Crypto Bull Run: Complete Guide, Definition and History 2026

📋 En bref (TL;DR)

- Crypto Bull Run : extended period of rising cryptocurrency prices (typically +20% or more), characterized by widespread investor optimism and sustained upward trends.

- 4 Distinct Phases : accumulation (whales buying), expansion (trend confirmation), euphoria (maximum FOMO, ATH), distribution (profit-taking).

- Bitcoin History : major bull runs in 2011 (+10,000%), 2013 (+5,400%), 2017 (+1,900%), 2020-21 (+1,600%), and 2024-25 (Spot ETFs).

- Key Indicators : rising volumes, on-chain whale accumulation, media coverage, institutional interest, post-halving period.

- Winning Strategies : buy early (accumulation phase), regular DCA, portfolio diversification, take profits progressively.

- Major Risks : extreme volatility, FOMO leading to buying at the top, sharp corrections of -30% to -80%.

- Difference with Bear Market : bull run is marked by optimism and price increases, bear market by pessimism and prolonged declines.

The bull run is the term every crypto investor eagerly awaits. This period of massive price increases can multiply your capital by 5, 10, or even 100 times in just a few months. But how do you recognize a bull run? How can you profit from it without getting trapped by FOMO? And most importantly, how do you avoid buying at the top just before a crash?

In this comprehensive guide, we’ll break down the crypto bull run phenomenon: its precise definition, the indicators that signal its arrival, the history of Bitcoin bull runs since 2011, and concrete strategies to maximize your gains while limiting your risks. Whether you’re a beginner or an experienced investor, understanding crypto market cycles is essential for making the right decisions.

What Is a Crypto Bull Run? Complete Definition

Bull Run Definition

A bull run refers to an extended period during which cryptocurrency prices increase significantly and sustainably. The term comes from how a bull attacks: by thrusting its horns upward, symbolizing rising prices.

In traditional finance, we typically speak of a bull market when prices rise more than 20% from their recent lows. In the crypto world, this definition is often more flexible because volatility is much higher: gains of 100%, 500%, or even 1000% are not uncommon during major bull runs.

Characteristics of a Bull Run

A genuine crypto bull run is distinguished by several characteristic elements:

- Extended upward trend: prices increase over several weeks, months, or even years, with temporary corrections that don’t challenge the overall trend.

- High trading volumes: growing interest translates into a significant increase in exchange volumes on trading platforms.

- New investors: massive influx of new market participants, attracted by potential gains.

- Positive media coverage: mainstream media increasingly talks about crypto, often with an optimistic tone.

- Positive market sentiment: the Fear & Greed Index leans toward « Greed » or even « Extreme Greed. »

Origin of the Term « Bull Run »

The expression « bull market » dates back to the 17th century. The symbolism of a bull charging upward contrasts with that of a bear (bear market) striking downward with its paws. A bronze bull statue stands on Wall Street in New York, symbolizing stock market optimism.

The 4 Phases of a Crypto Bull Run

Every crypto bull run typically follows a pattern of 4 distinct phases. Understanding these phases is crucial for optimizing your entry and exit points.

Phase 1: Accumulation

The accumulation phase occurs after a bear market. Overall sentiment is still negative, media ignores crypto, and many retail investors have capitulated. Yet this is when smart money — whales, institutions, early adopters — quietly start buying.

Characteristics:

- Stable or slightly rising prices

- Low trading volumes

- Negative or neutral overall sentiment

- On-chain accumulation by large wallets

- Typical duration: 6 to 12 months

Phase 2: Expansion

The upward trend confirms and becomes visible. Prices break through important resistances, specialized media starts covering it, and the first retail investors return to the market. FOMO gradually sets in.

Characteristics:

- 50% to 200% increase from lows

- Constantly increasing volumes

- Optimistic crypto media

- New exchange registrations

- Typical duration: 3 to 6 months

Phase 3: Euphoria

This is the most spectacular phase — and the most dangerous. FOMO reaches maximum levels, everyone talks about crypto (your hairdresser, your baker…), and prices reach all-time highs (ATH). The wildest predictions circulate.

