Bitcoin Wealth Management: Complete Guide for Financial Advisors 2026

📋 TL;DR (Key Takeaways)

- Bitcoin is now a recognized alternative asset class essential for diversified wealth management strategies in 2026

- Recommended allocation: 1-5% of portfolio based on risk profile — conservative (1-2%), balanced (2-3%), dynamic (3-5%)

- Clear regulatory framework globally: US SEC-approved spot ETFs + European MiCA regulation since 2024

- Tax varies by jurisdiction: US (0-37%), UK (10-20%), Germany (tax-free after 1yr), many tax-friendly options available

- Bitcoin spot ETF vs direct ownership: ETF simplifies management but direct ownership offers true sovereignty

- Professional custody essential for high-net-worth clients: institutional solutions (Coinbase Prime, Fidelity Digital Assets, Copper)

- Advisors must master this topic: 71% of clients already hold crypto outside the advisory relationship (Bitwise 2026)

Bitcoin and wealth management are no longer parallel universes. In 2026, ignoring cryptocurrencies as a financial advisor or wealth manager means ignoring an asset class that has outperformed all others over 15 years. With the approval of Bitcoin spot ETFs in the United States, the implementation of MiCA in Europe, and Bitcoin’s market capitalization exceeding $1.9 trillion, the question is no longer « should we pay attention? » but « how do we intelligently integrate it into a wealth strategy? »

This comprehensive guide is designed for financial advisors, wealth managers, RIAs, and family offices looking to master Bitcoin’s role in client portfolios. We’ll cover: the fundamentals justifying Bitcoin integration, the global regulatory landscape, allocation strategies by risk profile, tax optimization approaches, secure custody solutions, and practical case studies.

Why Integrate Bitcoin Into a Wealth Strategy in 2026?

An Asset Class Recognized by Institutions

Bitcoin reached a decisive milestone with the approval of Bitcoin spot ETFs by the US SEC in January 2024. In less than a year, these products attracted over $50 billion in inflows, making BlackRock’s iShares Bitcoin Trust (IBIT) the fastest-growing ETF in history. Larry Fink, CEO of BlackRock — the world’s largest asset manager with over $10 trillion under management — now calls Bitcoin « digital gold » and « the best-performing asset in half a century. »

This institutional legitimization is transformative for wealth managers:

- Growing client demand: According to the Bitwise/VettaFi 2026 survey, 71% of advisors have clients who already hold crypto outside the advisory relationship

- Professional adoption: 42% of US advisors can now invest in crypto for their clients, up from 35% in 2024

- Mature infrastructure: Institutional custodians, regulated platforms, and suitable financial instruments

