Stablecoins: The Yield Wars Hit the White House

📋 En bref (TL;DR)

- Tense White House meeting: On February 10, crypto and banking lobbies clashed over stablecoin yield regulations

- Total ban demanded: Banks want to prohibit any form of compensation tied to stablecoins in the Clarity Act

- Political deadlock: Despite White House calls for compromise, no agreement was reached

- Major stakes: Stablecoin yields are a core business model for crypto platforms

- Intense lobbying: Bank Policy Institute and American Bankers Association vs. Coinbase, Ripple, a16z, and the Blockchain Association

- Tight timeline: The 2026 midterms are approaching, limiting available time for legislation

A Summit Meeting That Turned Into a Showdown

On Tuesday, February 10, 2026, the White House hosted a negotiation meeting meant to bring together two worlds that couldn’t be more different: traditional banks and the cryptocurrency industry. The issue? Finding a compromise on one of the thorniest questions in the Digital Asset Market Clarity Act: stablecoin yields. According to CoinDesk, crypto negotiators arrived ready to discuss. Their banking counterparts, however, came with a non-negotiable position: ban these yields outright. The crypto industry was represented by its heavyweights: executives from Coinbase, Ripple, a16z, the Crypto Council for Innovation, and the Blockchain Association. Facing them were America’s most powerful banking lobbies, including the Bank Policy Institute and the American Bankers Association.The Document That Reveals Banks’ Hardline Stance

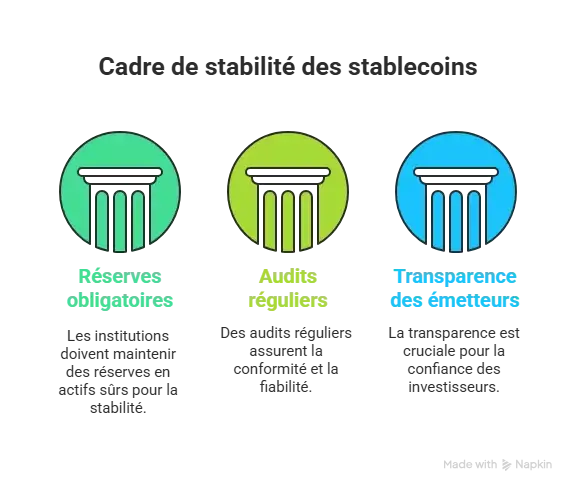

A principles document circulated by banking negotiators, obtained by CoinDesk, lays out their position without ambiguity. Banks are demanding a ban on “any form of financial or non-financial consideration given to the holder of a payment stablecoin in connection with the purchase, use, holding, possession, or custody of said stablecoin.” In plain terms, this wording aims to block any compensation mechanism: interest payments, yield farming, loyalty programs, or in-kind rewards. The document goes further. It demands that regulators have enforcement tools to uphold this ban and calls for an official study on how stablecoins impact bank deposits.Why Are Banks So Hostile to Yields?

The yield wars aren’t just a technical dispute. They strike at the heart of the banking business model.The Threat to Deposits

Traditional banks operate on customer deposits. These funds allow them to make loans to businesses and households—what the industry calls “Main Street lending.” But if stablecoins offer yields higher than traditional savings accounts, depositors could migrate en masse to crypto. This “deposit flight” is bankers’ nightmare. It would reduce their lending capacity and destabilize the entire American credit system.A Competitive Advantage Seen as Unfair

Crypto platforms like Coinbase or Circle can offer attractive stablecoin yields because they invest underlying reserves (typically in U.S. Treasury bills) and share a portion of the interest with users. Banks, on the other hand, face strict regulatory requirements: capital ratios, FDIC deposit insurance, regular stress tests. They argue that stablecoin issuers escape these constraints while capturing their customer base.The Clarity Act: A Bill Stuck for Months

The Digital Asset Market Clarity Act was supposed to be the landmark crypto regulation of the Trump 2.0 era. Passed by the House of Representatives last year, it has been mired in the Senate for several months.The Sticking Points

Beyond yields, several other issues divide Democrats and Republicans: 1. Presidential conflicts of interest — Democrats demand a prohibition on senior government officials holding significant crypto interests. This clause directly targets Donald Trump’s personal investments in the sector. Patrick Witt, White House crypto advisor, told CoinDesk that the administration “will not support legislation that attacks the president on ethics.” 2. Anti-money laundering — Democratic senators want stronger protections against using crypto for illicit purposes. 3. CFTC composition — They’re demanding the agency be fully staffed, including Democratic commissioners, before it can regulate crypto markets.A Tight Political Calendar

The November 2026 midterms are approaching. The traditionally slow Senate is already struggling to find session time for its priority items. The current deadlock over Department of Homeland Security funding is monopolizing attention. The longer this drags on, the less likely it becomes that major crypto legislation can pass before the elections.Lukewarm Official Statements