Characteristics:

- Frequent new ATHs

- Maximum media coverage (mainstream media)

- Widespread euphoria, « this time it’s different »

- Altcoins and meme coins explode

- This is often the best time to sell

Phase 4: Distribution

Smart investors (who bought in phase 1) take their profits. Corrections become more frequent and violent. The market loses momentum before transitioning into a new bear market.

Characteristics:

- Corrections of -30% to -50%

- Increasingly weaker bounces

- Decreasing volumes

- First doubts in the media

- Typical duration: 1 to 3 months

History of Bitcoin Bull Runs: From 2011 to 2025

Bitcoin has experienced 5 major bull runs since its creation. Let’s analyze each one to draw lessons.

2011 Bull Run: The Birth (+10,000%)

The first bull run in crypto history. Bitcoin went from $0.30 to approximately $31 between February and June 2011 — a 100x multiplication in a few months. It was the first time the world discovered this new technology’s potential.

Context: Bitcoin was still a confidential project, known only to cryptography enthusiasts and libertarians. The first exchange, Mt. Gox, had just opened.

2013 Bull Run: Crossing $1,000 (+5,400%)

Bitcoin broke through the symbolic $1,000 barrier for the first time, reaching an ATH of $1,163 in November 2013. The Cyprus crisis played a catalytic role: for the first time, Bitcoin appeared as an alternative to traditional banking systems.

Key event: China discovered Bitcoin and adopted it massively… before banning it, triggering a brutal crash.

2017 Bull Run: The ICO Craze (+1,900%)

The most publicized bull run until then. Bitcoin reached nearly $20,000 in December 2017. But it was especially altcoins and ICOs (Initial Coin Offerings) that exploded. Ethereum went from $8 to $1,400, Ripple from $0.006 to $3.84.

Context: ICOs promised to revolutionize fundraising. Projects raised millions in minutes. FOMO reached unprecedented levels.

2020-2021 Bull Run: The Institutional Era (+1,600%)

Bitcoin surpassed $69,000 in November 2021. What distinguished this cycle: the massive arrival of institutions. Tesla bought $1.5 billion in BTC, MicroStrategy accumulated, investment funds created crypto products.

Major innovations: DeFi (decentralized finance), NFTs (non-fungible tokens), and first discussions about Bitcoin ETFs.

2024-2025 Bull Run: Spot ETFs (+300%+)

In January 2024, the SEC finally approved the first Bitcoin Spot ETFs in the United States. It’s a historic turning point: traditional investors can now gain Bitcoin exposure through their regular brokerage accounts. Bitcoin reached new ATHs above $100,000.

Catalysts: Spot ETFs, April 2024 halving, massive institutional adoption, accommodative monetary policy.