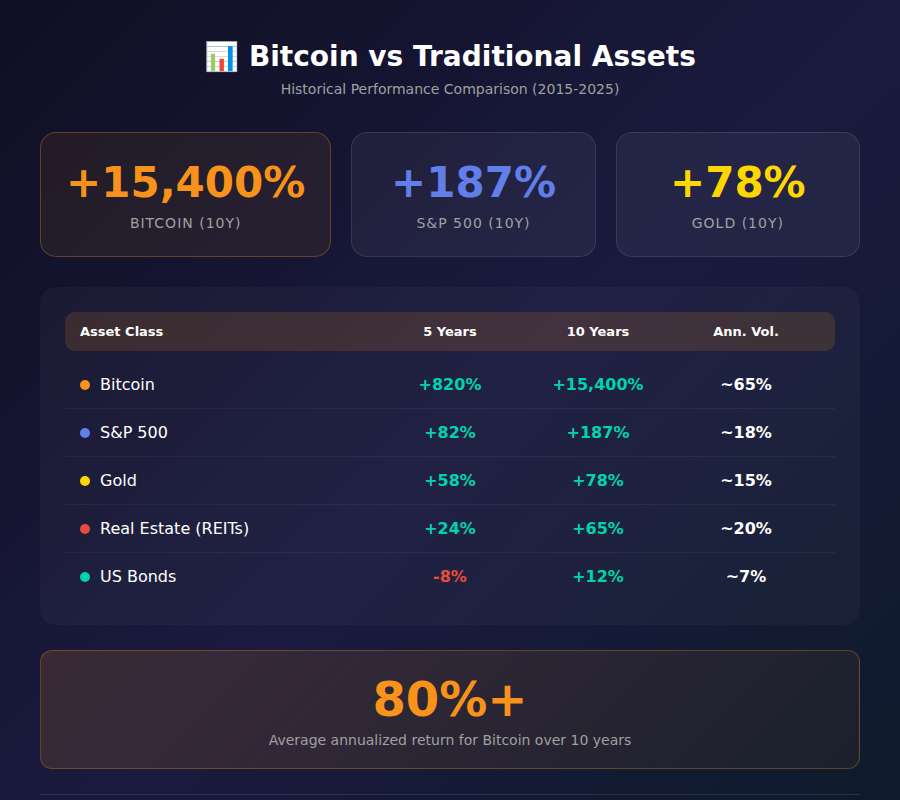

Exceptional Historical Performance

Over the past 15 years, Bitcoin has delivered returns that no other asset has matched:

- 2010-2025: From $0.003 to over $95,000, a multiplication of more than 30 million times

- Average annualized return (10 years): approximately 80%

- Comparison: During the same period, the S&P 500 delivered ~12% annualized, gold ~6%

Granted, past performance doesn’t guarantee future returns, and volatility remains high. But even a small allocation (1-5%) to an asset with this profile can significantly improve the overall return of a diversified portfolio.

Diversification and Decorrelation

The primary argument for including Bitcoin in a portfolio isn’t speculation but diversification. Over the past 10 years, Bitcoin’s correlation coefficient with traditional equity markets has fluctuated between 0 and 0.5 — much lower than the correlation between European and US stocks (~0.85).

This low correlation means Bitcoin can:

- Cushion shocks during specific market crises

- Improve the portfolio’s risk-adjusted return (Sharpe ratio)

- Provide exposure to a completely different asset class

Global Regulatory Landscape: What Advisors Need to Know

United States: SEC and Spot ETF Approval

The US regulatory environment has evolved dramatically with the SEC’s approval of Bitcoin spot ETFs in January 2024. This landmark decision provides:

- Regulatory clarity: Bitcoin ETFs are regulated investment products

- Investor protection: SEC oversight and disclosure requirements

- Easy access: Available through standard brokerage accounts

- Institutional adoption: Major asset managers (BlackRock, Fidelity, Invesco) now offer Bitcoin exposure

Key US platforms for advisors:

- Coinbase Prime: Institutional custody and trading

- Fidelity Digital Assets: Custody and execution for institutions

- Gemini: Regulated exchange with SOC 2 certification

- Anchorage Digital: Federally chartered crypto bank

Europe: MiCA Regulation (2024-2025)

The MiCA (Markets in Crypto-Assets) regulation, implemented progressively in 2024-2025, harmonizes the regulatory framework across Europe:

- Single European license: A licensed provider in one country can operate across the EU

- Enhanced requirements: Minimum capital, governance, risk management

- Investor protection: Mandatory white papers, marketing rules

- Stablecoin oversight: Audited reserves, volume restrictions

For wealth managers, MiCA provides enhanced legal certainty: working with MiCA-compliant providers ensures protection equivalent to traditional financial services.

United Kingdom: FCA Framework

The UK has established its own crypto regulatory approach through the FCA:

- Crypto asset businesses must be registered with the FCA

- Anti-money laundering requirements apply

- Marketing rules restrict promotion to retail investors

- The UK is developing a comprehensive regulatory framework

Asia-Pacific: Varied Approaches

The regulatory landscape in Asia varies significantly:

- Singapore: Progressive MAS regulation, crypto-friendly

- Hong Kong: New licensing regime for retail crypto trading

- Japan: Well-established FSA regulation since 2017

- Australia: ASIC oversight with evolving framework

Recommended Bitcoin Allocation by Risk Profile

General Allocation Principles

Integrating Bitcoin into a portfolio must follow fundamental portfolio management rules:

- Never invest more than you can afford to lose: Bitcoin can lose 80% of its value (as in 2022)

- Long-term horizon: Minimum 5 years, ideally 10+ years

- Gradual investment: Prefer DCA over lump sum

- Regular rebalancing: Maintain target allocation (annual or threshold-based)

Allocation by Profile

| Profile | BTC Allocation | Characteristics |

|---|---|---|

| Conservative | 1-2% | Capital preservation, 3-5 year horizon, high loss sensitivity |

| Balanced | 2-3% | Moderate growth, 5-10 year horizon, accepts moderate volatility |

| Dynamic | 3-5% | Maximum growth, 10+ year horizon, tolerates high volatility |

| Crypto-Convinced | 5-10% | Sophisticated client, deep market knowledge, diversified elsewhere |

Important: These percentages apply to financial assets, excluding primary residence. A client with $500,000 in financial assets and a balanced profile could allocate $10,000 to $15,000 to Bitcoin.

