BitVM: Smart Contracts on Bitcoin – Complete Guide 2026

📋 En bref (TL;DR)

- BitVM is a revolutionary technology enabling complex smart contracts on Bitcoin without modifying the protocol

- How it works: Off-chain computations with on-chain verification only in case of disputes (optimistic rollup model)

- Taproot & Script: BitVM leverages existing Bitcoin features, no hard fork required

- BitVM2 improves the initial design with multiple verifiers and faster challenge processes

- Applications: Trustless bridges, rollups, native Bitcoin DeFi, BTC-backed stablecoins

- Active projects: Bitlayer, BitVMX, Citrea, BOB Network are building real solutions based on BitVM

- Impact: BitVM opens Bitcoin’s “Season 2” with advanced programmability while preserving maximum security

BitVM represents one of the most significant innovations in the Bitcoin ecosystem since Taproot’s activation in 2021. This technology, introduced by Robin Linus in October 2023, enables complex computations and smart contracts on Bitcoin without requiring any protocol modifications. A technical breakthrough that could transform Bitcoin into a full-fledged decentralized finance (DeFi) platform while maintaining its legendary security.

In this comprehensive guide, we explore how BitVM works, its concrete applications, advantages over Ethereum smart contracts, and the challenges it still needs to overcome. Whether you’re a developer, investor, or simply curious about Bitcoin’s evolution, this article provides all the keys to understanding this revolutionary technology.

What Is BitVM? Definition and Core Principles

BitVM, standing for “Bitcoin Virtual Machine,” is a computing paradigm that enables Turing-complete Bitcoin contracts. In practical terms, this means BitVM can theoretically execute any computer program on Bitcoin—a capability previously reserved for blockchains like Ethereum.

BitVM’s major innovation lies in its approach: rather than executing computations directly on the Bitcoin blockchain (which would be impossible without protocol changes), BitVM verifies them. This fundamental distinction is inspired by optimistic rollups used on Ethereum.

Key Principles of BitVM

- Off-chain computation: Complex operations are executed outside the Bitcoin blockchain

- On-chain verification: Only fraud proofs are published on Bitcoin, in case of disputes

- Cryptographic security: Participants deposit BTC as collateral, confiscated if they act dishonestly

- Native compatibility: Uses existing Taproot and Bitcoin Script, no fork required

Robin Linus, co-founder of ZeroSync, presented BitVM in a whitepaper published in October 2023. Since then, the technology has seen significant developments with BitVM2, and several projects are actively building applications based on this paradigm.

