet (hardware wallet like Ledger or Trezor). For smaller amounts, storage on a reputable platform is acceptable.

Step 5: Rebalance annually

Once a year (e.g., in January), check if your allocation has drifted more than 10% and adjust if necessary.

What investment frequency to choose? (Weekly, monthly, quarterly)

Your DCA purchase frequency impacts volatility smoothing and fees. Here’s how to choose:

Weekly DCA

Ideal for: budgets of $50-200/week, maximum volatility (like currently). 52 entry points per year offer the best possible smoothing. Disadvantage: higher transaction fees if fixed fees apply.

Monthly DCA

Most popular: optimal balance between smoothing and fees. Ideal for budgets of $100-1,000/month. This is our default recommendation for most investors.

Quarterly DCA

For large amounts: $500-5,000+ per quarter. Less smoothing but minimal fees. Suited for investors receiving bonuses or irregular income.

Optimal purchase day? Contrary to beliefs, studies show little significant difference by day of the week. What matters isn’t when you buy, but that you buy regularly.

Automating passive management: platforms and tools

Automation is key to successful passive management. Here are the best tools currently available:

Native recurring purchase features

- Kraken: “Recurring Buy” — easy setup, 1.5% fees

- Coinbase: daily/weekly/monthly scheduled purchases

- Binance: “Auto-Invest” — very comprehensive, wide crypto selection

- Crypto.com: “Recurring Buy” with possible cashback

Bots and third-party services

Services like Swan Bitcoin (Bitcoin DCA specialist), Delta Investment Tracker or 3Commas allow more sophisticated strategies. Watch out for additional fees and security when sharing API access.

ETFs via broker

If you go through ETFs, your traditional broker (Fidelity, Schwab, Robinhood…) usually offers scheduled investment plans with zero or reduced fees.

Tax considerations for passive crypto investors

Tax treatment is an often underestimated advantage of passive investing. Here’s what to consider:

Fewer transactions = fewer taxable events

In most jurisdictions, crypto taxation triggers upon conversion to fiat currency or crypto-to-crypto trades. A passive investor who accumulates without selling has no taxes to pay until final disposal. An active trader must report every gain.

Long-term capital gains

In the US, holding crypto for over a year qualifies for long-term capital gains rates (0%, 15%, or 20% depending on income), significantly lower than short-term rates (ordinary income tax). Similar preferential treatment exists in many countries.

Simplified reporting

The passive investor often has only one or two annual transactions to report. The active trader may need to reconstruct potentially hundreds of operations — an accounting nightmare.

ETFs: different treatment

Crypto ETFs follow traditional securities tax rules. They can potentially be held in tax-advantaged accounts (IRA, 401k in the US) for optimized taxation.

DCA historical performance on Bitcoin: the numbers

Past performance doesn’t guarantee future results, but historical Bitcoin DCA data is compelling:

Simulation: $100/month in Bitcoin

- Since January 2015 (10 years): $12,000 invested → ~$234,000 (+1,850%)

- Since January 2018 (7 years): $8,400 invested → ~$47,000 (+460%)

- Since January 2020 (5 years): $6,000 invested → ~$24,500 (+308%)

- Since January 2022 (3 years, post-ATH): $3,600 invested → ~$7,200 (+100%)

Key lesson: even starting at the worst possible moment (2021 ATH), DCA allows you to double your investment in 3 years thanks to accumulation during the bear market. This is the power of price smoothing in action.

Mistakes to avoid in passive crypto investing

Passive investing seems simple, but certain mistakes can sabotage your results:

1. Trying to “time” the market anyway

“I’ll wait for it to drop a bit before resuming my DCA”… And you miss the rally. The essence of DCA is precisely NOT trying to time. Trust the process.

2. Checking prices too often

Looking at your portfolio 10 times daily tempts you to make impulsive decisions. Once a month is enough. Disable price notifications if needed.