Concrete Allocation Example

Client case: Mr. Johnson, 45 years old, senior executive

- Financial assets: $800,000

- Profile: Balanced, 15-year horizon (retirement)

- Objective: Capital growth with controlled risk

Proposed allocation with Bitcoin integration (3%):

- Fixed income / bonds: 30% ($240,000)

- Equities (global ETFs): 40% ($320,000)

- Real estate (REITs): 15% ($120,000)

- Gold / commodities: 7% ($56,000)

- Private equity: 5% ($40,000)

- Bitcoin: 3% ($24,000)

Crypto Taxation: International Overview

United States

The IRS treats cryptocurrency as property for tax purposes:

- Short-term gains (held less than 1 year): Taxed as ordinary income (10-37%)

- Long-term gains (held more than 1 year): Preferential rates (0%, 15%, or 20%)

- Crypto-to-crypto trades: Taxable events

- Reporting: Form 8949 and Schedule D

European Union (Selected Countries)

- Germany: Tax-free after 1-year holding period (major advantage)

- France: 30% flat tax on gains when converting to fiat

- Portugal: 28% on short-term gains, exemptions available

- Netherlands: Wealth tax based on deemed returns

United Kingdom

- Capital Gains Tax allowance: £3,000 per year (2024/25)

- Basic rate taxpayers: 10% CGT

- Higher rate taxpayers: 20% CGT

- Crypto-to-crypto: Taxable disposal

Tax-Friendly Jurisdictions

- UAE: 0% personal income tax

- Singapore: No capital gains tax

- Switzerland: No capital gains tax for individuals (wealth tax applies)

- El Salvador: Bitcoin is legal tender, no capital gains tax

Key Tax Optimization Strategies

- Hold for long-term: Benefit from reduced rates (US, Germany)

- Tax-loss harvesting: Offset gains with losses

- Consider jurisdiction: Where you’re tax resident matters

- Keep detailed records: Track all transactions and cost basis

- Use specialized software: CoinTracker, Koinly, TaxBit

Bitcoin ETF vs Direct Ownership: Which for Your Clients?

Advantages of Bitcoin Spot ETFs

Bitcoin spot ETFs, available in the US since January 2024 and progressively in other jurisdictions, offer several advantages:

- Simplicity: Purchase through a standard brokerage account, like a stock

- Regulation: Products supervised by authorities (SEC, etc.)

- No technical management: No wallet, no private keys to secure

- Integrated tax reporting: Standard brokerage statements

- Liquidity: Trading during market hours with order book

Advantages of Direct Ownership

Owning Bitcoin directly also has unique benefits:

- Total sovereignty: « Not your keys, not your coins » — true ownership

- No counterparty risk: Independent of financial intermediaries

- 24/7 trading: Crypto markets are always open

- Transferability: Instant global transfers

- Ecosystem access: DeFi, staking, lending if desired

Comparison Table

| Criteria | Bitcoin ETF | Direct Ownership |

|---|---|---|

| Simplicity | ⭐⭐⭐⭐⭐ | ⭐⭐⭐ |

| Security (counterparty) | ⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Fees | 0.2-0.5%/year | Purchase fees only |

| 24/7 Availability | ❌ (market hours) | ✅ |

| Tax Reporting | Automatic | Manual tracking |

| Ideal Client | Novice, institutional | Sophisticated, autonomous |

Advisor recommendation: For most wealth management clients, Bitcoin ETFs will be more suitable. Direct ownership is appropriate for sophisticated clients seeking maximum sovereignty or DeFi ecosystem access.

