Bitcoin: A Solution to the Climate Crisis?

📋 En bref (TL;DR)

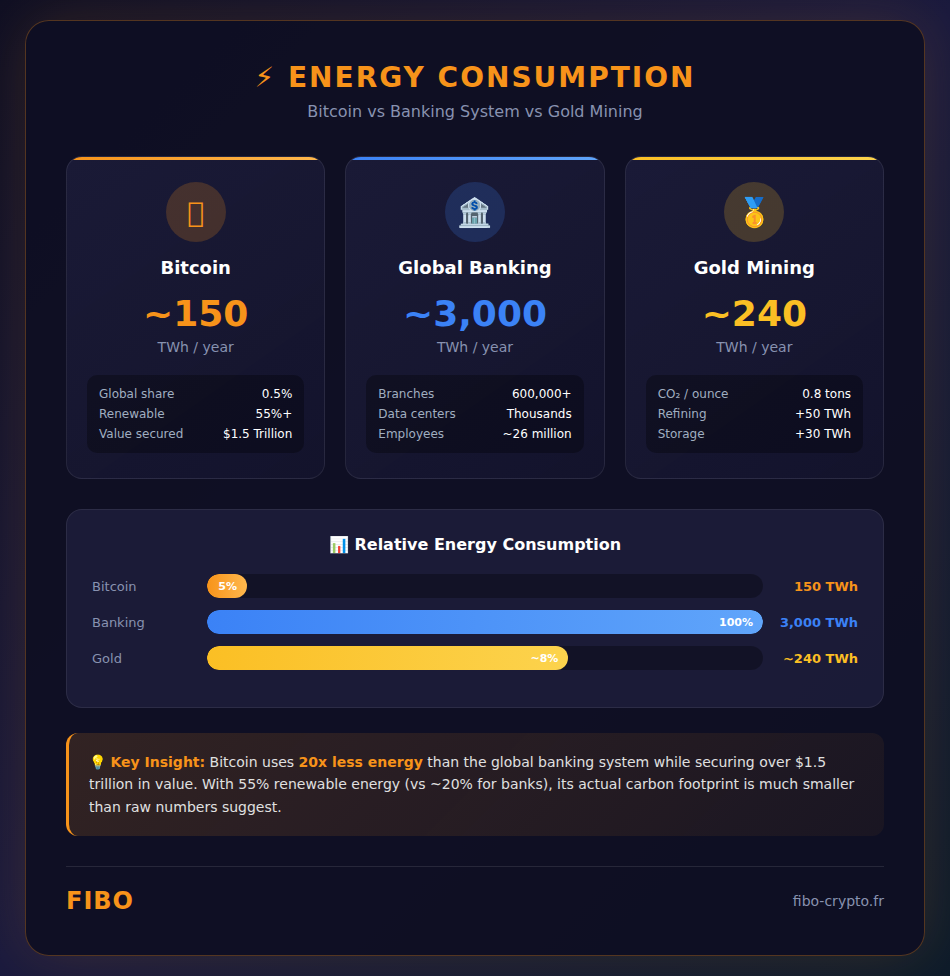

- Bitcoin consumption: ~127-160 TWh/year, i.e., 0.5% of global electricity — comparable to a small country, but less than American clothes dryers

- Energy mix: 52-56% renewable energy according to the Bitcoin Mining Council — steadily rising from 39% in 2020

- Hidden utility: Mining monetizes wasted energy (flared gas, hydro surplus) and funds green projects in isolated areas

- Banking comparison: Bitcoin is reportedly 56x more efficient than traditional banking per dollar secured

- Trend: The network is rapidly greening — some analysts predict 70-80% renewables by 2030

Imagine being told that a technology consuming as much electricity as a country of 45 million people could actually help solve the climate crisis. Counterintuitive? Yet this is the thesis increasingly defended by researchers, energy experts, and even some environmentalists.

Today, the climate crisis and energy transition are at the heart of global concerns. Nearly ten years after the 2015 Paris Agreement, the situation is alarming: the world is not on track to limit warming to 1.5°C. In this context, Bitcoin is often pointed to as a major environmental problem. But stopping at this observation means ignoring a much more nuanced reality.

Bitcoin’s Real Consumption: Putting the Numbers in Perspective

The Bitcoin network consumes about 127-160 TWh per year, roughly 0.5% of global electricity consumption. To put this number in perspective:

- It’s comparable to the consumption of Argentina (45 million inhabitants) or Norway

- It’s less than American clothes dryers (~108 TWh/year)

- It’s about 7 times Google’s consumption (all data centers combined)

- It’s 0.1% of global CO₂ emissions

The “Per Transaction” Comparison Trap

You may have read that a Bitcoin transaction consumes as much as an American household for a month (~1,200 kWh). These figures are technically true — but deeply misleading. Why? Because Bitcoin is not Visa. Bitcoin is a final settlement system that secures a store of value worth over $1.5 trillion — 24/7, without intermediaries.

🎯 The Safe Analogy: Imagine a giant safe that protects $1.5 trillion permanently. You don’t judge its energy cost “per item deposited” — you judge it relative to the value it secures.

An Increasingly Green Energy Mix

Despite its “dirty energy” reputation, Bitcoin mining is greening at a remarkable pace. According to Cambridge University, in 2020, only 39% of miners’ energy came from renewable sources. Today, that figure exceeds 55% — a 16-point increase in five years.