How Does BitVM Work? Technical Deep Dive

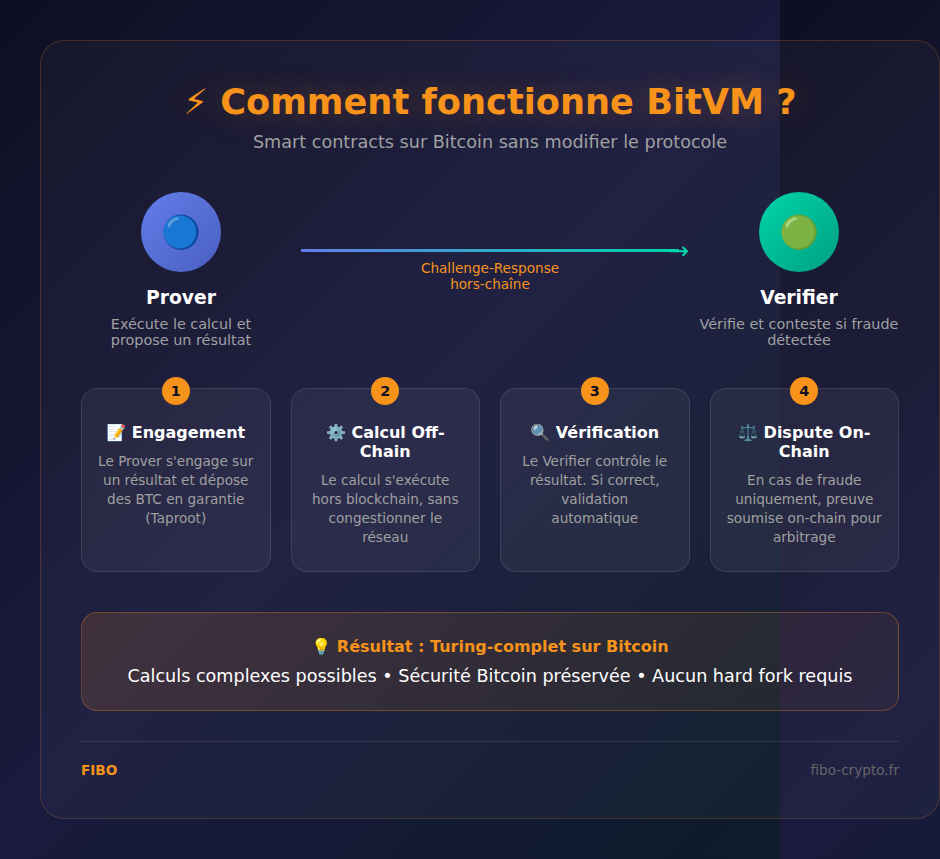

BitVM’s operation relies on a challenge-response system between two main actors: the Prover and the Verifier.

The Actors in the BitVM System

The Prover is the actor who executes the computation and commits to a result. They deposit bitcoins into a Taproot contract as collateral for their honesty. If their computation is correct, they get their funds back. If they cheat, they lose their stake.

The Verifier is responsible for checking the accuracy of the Prover’s proposed result. They can initiate a series of challenges if the result appears incorrect. The Verifier only needs to submit proof on-chain if the Prover is dishonest.

The 4-Step Process

- Initial commitment: The Prover and Verifier deposit BTC into a 2-of-2 multisig address via Taproot. The Prover commits to the result of a specific computation.

- Off-chain execution: The complex computation (smart contract simulation, data verification, etc.) is executed entirely off the Bitcoin blockchain. This prevents network congestion.

- Verification: The Verifier checks the proposed result. If everything is correct, the transaction finalizes automatically after a predefined delay.

- On-chain dispute (if needed): If the Verifier detects fraud, they initiate a “bisection game” that precisely isolates the error. A small portion of the computation is then executed on-chain to determine who is right.

The Bisection Game: Dispute Resolution

The bisection game is at the heart of BitVM’s security. When a dispute arises, rather than executing the entire computation on-chain (which would be costly and slow), the protocol successively divides the computation in half until it isolates the precise operation where the Prover made an error.

This technique drastically reduces the amount of data published on-chain, even for very complex programs. The final fraud proof typically requires only a few Bitcoin transactions.

BitVM2: The Enhanced Protocol

A few months after the initial whitepaper, Robin Linus and his team introduced BitVM2, a significant evolution that addresses several limitations of the first version.

BitVM2 Improvements

- Multiple verifiers: Unlike BitVM1 which only supported two parties, BitVM2 allows anyone to challenge a fraudulent claim. This significantly strengthens system security.

- Simplified process: The number of challenge-response steps is reduced to just two, compared to potentially dozens in the original version.

- Easier deployment: BitVM2’s architecture is simpler to implement, accelerating developer adoption.

- Zero-knowledge proof support: BitVM2 can verify ZK (Zero-Knowledge) proofs, paving the way for ZK-rollups on Bitcoin.

1-of-n Trust Model

One of BitVM2’s major innovations is its “1-of-n” trust model. This means that only one honest participant needs to exist in the system to guarantee security. As long as at least one person is willing to submit a fraud proof, dishonest actors will be penalized.

This model is similar to that of optimistic rollups on Ethereum, which have proven their effectiveness with protocols like Optimism and Arbitrum.

Real-World BitVM Applications

BitVM isn’t just a theoretical innovation. Several projects are actively developing applications based on this technology, with concrete use cases that are transforming Bitcoin’s utility.