After the meeting, both sides communicated—without conceding anything. Summer Mersinger, CEO of the Blockchain Association, struck an optimistic tone: “We are encouraged by the progress made as stakeholders remain constructively engaged to resolve outstanding issues.” Ji Kim, head of the Crypto Council for Innovation, soberly stated that “important work continues” and thanked “the banking industry for its ongoing engagement.” On the banking side, a joint statement from the Bank Policy Institute and the American Bankers Association reiterated their red line: “This framework can and should embrace financial innovation without compromising safety, and without jeopardizing the bank deposits that fuel local lending and economic activity.”What’s Next? Possible Scenarios

After two White House meetings without significant progress, the ball could return to legislators.Scenario 1: A Last-Minute Compromise

Negotiators could find a middle-ground formula: allowing yields under strict conditions (rate caps, audited reserves, specific licensing). This would be a partial victory for both camps.Scenario 2: A Vote Without Consensus

The Senate Banking Committee could force a majority vote, even without bipartisan agreement. The bill would then be modified through amendments, with unpredictable results.Scenario 3: Indefinite Postponement

Faced with multiple roadblocks, the Clarity Act could be pushed back until after the midterms. The crypto industry would continue operating in regulatory limbo that benefits offshore players.What This Means for Investors

For holders of stablecoins like USDT or USDC, this battle has concrete implications. If yields are banned in the United States, American platforms (Coinbase, Kraken, Gemini) won’t be able to offer stablecoin returns. Investors would need to either: – Turn to offshore platforms (with associated risks) – Accept stablecoins without compensation – Migrate to decentralized DeFi solutions, outside the regulatory perimeter Conversely, if a compromise allows regulated yields, American stablecoins could become more attractive and strengthen their dominance over Tether’s USDT, issued from the British Virgin Islands.Conclusion: A War of Attrition Shaping America’s Crypto Future

The February 10 meeting at the White House didn’t resolve the conflict between banks and crypto over stablecoin yields. It confirmed that this issue has become the Gordian knot of American crypto regulation. Banks are defending their historical model. The crypto industry is defending its competitive advantage. And in the middle, legislators are trying to build a framework that satisfies both camps—an equation that seems unsolvable today. One thing is certain: the outcome of this battle will determine whether the United States remains the center of gravity for financial innovation or lets it migrate to more welcoming jurisdictions.📚 Glossary

- Stablecoin : A cryptocurrency whose value is pegged to a stable asset, typically the U.S. dollar. The most well-known are USDT (Tether) and USDC (Circle).

- Stablecoin yields : Interest or rewards paid to stablecoin holders, typically derived from investing reserves in Treasury bills.

- Yield : The return or interest rate generated by a financial asset.

- CFTC : Commodity Futures Trading Commission, the U.S. agency that regulates derivatives markets and could oversee crypto under the Clarity Act.

- DeFi : Decentralized Finance, a set of financial protocols operating on blockchain without centralized intermediaries.

- USDT : Tether, the world’s most widely used stablecoin with over $140 billion in circulation.

- USDC : A stablecoin issued by Circle, considered more transparent and compliant with U.S. regulations.

Frequently Asked Questions

What is the Digital Asset Market Clarity Act?

It’s a U.S. bill aimed at creating a comprehensive regulatory framework for cryptocurrencies. It defines which cryptos are securities (regulated by the SEC) and which are commodities (regulated by the CFTC). The bill also includes rules on stablecoins and their issuers.

Why do banks want to ban stablecoin yields?

Banks fear deposit flight to stablecoins if they offer yields higher than traditional savings accounts. This migration would reduce their lending capacity and undermine their business model based on customer deposits.

Can stablecoins really offer attractive yields?

Yes. Stablecoin issuers typically invest their reserves in U.S. Treasury bills. With benchmark rates around 4-5%, they can pass on part of this interest to users, offering returns higher than traditional savings accounts.

What happens if the Clarity Act isn't passed before the midterms?

The bill would be postponed to the next Congressional session in 2027. The crypto industry would continue operating without a clear regulatory framework in the U.S., which could push some players to relocate to more favorable jurisdictions like Dubai or Singapore.

What's the impact for European stablecoin holders?

Europe has already adopted the MiCA regulation governing stablecoins. U.S. decisions won’t directly affect European investors, but could influence the availability of certain American stablecoins like USDC on European platforms.

📰 Sources

This article is based on the following sources:

- CoinDesk – Crypto’s banker adversaries didn’t want to deal in latest White House meeting

- Bank Policy Institute – Statement on White House crypto market structure meeting

- CoinDesk – Trump adviser says White House won’t allow crypto bill to attack president

- CoinDesk – White House crypto meeting on market structure bill

Comment citer cet article : Fibo Crypto. (2026). Stablecoins: The Yield Wars Hit the White House. Consulté le 13 February 2026 sur https://fibo-crypto.fr/en/blog/stablecoins-yield-wars-white-house-clarity-act