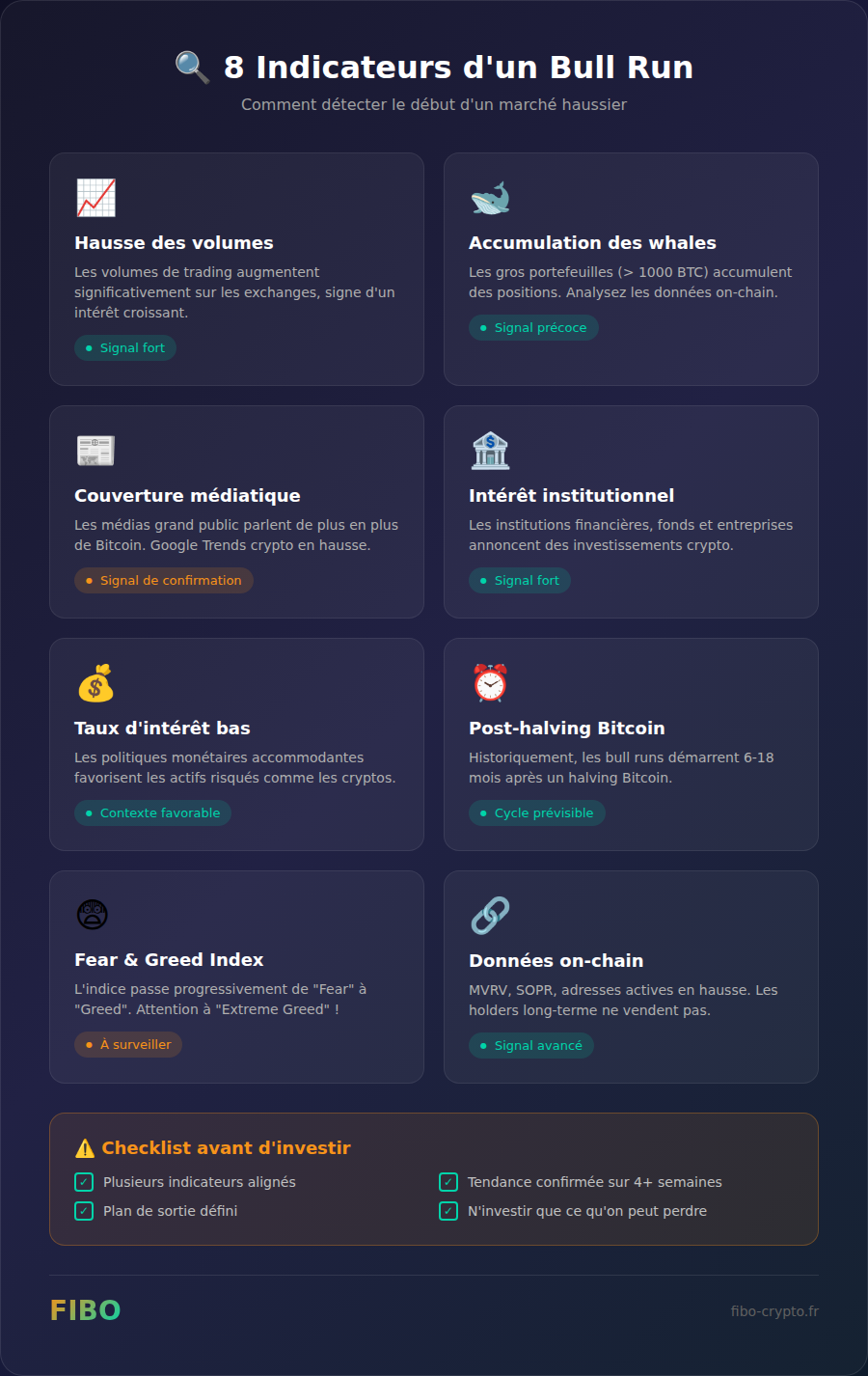

8 Indicators to Detect a Bull Run

How do you know if a bull run is underway or about to start? Here are the 8 most reliable indicators to watch.

1. Rising Trading Volumes

A significant and sustained increase in exchange volumes is often the first sign of a trend change. Volumes generally precede prices.

2. On-Chain Whale Accumulation

On-chain data allows observation of large wallet behavior. When whales (>1000 BTC) accumulate while prices are low, it’s a strong signal.

3. Post-Bitcoin Halving

Historically, major bull runs start 6 to 18 months after a Bitcoin halving. The 2024 halving fits the usual pattern.

4. Growing Institutional Interest

Investment announcements by companies, crypto product launches by banks, ETF inflows… The arrival of institutions validates the market.

5. Positive Media Coverage

Google Trends for « Bitcoin » rising, positive articles in mainstream media, celebrities talking about it… Warning: when your hairdresser talks crypto, you might already be in the euphoria phase!

6. Fear & Greed Index

This index measures market sentiment from 0 (extreme fear) to 100 (extreme greed). A gradual shift from « Fear » to « Greed » confirms a bull run. Watch out for « Extreme Greed » — it’s often the signal to sell.

7. Low Interest Rates / Accommodative Monetary Policy

Cryptocurrencies, like all risk assets, perform better when central banks inject liquidity and maintain low rates.

8. Positive On-Chain Indicators

MVRV ratio, SOPR, active addresses, exchange inflows/outflows… These on-chain metrics help anticipate price movements.

Bull Run vs Bear Market: Complete Comparison

To fully understand bull runs, you must also understand their opposite: the bear market. These two phases naturally alternate in crypto cycles.

Compared Characteristics

Bull Run:

- Extended price increases

- Frequent new ATHs

- Optimism and euphoria

- Dominant FOMO

- High volumes

- Enthusiastic media

Bear Market:

- Extended price decline (-50% to -80%)

- No new ATHs

- Pessimism and capitulation

- Dominant FUD

- Low volumes

- « Bitcoin is dead » articles

Strategies Adapted to Each Phase

During a bull run: take profits progressively, don’t be too greedy, define sell targets in advance.