Trustless Cross-Chain Bridges

One of BitVM’s most promising applications is creating truly decentralized bridges between Bitcoin and other blockchains.

Currently, transferring BTC to another chain (like Ethereum or Solana) requires trusting a centralized intermediary or a group of signers (multisig). These solutions carry risks: hacking, collusion, censorship.

With BitVM, it becomes possible to create “trustless” bridges where security is cryptographically guaranteed. The Bitlayer Finality Bridge project is pioneering this space, with testnet deployment in early 2025 and partnerships with major mining pools (Antpool, F2Pool, SpiderPool) representing ~36% of Bitcoin’s hashrate.

Optimistic Rollups on Bitcoin

BitVM enables building rollups similar to Ethereum’s, but secured by Bitcoin. These Layer 2s execute transactions off-chain, then publish compressed summaries on the main chain.

Notable projects:

- BitVMX: An advanced framework enabling general program execution via a virtual CPU

- Citrea: A ZK-rollup using BitVM for proof verification

- BOB Network: A hybrid Bitcoin-Ethereum solution with settlement on Bitcoin

Native DeFi on Bitcoin

BitVM paves the way for true decentralized finance directly on Bitcoin, without needing wrapped BTC on other chains. Potential applications include:

- Lending and borrowing: Lending protocols collateralized by native BTC

- Stablecoins: Bitlayer’s YBTC project offers a 1:1 stablecoin backed by Bitcoin

- Decentralized exchanges: DEXs enabling BTC trading without intermediaries

- Derivatives: Trustless options and futures on Bitcoin

Gaming and Conditional Contracts

BitVM also enables verifiable games and conditional contracts on Bitcoin. For example, two players can compete in chess with a BTC stake, with the winner automatically receiving the funds through the smart contract.

BitVM vs Ethereum: Comparing Approaches

BitVM and the Ethereum Virtual Machine (EVM) represent two different philosophies for bringing programmability to blockchains. Understanding their differences is essential for evaluating BitVM’s potential.

On-Chain vs Off-Chain Execution

EVM (Ethereum): All computations are executed on-chain by all network nodes. This guarantees total transparency but leads to high gas fees and limited scalability.

BitVM (Bitcoin): Computations are performed off-chain and only fraud proofs are published on-chain in case of disputes. This approach is much more efficient in terms of costs and network congestion.

Trust Model

EVM: The trust model relies on Ethereum’s security and Proof-of-Stake consensus mechanism. All validators verify every transaction.

BitVM: BitVM’s “optimistic” model assumes participants are honest by default. Trust relies on the fact that at least one verifier will monitor the system and challenge fraud. The underlying security is that of Bitcoin (Proof-of-Work).

Advantages of Each Approach

| Criteria | BitVM | EVM |

|---|---|---|

| Underlying security | Bitcoin PoW (maximum) | Ethereum PoS |

| Normal usage fees | Very low | Variable (often high) |

| Scalability | High (off-chain) | Limited (+ L2) |

| Native multi-party | BitVM2 only | Yes |

| DeFi ecosystem | Developing | Mature |

| Oracles | Not native | Chainlink, etc. |

BitVM Advantages for the Bitcoin Ecosystem

BitVM brings several significant advantages that could transform Bitcoin’s utility and adoption.

Preserving Bitcoin Security

BitVM’s main asset is that it requires no modification to the Bitcoin protocol. The technology leverages already-present features (Taproot, Bitcoin Script) to enable complex computations. This means:

- No risk of controversial forks

- Preservation of decentralization and censorship resistance

- Maximum security inherited from Bitcoin’s hashrate

Fee Reduction

By executing computations off-chain, BitVM enables significantly reduced transaction fees. Users only pay Bitcoin fees when opening and closing channels, or in case of disputes (rare if participants are honest).

Unlocking Bitcoin Value

With over $1 trillion in market cap, Bitcoin represents a massive store of value but is largely underutilized in DeFi. BitVM enables “unlocking” this value by allowing BTC holders to participate in DeFi applications without leaving the Bitcoin ecosystem.