Custody and Security for High-Net-Worth Clients

Specific Risks of Cryptocurrencies

Custody of crypto assets presents unique risks that advisors must understand:

- Loss of private keys: Without backup, funds are permanently lost

- Hacking: Exchange hacks (Mt. Gox, FTX) = massive losses

- Phishing: Sophisticated scams targeting holders

- Transaction errors: Sending to wrong address = irrecoverable

Custody Solutions for HNW Clients

For high-net-worth clients (assets > $1M), several security levels exist:

1. Institutional Custody (Recommended)

- Coinbase Prime: Industry-leading institutional custody

- Fidelity Digital Assets: Trusted name, SOC 2 audited

- Fireblocks: Multi-signature custody, used by institutions

- Copper: European solution, MiCA compliant

- Anchorage Digital: Federally chartered crypto bank

2. Personal Hardware Wallet

- Ledger Nano X/S Plus: Consumer solution, ~$150

- Trezor Model T: Open source alternative

- Coldcard: For Bitcoin maximalists

3. Multi-signature (Multisig)

Configuration where multiple keys (e.g., 2 of 3) are required to validate a transaction. Ideal for significant amounts: one key with client, one with custodian, one in backup (lawyer, safe deposit).

Crypto Asset Insurance

Some custodians now offer insurance against theft or loss:

- Coinbase: Up to $255M in crime insurance

- Gemini: Cold storage insurance through Nakamoto Ltd

- Lloyd’s of London: Policies for institutional custody

- Coincover: Insurance up to $1M per wallet

Investment Strategies: DCA and Rebalancing

Dollar Cost Averaging (DCA)

DCA (scheduled investing) is the most recommended strategy for entering the Bitcoin market:

Principle: Invest a fixed amount at regular intervals (weekly, monthly), regardless of price.

Advantages:

- Smooths entry price over time

- Eliminates « bad timing » risk

- Psychologically easier (no market timing decisions)

- Automated investment discipline

Concrete example: A client investing $200/month in Bitcoin since January 2020 would have invested $14,400 for a current value of approximately $42,000 (+190%).

Portfolio Rebalancing

With an asset as volatile as Bitcoin, rebalancing is essential to maintain target allocation:

Calendar rebalancing (annual):

- Each year, check if Bitcoin allocation has drifted

- If BTC = 6% instead of 3% target → sell half

- If BTC = 1.5% instead of 3% → add more

Threshold rebalancing (recommended):

- Define bands (e.g., target 3%, bands 2-4%)

- Rebalance only when outside bands

- Avoids excessive transaction fees

Advisor tip: Rebalancing forces « sell high, buy low » — mechanically, it improves risk-adjusted returns over the long term.

Practical Cases for Advisors: 3 Client Profiles

Case 1: The Young Tech Professional (35 years old)

Situation: Thomas, 35, tech engineer, $150,000 portfolio, dynamic profile

Request: « I want to put 10% of my portfolio in Bitcoin, what do you think? »

Advisor response:

- Validate client understanding (crypto questionnaire)

- Moderate expectations: « 10% is high, I recommend 5% maximum to start »

- Propose 12-month DCA ($625/month to reach $7,500)

- Suggest Bitcoin ETF for simplicity

- Annual rebalancing to maintain 5%

Case 2: The Business Owner (50 years old)

Situation: Marie, 50, company director, $2M portfolio (excluding business), balanced profile

Request: « My son keeps talking about Bitcoin, is it relevant for my wealth? »

Advisor response:

- Contextualize: « Bitcoin is now a recognized alternative asset class »

- Propose 2-3% of financial assets ($40-60K)

- Favor Bitcoin ETF via brokerage account (simplicity, reporting)

- If direct ownership desired: institutional custody with insurance

- Document recommendation (risk disclosure, client signature)

Case 3: The Conservative Retiree (65 years old)

Situation: John, 65, retired, $500,000 portfolio, conservative profile, fixed income

Request: « I read everywhere that Bitcoin is going to $1 million, I don’t want to miss out »

Advisor response:

- Explain risks: « Bitcoin can lose 80% of its value in 1 year »

- Remind of short horizon: « At 65, you need stability »

- Propose 1% maximum ($5,000) « to satisfy curiosity »

- If insistent: spread over 2 years via monthly DCA

- Prefer ETF for estate planning simplicity

Risks and Common Objections: How to Respond

« Bitcoin has no intrinsic value »

Response: « Intrinsic value » is a debatable concept. Gold doesn’t have cash flow either. Bitcoin’s value comes from its programmed scarcity (21M maximum), its secured network, and growing adoption. It’s a digital store of value.