3. Panicking and selling during corrections

Bear markets are part of the crypto cycle. If you sell at -50%, you turn a paper loss into a real loss AND miss the recovery. DCA during bear markets is what boosts your long-term returns.

4. Investing money you need

Only invest what you can lock away for 5+ years minimum. If you must urgently sell during a dip, the passive strategy fails.

5. Over-diversifying

A portfolio of 30 different cryptos isn’t diversification, it’s dilution. 3-7 well-chosen assets are plenty for a passive portfolio.

Conclusion: passive investing, your best ally for crypto wealth building

Passive investing isn’t a miracle solution, but it’s the most rational and accessible strategy for cryptocurrency investment. Data proves it: it statistically beats active trading, reduces stress and fees, and allows anyone to build crypto wealth over the long term.

Keys to success? Simplicity, consistency, and patience. Choose 2-5 quality assets, schedule automatic purchases, and let time do its work. In a market as volatile as crypto, DCA’s mechanical discipline is your best shield against your own emotions.

And if you want guidance on this journey, Fibo offers a turnkey solution to build and manage your passive crypto portfolio, without technical jargon and with responsive support. Start today — your future self will thank you.

📚 Glossary

- Passive investing : Investment strategy of buying and holding a diversified portfolio long-term, without trying to anticipate market movements or “beat” a benchmark index.

- DCA (Dollar Cost Averaging) : Scheduled investment technique of investing a fixed amount at regular intervals, regardless of asset price, to smooth the average purchase price.

- HODL : Crypto term meaning “Hold On for Dear Life” — long-term hold strategy without selling, regardless of market volatility.

- Active management : Investment approach where traders attempt to outperform the market through frequent buying and selling based on technical or fundamental analysis.

- ETF (Exchange-Traded Fund) : Publicly traded index fund that replicates an underlying asset’s price. Spot Bitcoin ETFs allow Bitcoin investment through a traditional brokerage account.

- Lump Sum : Investing a large amount all at once, as opposed to DCA which spreads purchases over time.

- Rebalancing : Readjusting portfolio proportions to return to target allocation, typically by selling overweight assets and buying underweight ones.

- Bitcoin (BTC) : First and largest cryptocurrency by market cap, created in 2009 by Satoshi Nakamoto. Reference asset for passive crypto investing.

- Ethereum (ETH) : Second cryptocurrency by market cap, smart contract platform used for DeFi, NFTs and numerous decentralized applications.

- Altcoin : Any cryptocurrency other than Bitcoin. Includes Ethereum, Solana, Cardano, Polygon, Avalanche and thousands of other projects.

- Volatility : Measure of price variation amplitude and frequency for an asset. The crypto market is characterized by extreme volatility compared to traditional markets.

- Wallet : Software or physical device for storing, receiving and sending cryptocurrencies. Hardware wallets (Ledger, Trezor) offer maximum security.

- Bear market : Extended period of price decline in a market. In crypto, bear markets can see 70-90% corrections from peaks.

- Bull market : Extended period of rising prices, characterized by investor optimism and high buying volumes.

- Market timing : Attempting to predict market highs and lows to optimize buy/sell decisions — statistically proven to underperform passive strategies.

Frequently Asked Questions

What is passive investing in cryptocurrency?

Passive crypto investing is a long-term investment strategy that involves buying and holding a diversified portfolio of cryptocurrencies (typically Bitcoin, Ethereum and a few major altcoins) without trying to “time” the market or actively trade. The goal is to benefit from the sector’s overall growth over several years while minimizing fees, stress and emotional mistakes. Unlike active management requiring constant monitoring, passive investing only requires a few hours monthly.

Is DCA really effective for crypto investing?

Yes, DCA (Dollar Cost Averaging) is a proven strategy particularly effective in crypto. By investing a fixed amount at regular intervals, you mechanically buy more when prices are low and less when high, smoothing your average entry price. Historical data shows monthly Bitcoin DCA has been profitable over 5+ years from any starting period. Additionally, DCA eliminates “market timing” stress — the main cause of underperformance among retail investors.