More Secure Bridges

Crypto bridges have been targeted by numerous hacks costing billions of dollars. BitVM offers a fundamentally more secure alternative through its trustless model, where security relies on cryptographic guarantees rather than trust in operators.

Current BitVM Limitations and Challenges

Despite its revolutionary potential, BitVM faces several technical and practical challenges worth understanding.

Two-Party Model (BitVM1)

The original BitVM version only supports two participants (Prover and Verifier). This limitation makes it difficult to create multi-user applications like DEXs or liquidity pools. BitVM2 partially solves this, but the ecosystem is still developing.

Dispute Complexity

In case of disputes, the challenge-response process can be lengthy and costly. Participants must stay online and responsive throughout the dispute period, which can create UX issues.

Off-Chain Data Management

BitVM generates significant data volumes that must be stored and managed off-chain. The availability and integrity of this data are crucial for proper system operation.

Lack of Native Oracles

Unlike Ethereum which has mature oracles like Chainlink, BitVM doesn’t yet have a standardized solution for integrating external data (prices, real-world events). This limits certain use cases like parametric insurance or prediction markets.

Ecosystem Maturity

BitVM is a recent technology (2023) and its ecosystem is still under construction. It will take time before seeing robust, audited, and widely adopted applications.

The BitVM Ecosystem: Major Projects and Players

Several teams and projects are actively developing the BitVM ecosystem. Here are the most important players to watch.

Bitlayer

Bitlayer is one of the most advanced projects implementing BitVM. Their “Finality Bridge” aims to create a trustless bridge between Bitcoin and other chains. In 2025, they announced partnerships with major mining pools to ensure BitVM transaction inclusion.

BitVMX

BitVMX is a framework developed by RootstockLabs and FairGate that pushes BitVM further by enabling program execution via a general-purpose virtual CPU. This approach opens possibilities well beyond traditional smart contracts.

Rootstock (RSK)

Rootstock is an EVM-compatible Bitcoin sidechain that has existed for several years. The team is actively exploring BitVM integration to improve their bridge security and enable trustless validation on Bitcoin.

Citrea and BOB Network

Citrea is developing a ZK-rollup that uses BitVM for zero-knowledge proof verification on Bitcoin. BOB Network offers a hybrid approach combining Bitcoin’s security with EVM flexibility.

ZeroSync

ZeroSync, Robin Linus’s organization (BitVM creator), works on cryptographic proofs for Bitcoin. Their ZK proofs expertise is directly applicable to BitVM’s evolution.

📚 Glossary

- BitVM : Bitcoin Virtual Machine, a computing paradigm enabling Turing-complete smart contracts on Bitcoin without modifying the protocol.

- Prover : Actor in the BitVM system who executes an off-chain computation and commits to a result by depositing BTC as collateral.

- Verifier : Actor who verifies the Prover’s computation accuracy and can initiate a challenge if fraud is detected.

- Turing-complete : A computer system’s ability to execute any calculable algorithm, like Ethereum or a regular computer.

- Smart contract : An autonomous blockchain program that executes automatically according to predefined conditions, without intermediaries.

- Taproot : 2021 Bitcoin upgrade improving privacy and enabling more complex scripts via MAST and Schnorr signatures.

- Rollup : Scalability solution executing transactions off-chain then publishing a compressed summary on-chain for validation.

- Bridge : Infrastructure enabling asset transfers between different blockchains securely.

- DeFi : Decentralized Finance, financial services (lending, exchanges, savings) operating without intermediaries on blockchain.

- Zero-knowledge (ZK) : Cryptographic proof allowing one to prove information’s truth without revealing the information itself.

- Off-chain : Operations performed outside the main blockchain, typically to reduce costs and improve scalability.

- On-chain : Operations recorded and executed directly on the blockchain, visible and verifiable by all nodes.

- Fraud proof : Cryptographic proof demonstrating that an actor attempted to submit false information, triggering their penalty.