During a bear market: accumulate progressively via DCA, stay patient, educate yourself, don’t panic sell.

How to Profit from a Bull Run: Concrete Strategies

Strategy 1: Buy During Accumulation

The most profitable strategy — but the most psychologically difficult. Buy when everyone is scared, when media talks about « Bitcoin’s death. » That’s when prices are at their lowest.

Strategy 2: DCA (Dollar Cost Averaging)

Investing a fixed amount at regular intervals (weekly, monthly) allows you to average your purchase price and not worry about timing. This strategy is particularly effective for beginners.

Strategy 3: Take Profits Progressively

Define your price targets in advance and sell in stages. For example: sell 10% at +100%, 20% at +200%, etc. This guarantees gains even if you don’t sell at the exact top.

Strategy 4: Smart Diversification

Don’t put everything in Bitcoin. A balanced portfolio might include:

- 50-60% Bitcoin (crypto store of value)

- 20-30% Ethereum (smart contracts)

- 10-20% Selected altcoins (riskier, more potential)

Strategy 5: Use Corrections as Opportunities

Even during bull runs, corrections of -20% to -30% are normal. These « dips » are buying opportunities to strengthen your positions.

Risks to Know During a Bull Run

The FOMO Trap

FOMO (Fear Of Missing Out) pushes people to buy impulsively, often at the worst time. When everyone talks about crypto and prices are already very high, it’s generally too late to enter.

Extreme Volatility

Even in a bull run, corrections of -30% to -50% can occur in a few days. You need strong nerves and should never invest more than you can afford to lose.

Scams and Fraudulent Projects

Bull runs attract scammers. Beware of projects promising guaranteed returns, influencers promoting obscure tokens, and opportunities too good to be true.

Leverage Effect

Using leverage (margin trading) during a bull run may seem tempting. But crypto volatility makes this practice extremely dangerous: liquidations are frequent.

2024-2025 Bull Run: Where Are We Now?

Current Catalysts

Several elements suggest this cycle is particularly promising:

- Bitcoin Spot ETFs: approved in January 2024, they attract billions of dollars in institutional investments

- April 2024 Halving: the reduction in new BTC supply is historically bullish

- Growing Adoption: more and more companies accept Bitcoin

- Macro Context: potential rate cuts in 2024-2025

Outlook and Predictions

Analysts are divided on price targets, but consensus emerges around several points:

- The current bull run could last until late 2025 / early 2026

- Bitcoin could reach significant new ATHs

- Altcoins with solid fundamentals should outperform

Conclusion: How to Navigate the Next Bull Run

The bull run is when fortunes are made — and lost — in the crypto world. To profit intelligently, remember these essential principles:

- Understand the cycles: bull runs and bear markets alternate. Don’t panic during drops, don’t be euphoric during rises.

- Have a plan: define your entry points, exit targets, and allocation in advance. Stick to your plan.

- Manage your emotions: FOMO and panic are your worst enemies. Emotional decisions lead to losses.

- Secure your gains: taking profits isn’t losing. It’s being prudent.

- Only invest what you can afford to lose: crypto remains a risky investment. Don’t gamble with money you need.

The next bull run will come — that’s certain. The question is: will you be ready when it starts?

📚 Glossaire

- Bull Run : Extended period of rising prices in financial markets, characterized by widespread optimism. The term comes from how a bull attacks upward.

- Bear Market : Extended period of falling prices, opposite of a bull run. Characterized by pessimism and massive selling. A bear strikes downward.

- ATH (All-Time High) : The highest price ever reached by an asset. When a price reaches a level never seen before.

- Cryptocurrency : Digital currency using cryptography to secure transactions, operating on a decentralized blockchain.

- Altcoin : Any cryptocurrency other than Bitcoin. Examples: Ethereum, Solana, Cardano, XRP.

- FOMO (Fear Of Missing Out) : Fear of missing an investment opportunity. Often leads to impulsive buying at the wrong time.