Passive or active management: which should I choose?

For 95% of investors, passive management is superior. According to Binance Research 2024, 92% of active traders underperform a simple passive portfolio over 2 years. Passive management offers: less stress, fewer fees, less time required, and statistically better performance. Active management only suits professional traders dedicating 40+ hours weekly who accept the risk of underperformance. If you have a job, social life and other priorities, passive investing is for you.

What's the best frequency for crypto DCA?

Monthly frequency is the best compromise for most investors. It offers good volatility smoothing with only 12 yearly transactions (optimized fees). Weekly DCA provides better smoothing but generates more fees. Quarterly DCA suits large amounts. What matters isn’t the exact frequency but consistency: choose a frequency you can maintain for years without fail.

How much should I invest in crypto with a passive strategy?

The golden rule: only invest what you can lock away for 5+ years and whose total loss wouldn’t change your life. A typical allocation is 5-15% of your total net worth in crypto. For monthly amounts, start with what won’t put you in financial difficulty — even $50/month can build significant wealth over 10 years. Consistency over time matters more than initial amount.

How do I build a balanced passive crypto portfolio?

For a balanced passive portfolio, start simple: 60-70% Bitcoin (store of value), 20-30% Ethereum (smart contracts), and optionally 10-20% in major altcoins (Solana, Cardano, Polygon). Choose a reliable platform with recurring purchase features (Kraken, Binance, Coinbase), schedule automatic purchases, and rebalance once yearly if allocation drifts more than 10%. For amounts over $5,000, transfer to a hardware wallet.

Are Bitcoin ETFs a good option for passive investing?

Yes, spot Bitcoin ETFs are excellent for passive investing, especially if you’re a beginner or prefer simplicity. Advantages: purchase through traditional broker, no wallet to manage, institutional security, potentially optimizable taxation. Disadvantages: annual management fees (0.2-0.5%), no direct bitcoin ownership. For crypto purists, direct purchase remains preferable. For traditional investors wanting simple exposure, ETFs are perfect.

What are the tax implications of passive crypto investing?

Tax treatment varies by jurisdiction, but passive investing generally offers advantages. Holding reduces taxable events since taxes typically trigger on disposal. In the US, holding over a year qualifies for favorable long-term capital gains rates. Fewer transactions mean simpler reporting. ETFs may be held in tax-advantaged accounts. Always consult a tax professional for your specific situation.

What mistakes should I avoid in passive crypto investing?

The 5 fatal mistakes: 1) Trying to “time” the market anyway (don’t wait for a dip to resume DCA); 2) Checking prices too often (once monthly is enough); 3) Panicking and selling during bear markets (that’s when you accumulate most); 4) Investing money you might need soon; 5) Over-diversifying with 30+ cryptos instead of 3-7 quality assets. Discipline and patience are the keys to success.

Does DCA work even during a bear market?

Yes, and that’s when it shines most! During a bear market, your regular purchases accumulate more crypto for the same amount. This is exactly when DCA discipline makes the difference. Example: someone who started DCA at the worst time (November 2021 ATH) still doubled their investment in 3 years thanks to discounted purchases during 2022-2023. Bear markets aren’t a problem for passive investors — they’re accumulation opportunities.

📰 Sources

This article is based on the following sources:

- Binance Research – Annual Trading Report 2024

- Vanguard – Dollar Cost Averaging Study

- BlackRock iShares – Bitcoin ETF Data

- CoinMarketCap – Market Analytics

- Bitcoin Magazine – DCA Research

- ARK Invest – Big Ideas 2025

- Fidelity Digital Assets Research

- CoinGecko – Historical Price Data

Comment citer cet article : Fibo Crypto. (2026). Passive Crypto Investing: Complete DCA Guide and Dollar Cost Averaging Strategy 2026. Consulté le 11 February 2026 sur https://fibo-crypto.fr/en/blog/passive-crypto-investing-dca-guide