« It’s too volatile for my portfolio »

Response: That’s exactly why we recommend 1-5% maximum. With a 3% allocation, even an 80% Bitcoin crash would only impact your portfolio by 2.4%. In return, you capture part of the potential upside.

« It’s used by criminals »

Response: According to Chainalysis, less than 0.5% of crypto transactions are illicit. Cash remains the preferred money laundering method. Additionally, the blockchain is transparent and traceable — that’s why authorities can seize criminal funds in crypto.

« It’s bad for the environment »

Response: Bitcoin mining uses energy, but increasingly renewable energy (59% according to the Cambridge Bitcoin Electricity Consumption Index). Moreover, Bitcoin incentivizes green energy development by monetizing surplus electricity.

« What if the government bans Bitcoin? »

Response: In Europe, MiCA regulates and legitimizes Bitcoin. In the US, spot ETFs are SEC-approved. The global trend is toward regulation, not prohibition. Even China hasn’t managed to eradicate it.

Conclusion: The Advisor in the Bitcoin Era

In 2026, ignoring Bitcoin is no longer an option for wealth managers. Whether you recommend its integration or not, you must be able to discuss it knowledgeably with clients. The demand is there: 71% of your clients likely already hold crypto without telling you.

Keys to success for advisors:

- Get educated: Understand blockchain fundamentals, risks, tax implications

- Document: Track recommendations, have clients sign risk disclosures

- Partner with institutions: Coinbase Prime, Fidelity Digital Assets offer advisor programs

- Stay prudent: 1-5% maximum, never at the expense of fundamentals

- Guide clients: Even reluctant clients will appreciate your expertise

Bitcoin is not a passing fad. It’s a new asset class that is permanently establishing itself in the global financial landscape. The advisor who prepares today will have a major competitive advantage for decades to come.

📚 Glossary

- Bitcoin: The first cryptocurrency created in 2009 by Satoshi Nakamoto, operating on a decentralized network with a supply limited to 21 million units.

- Wealth Manager: Professional who advises clients on optimizing and protecting their wealth, including financial planning and investment management.

- RIA: Registered Investment Advisor, a firm or individual registered with the SEC or state regulators to provide investment advice.

- SEC: Securities and Exchange Commission, the US federal agency responsible for regulating securities markets.

- MiCA: Markets in Crypto-Assets, the European regulation harmonizing crypto-asset regulation across the EU since 2024.

- FCA: Financial Conduct Authority, the UK financial regulatory body overseeing crypto businesses.

- ETF: Exchange Traded Fund, a fund traded on exchanges allowing simplified Bitcoin exposure through standard brokerage accounts.

- DCA: Dollar Cost Averaging, an investment strategy of buying a fixed dollar amount at regular intervals regardless of price.

- CGT: Capital Gains Tax, tax on profits from selling assets like cryptocurrency in jurisdictions like the UK and Australia.

- Custody: Storage and safekeeping of crypto assets, either self-custody (by the investor) or through a specialized custodian.

- Cold Wallet: Offline storage wallet (hardware wallet) offering maximum security against hacking.

- Hot Wallet: Internet-connected wallet, more convenient but more exposed to hacking risks.

- Volatility: Measure of price variation amplitude — Bitcoin shows historical volatility of 60-80% annualized.

- Blockchain: Distributed ledger technology recording all Bitcoin transactions in an immutable and transparent manner.

- Cryptocurrency: Digital asset operating on a blockchain without a central issuing authority.

- Seed Phrase: Sequence of 12 or 24 words allowing recovery of crypto wallet access — must be stored securely offline.

- Multisig: Multi-signature wallet requiring multiple private keys to authorize a transaction, enhancing security for large holdings.

Frequently Asked Questions

What percentage of a portfolio should be allocated to Bitcoin in 2026?

Experts recommend allocating 1-5% of financial assets to Bitcoin based on risk profile. Conservative investors should stay at 1-2%, balanced profiles at 2-3%, and dynamic profiles can go up to 5%. This allocation captures Bitcoin’s upside potential while limiting the impact of a potential 80% crash to less than 4% of total portfolio value.

How is Bitcoin taxed in the United States?

The IRS treats cryptocurrency as property. Short-term gains (held less than 1 year) are taxed as ordinary income at 10-37%. Long-term gains (held over 1 year) benefit from preferential rates of 0%, 15%, or 20% depending on income. Crypto-to-crypto trades are taxable events. Report using Form 8949 and Schedule D.