- Challenge-response : Mechanism where a verifier can contest a claim by initiating exchanges to prove fraud.

- Optimistic rollup : Type of rollup assuming transactions are valid by default and only verifying on-chain in case of challenge.

Frequently Asked Questions

Does BitVM require a Bitcoin upgrade?

No, this is BitVM’s strong point. The technology uses Bitcoin’s existing features, notably Taproot (activated in 2021) and Bitcoin Script. No soft fork or hard fork is needed, preserving Bitcoin protocol’s stability and security.

What's the difference between BitVM and Ethereum smart contracts?

On Ethereum, all computations are executed on-chain by all nodes. BitVM performs computations off-chain and only uses the Bitcoin blockchain to verify fraud proofs in case of disputes. BitVM is more efficient but was limited to two parties in its initial version. BitVM2 improves this with multiple verifiers.

Does BitVM really enable DeFi on Bitcoin?

Yes, BitVM opens the door to native DeFi on Bitcoin. Projects like Bitlayer are already developing concrete applications: trustless bridges, stablecoins (YBTC), lending protocols. The ecosystem is under construction but the technical foundations are solid.

What are BitVM's limitations?

Main limitations include: the two-party model (solved by BitVM2), on-chain dispute complexity, lack of native oracles for external data, and the volume of off-chain data to manage. The ecosystem is also still young and developing.

Who created BitVM?

BitVM was introduced by Robin Linus, co-founder of ZeroSync, in a whitepaper published on October 9, 2023. Other notable contributors include Sam Parker and the pseudonymous developer Super Testnet who created the first proof of concept.

Is BitVM secure?

BitVM inherits Bitcoin’s security (the most secure network in the world). The security model relies on cryptographic guarantees: participants deposit BTC as collateral that is confiscated in case of fraud. Only one honest verifier needs to monitor the system for security to be ensured.

What projects use BitVM?

Several projects are developing BitVM-based applications: Bitlayer (bridges and DeFi), BitVMX (general computation framework), Citrea (ZK-rollup), BOB Network (Bitcoin-Ethereum hybrid), and Rootstock (EVM sidechain). The ecosystem is developing rapidly.

Will BitVM replace Ethereum?

No, BitVM and Ethereum have complementary approaches. Ethereum has a mature DeFi ecosystem with oracles and established applications. BitVM brings programmability to Bitcoin while benefiting from its maximum security. Both can coexist and serve different use cases.

📰 Sources

This article is based on the following sources:

- BitVM Whitepaper – Robin Linus

- Fidelity Digital Assets – Overview of BitVM

- Bitcoin Magazine – BitVM 2 Opening Up the Playing Field

- Blockworks – Bitlayer Finality Bridge

- Kraken Learn – What is BitVM

- BitVMX Whitepaper

- The Block – BitVM aims to enhance Bitcoin

Comment citer cet article : Fibo Crypto. (2026). BitVM: Smart Contracts on Bitcoin - Complete Guide 2026. Consulté le 11 February 2026 sur https://fibo-crypto.fr/en/blog/bitvm-bitcoin-smart-contracts

Conclusion: BitVM, the Dawn of Bitcoin 2.0?

BitVM represents a major technical breakthrough that could radically transform Bitcoin’s utility. By enabling complex smart contract execution without modifying the protocol, this technology paves the way for a native DeFi ecosystem on the world’s most secure blockchain.

The applications are numerous and promising: trustless bridges eliminating hack risks, scalable rollups secured by Bitcoin, lending protocols and stablecoins backed by native BTC. Projects like Bitlayer, BitVMX, and Citrea are actively working to make this vision reality.

Of course, challenges remain. The ecosystem is still young, some technical limitations need to be overcome, and mass adoption will take time. But the foundations are laid for what some call Bitcoin’s “Season 2”: an era of advanced programmability while preserving the core values of decentralization and security that make Bitcoin unique.

For investors and developers, BitVM deserves particular attention. This technology may well define the next chapter in Bitcoin’s history and blockchain as a whole.