- FUD (Fear, Uncertainty, Doubt) : Fear, uncertainty, and doubt. Negative sentiment that pushes people to panic sell.

- Whale : Investor holding a very large amount of cryptocurrency (typically >1000 BTC). Their movements influence the market.

- Halving : The halving of Bitcoin miner rewards, occurring approximately every 4 years. Reduces the supply of new BTC.

- DCA (Dollar Cost Averaging) : Investment strategy of regularly buying a fixed amount, regardless of price.

- On-chain : Data directly recorded on the blockchain. Allows analysis of investor behaviors.

- ICO (Initial Coin Offering) : Cryptocurrency fundraising to finance a blockchain project. Popular in 2017.

- Volatility : Measure of price variation amplitude. The higher the volatility, the faster prices fluctuate.

- ETF (Exchange-Traded Fund) : Exchange-traded fund that replicates an asset’s price. Bitcoin Spot ETFs allow investing in BTC through a regular brokerage account.

- Liquidity : Ability to buy or sell an asset quickly without significantly impacting its price. A liquid market has many buyers and sellers.

Questions fréquentes

What is a crypto bull run?

A crypto bull run is an extended period during which cryptocurrency prices increase significantly (typically +20% or more). It’s characterized by widespread investor optimism, rising trading volumes, positive media coverage, and the arrival of new investors in the market. Bull runs can last from a few months to several years.

How long does a crypto bull run last?

The duration of a bull run varies considerably. Historically, major Bitcoin bull runs have lasted between 12 and 24 months. The 2017 bull run lasted about 12 months, the 2020-2021 one about 18 months. The current cycle (2024-2025) is still ongoing. Mini bull runs can last only a few weeks or months.

How do you know if a bull run has started?

Several indicators signal the start of a bull run: sustained increase in trading volumes, whale accumulation (visible on-chain), breaking major resistances, growing media coverage, increasing Google searches for « Bitcoin, » Fear & Greed Index moving from « Fear » to « Greed, » and typically 6-18 months after a Bitcoin halving.

What's the difference between a bull run and a bear market?

A bull run is an extended period of rising prices, marked by optimism, FOMO, and high volumes. A bear market is the opposite: an extended decline (-50% to -80% from ATH), marked by pessimism, capitulation, and low volumes. These two phases naturally alternate in crypto market cycles.

How to profit from a bull run without getting trapped?

To profit from a bull run intelligently: 1) Buy during the accumulation phase (when sentiment is negative), 2) Use DCA to average your entry price, 3) Define profit-taking targets in advance, 4) Sell progressively in stages, 5) Never give in to FOMO to buy at the top, 6) Always keep part of your gains in stablecoins or fiat.

Is the 2024-2025 bull run different from previous ones?

The 2024-2025 cycle is distinguished by the approval of Bitcoin Spot ETFs in the USA (January 2024), which attract massive institutional investments. It’s the first time traditional investors can easily gain Bitcoin exposure through their brokerage accounts. The April 2024 halving and growing corporate adoption also reinforce this cycle.

What are the risks during a bull run?

The main risks are: FOMO pushing you to buy at the top, extreme volatility (corrections of -30% even in bull runs), proliferating scams and fraudulent projects, leveraged trading that can lead to liquidations, and euphoria making you forget to take profits. Never invest more than you can afford to lose.

When will the next Bitcoin bull run happen?

Bitcoin bull runs historically follow a 4-year cycle, linked to the halving. After the April 2024 halving, the current cycle should continue until late 2025 / early 2026 according to historical patterns. However, each cycle is different and past performance doesn’t guarantee future results. ETFs could modify the usual dynamics.

📰 Sources

Cet article s'appuie sur les sources suivantes :

- Investopedia – Bull Market Definition

- Bitpanda Academy – What is a Bull Market

- Glassnode – On-chain Analytics

- Alternative.me – Fear & Greed Index

- CoinMarketCap – Historical Data

- SEC – Bitcoin ETF Approval

- Bitcoin Magazine – Halving History

- CoinDesk – Bitcoin History

Comment citer cet article : Fibo Crypto. (2026). Crypto Bull Run: Complete Guide, Definition and History 2026. Consulté le 11 février 2026 sur https://fibo-crypto.fr/blog/crypto-bull-run-guide