Can financial advisors legally recommend Bitcoin investments?

Yes, advisors can recommend Bitcoin investments provided they: understand the asset class (competency duty), verify suitability for the client (suitability duty), use regulated platforms and products, and document recommendations with appropriate risk disclosures. Not addressing crypto may also be risky if clients invest independently on unregulated platforms.

Bitcoin ETF or direct purchase: which should I recommend to clients?

For most wealth management clients, Bitcoin spot ETFs are more suitable: simple purchase via brokerage account, regulated products, automatic tax reporting, no technical management required. Direct ownership suits sophisticated clients seeking total sovereignty, 24/7 access, or DeFi ecosystem participation.

What are the major Bitcoin custody options for institutions?

Leading institutional custody solutions include: Coinbase Prime (industry leader), Fidelity Digital Assets (trusted brand, SOC 2 audited), Fireblocks (multi-signature, used by major institutions), Copper (European, MiCA compliant), and Anchorage Digital (federally chartered crypto bank). These offer insurance, audit trails, and regulatory compliance.

How can high-net-worth clients secure their Bitcoin holdings?

For HNW clients, several solutions exist: institutional custody (Coinbase Prime, Fidelity) with insurance and audits, personal hardware wallets (Ledger, Trezor) for moderate amounts, or multi-signature configurations where 2-of-3 keys are required for transactions. Crypto insurance is increasingly available through providers like Lloyd’s of London.

Is Bitcoin a speculative bubble?

Bitcoin has experienced multiple ‘bubbles’ (-80% in 2018, -65% in 2022) but has always reached new highs afterward. Unlike classic bubbles, Bitcoin has fundamentals: programmed scarcity (21M max), network secured by massive computing power, growing institutional adoption (ETFs, corporate treasuries). It’s a volatile asset, not necessarily a bubble.

What is the best strategy for investing in Bitcoin?

Dollar Cost Averaging (DCA) is the most recommended strategy: invest a fixed amount regularly (e.g., $200/month) regardless of price. This smooths entry price, eliminates market timing stress, and enforces investment discipline. Combined with annual rebalancing to maintain target allocation, DCA optimizes risk-adjusted returns over time.

Is Bitcoin legal in the United States and Europe?

Yes, Bitcoin is fully legal in the US and Europe. In the US, Bitcoin spot ETFs are SEC-approved since January 2024. In Europe, MiCA regulation (2024) provides a harmonized framework across the EU. The global trend is toward regulation and legitimization, not prohibition.

Do I need to report cryptocurrency holdings to tax authorities?

Yes, in most jurisdictions cryptocurrency must be reported for tax purposes. In the US, you must report on your tax return and answer the crypto question on Form 1040. In the UK, gains above the CGT allowance must be declared. Using regulated platforms simplifies compliance as they often provide tax reporting tools and documentation.

– [Bitwise/VettaFi 2026 Survey](https://bitwiseinvestments.com/research) – Annual study on crypto adoption by financial advisors (42% can now invest for clients)

– [SEC Bitcoin Spot ETF Approval](https://www.sec.gov/news/press-release/2024-10) – Official SEC announcement approving Bitcoin spot ETFs in January 2024

– [MiCA Regulation – EUR-Lex](https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32023R1114) – Official text of European Markets in Crypto-Assets regulation

– [BlackRock iShares Bitcoin Trust](https://www.blackrock.com/us/individual/products/333011/ishares-bitcoin-trust) – Information on the Bitcoin spot ETF that collected $50B+ in under a year

– [Chainalysis Crypto Crime Report 2024](https://www.chainalysis.com/crypto-crime-report/) – Data on illicit cryptocurrency use (<0.5% of transactions) - [Cambridge Bitcoin Electricity Consumption Index](https://ccaf.io/cbnsi/cbeci) – Data on Bitcoin mining energy consumption and renewable mix - [IRS Virtual Currency Guidance](https://www.irs.gov/businesses/small-businesses-self-employed/virtual-currencies) – US tax guidance for cryptocurrency - [Fidelity Digital Assets Research](https://www.fidelitydigitalassets.com/research-and-insights) – Studies on institutional Bitcoin adoption [/fibo_sources]