This transformation is driven by several factors:

- 🇨🇦 Migration to green regions: Canada (Quebec), Iceland, and Scandinavia attract miners with their 100% hydroelectric or geothermal electricity

- 🇨🇳 The 2021 Chinese ban: China represented 65% of global hashrate, largely powered by coal. Its ban forced a massive migration to countries with cleaner energy

- 💰 Pure economics: Miners chase the cheapest electricity. Renewables have become the cheapest in many regions

- 🌍 ESG pressure: Publicly traded miners must justify their energy mix to institutional investors

Bitcoin as “Buyer of Last Resort”

Here’s the most powerful argument for Bitcoin mining: its role as an electricity buyer of last resort. Mining has three unique characteristics that make it the ideal partner for renewable energy:

- ⚡ Flexible demand: A miner can turn on or off in seconds

- 🌍 Relocatable demand: Mining can be set up anywhere — in the middle of the desert, on an isolated oil field

- 💵 Profitable demand: Mining generates predictable revenue, enabling funding of otherwise non-viable green energy projects

Flared Gas Monetization

Every year, the oil industry burns about 150 billion m³ of natural gas in the open air. Companies like Crusoe Energy install mining containers directly on extraction sites. The gas that would have been flared powers generators that run ASICs. Crusoe Energy already captures the equivalent of 8 million tons of CO₂ per year.

Bitcoin vs Banking System: The Real Comparison

When you add up the 600,000+ bank branches, thousands of data centers, millions of daily commutes, and physical gold storage, the global banking system consumes between 2,000 and 4,000 TWh per year — 20 to 30 times more than Bitcoin.

According to analyses by Hass McCook and Galaxy Digital, Bitcoin is 56 times more energy efficient than traditional banking for securing value.

Legitimate Criticisms

It would be dishonest to present only the positive aspects:

- 📊 Absolute consumption remains significant: ~70 TWh still comes from fossil sources

- 🏭 Some miners use coal: Notably in Kazakhstan after the Chinese ban

- 📈 Hashrate growth: If the price rises, consumption could increase

- 🔌 Competition for electricity: In some regions, miners may compete with residents

The Future: Towards 100% Green Mining?

Several converging trends suggest Bitcoin mining will become one of the greenest industries:

- 📉 Falling renewable costs: Solar costs have dropped 90% in 15 years

- 🏛️ ESG regulation: Growing pressure from institutional investors

- 💡 Technological innovation: ASICs are becoming increasingly efficient (15 J/TH in 2025 vs 30 J/TH in 2020)

- 🔥 Waste valorization: Biogas, residual heat, tidal energy…

Some analysts estimate that mining could reach 70-80% renewable energy by 2030.

Conclusion

Bitcoin consumes energy, that’s undeniable. But this consumption can become a tool for energy transition: by monetizing surpluses, funding isolated green projects, transforming waste into resources. Bitcoin mining is neither an ecological disaster nor a miracle solution. It’s a tool — and its impact depends on how we use it.

📚 Glossary

- Bitcoin : First decentralized cryptocurrency, created in 2009. Consumes electricity to secure its network through mining.

- Mining : Bitcoin transaction validation process that requires computing power and therefore electricity.

- Hashrate : Total computing power of the Bitcoin network, measured in hashes per second (currently EH/s).

- Proof of Work : Bitcoin’s consensus mechanism where miners prove they’ve performed computational work.

- Renewable energy : Energy sources that naturally replenish (solar, wind, hydro, geothermal).

- Flared gas : Natural gas burned at oil extraction sites, normally wasted.

- Energy mix : Distribution of energy sources used (fossil vs renewable).

- Carbon footprint : Amount of CO₂ emitted by an activity or system.

- TWh : Terawatt-hour, unit of energy measurement (1 TWh = 1 billion kWh).

- ASIC : Specialized machine for Bitcoin mining, increasingly energy efficient.

- ESG : Environmental, Social and Governance criteria used to evaluate companies.

- Bitcoin Mining Council : Organization of major miners that publishes data on energy mix.

Frequently Asked Questions

Is Bitcoin really bad for the environment?

The answer is nuanced. Bitcoin consumes ~0.5% of global electricity, which is significant. But over 55% comes from renewable energy, and mining can monetize otherwise wasted energy (flared gas, hydro surpluses). The impact heavily depends on the energy mix used.

What percentage of Bitcoin mining uses renewable energy?

According to the Bitcoin Mining Council (2023-2025), about 52-56% of mining uses renewable energy. This figure has been rising steadily from about 39% in 2020. Some analysts predict 70-80% by 2030.

Why can Bitcoin mining help renewable energy?

Mining is flexible demand that can turn on/off instantly. It can absorb solar/wind production surpluses, guarantee revenue for green energy producers in isolated areas, and monetize otherwise wasted energy like flared gas.

How much energy does a Bitcoin transaction consume?

A Bitcoin transaction consumes an average of ~1,200 kWh. But this metric is misleading because Bitcoin secures a store of value (~$1.5 trillion), not just transactions. It’s like judging a safe’s cost “per item deposited.”

Will Bitcoin mining ever be 100% green?

It’s possible, and the trend is heading that way. With falling solar/wind costs, ESG pressure on listed miners, and technological innovation, some analysts estimate mining could reach 70-80% renewable by 2030.

What is flared gas and what does it have to do with Bitcoin?

Flared gas is natural gas burned in the open air at oil extraction sites — about 150 billion m³/year. Companies like Crusoe Energy use this gas to power mining containers, transforming a polluting waste into a revenue source.

📰 Sources

This article is based on the following sources:

- Cambridge Bitcoin Electricity Consumption Index

- Bitcoin Mining Council Reports

- IEA World Energy Outlook

- Daniel Batten – Bitcoin ESG Analysis

- IRENA Renewable Energy Statistics

- Galaxy Digital Research

Comment citer cet article : Fibo Crypto. (2026). Bitcoin: A Solution to the Climate Crisis?. Consulté le 10 February 2026 sur https://fibo-crypto.fr/en/blog/bitcoin-climate-solution