Binance and Trump: The Disturbing Ties Between the Crypto Giant and World Liberty Financial

📋 En bref (TL;DR)

- Presidential pardon: Trump pardoned CZ (Binance founder) in October 2025 after his conviction for money laundering violations

- Major investment: MGX (Abu Dhabi) invested $2 billion in Binance through World Liberty Financial’s USD1 stablecoin

- Conflicts of interest: The Trump family owns 60% of WLF and receives 75% of token sale revenues

- Close ties: Binance helped develop USD1 stablecoin technology and actively promotes this token

- Secret stake: The United Arab Emirates acquired 49% of WLF for $500 million before Trump’s inauguration

- Bipartisan criticism: Democratic lawmakers denounce potential corruption linked to CZ’s pardon

The case is shaking Washington and the crypto world. According to a New York Times investigation published on February 7, 2026, the ties between Binance, the world’s largest cryptocurrency exchange, and World Liberty Financial (WLF), the Trump family’s crypto venture, have significantly strengthened since the presidential pardon granted to Changpeng Zhao.

This revelation comes amid an already tense context for the crypto market, marked by significant volatility in early 2026. Accusations of conflicts of interest are mounting, raising fundamental questions about the independence of American crypto policy.

CZ’s pardon: timeline of a controversial clemency

In November 2023, Changpeng Zhao (CZ), then CEO of Binance, pleaded guilty to violations of anti-money laundering laws. He was sentenced to four months in prison, and Binance had to pay a colossal fine of $4.3 billion to the U.S. Department of Justice.

CZ was released in September 2024, but in October 2025, the case took a major political turn: President Trump granted him a full presidential pardon. “I was informed that he was a victim, like myself and many others, of a vicious and horrible group of people from the Biden administration,” Trump declared to CBS.

This presidential clemency immediately sparked fierce criticism. Senators Elizabeth Warren and Representative Maxine Waters denounced what they called “blatant corruption,” pointing to the pre-existing financial ties between Binance and the Trump family’s business interests.

World Liberty Financial: the Trump crypto empire

To understand this case, we need to look back at World Liberty Financial. Launched in September 2024 by Donald Trump’s sons (Eric and Donald Jr.) with Barron Trump as “DeFi visionary,” this company represents the presidential family’s official foray into the cryptocurrency world.

A structure favorable to the presidential family

The numbers speak for themselves:

- The Trump family owns 60% of World Liberty Financial

- They receive 75% of net revenues from token sales

- 22.5 billion units of the WLFI token were allocated to the family and its affiliates

- By December 2025, the Trump family’s profits reached $1 billion

The USD1 stablecoin: at the heart of the scandal

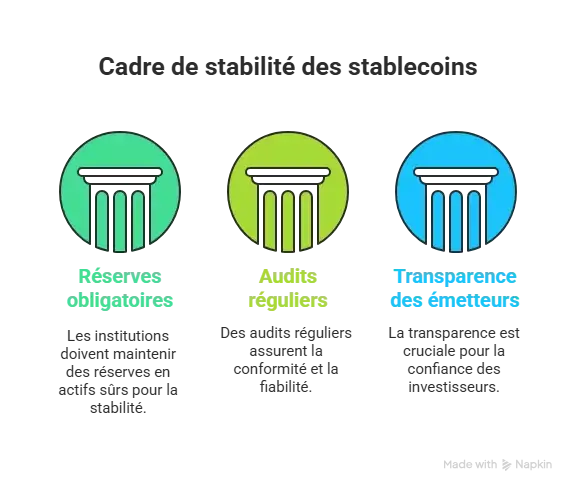

In March 2025, WLF launched USD1, a stablecoin backed by the U.S. dollar, Treasury bonds, and other cash equivalents. This stablecoin has become the central financial vehicle of current controversies.

With a market cap of $2.7 billion, USD1 now ranks 6th among global stablecoins. But it’s its use in transactions involving Binance that raises questions.

The $2 billion investment causing scandal

In May 2025, MGX, an Abu Dhabi sovereign fund led by Sheikh Tahnoun bin Zayed Al Nahyan (UAE National Security Advisor), announced a historic investment of $2 billion in Binance.

The particularity? This transaction was settled entirely in USD1 stablecoin, thus creating a direct financial windfall for World Liberty Financial. The Wall Street Journal revealed that Binance had even helped develop the technology behind USD1.

The secret 49% stake

In late January 2026, a media bombshell exploded: just days before Trump’s inauguration, Sheikh Tahnoun’s interests had secretly acquired 49% of World Liberty Financial for $500 million. This transaction had never been made public.

Even more troubling: two of Tahnoun’s affiliates (Martin Edelman and Peng Xiao of G42) were placed on WLF’s board of directors without any public disclosure.

Binance promotions favoring WLF

According to the New York Times, the ties between the two entities go beyond this investment. Binance has deployed a series of marketing promotions to encourage its customers to buy and use World Liberty Financial’s USD1 stablecoin.

In December 2025, Binance extended the use of USD1 as trading collateral on its platform, further strengthening adoption of this token linked to the presidential family.

The decentralized platform PancakeSwap, operated by Binance, even launched a “Liquidity Drive” offering up to $1 million in prizes to stimulate USD1 trading.

CZ and World Liberty Financial’s defenses

When questioned at the World Economic Forum in Davos in January 2026, CZ categorically denied any business relationship with the Trump family:

“There is no business relationship. MGX is the investor, they chose USD1. My request was simply that they pay me in crypto. Many people have misconstrued this.”

CZ also claims he has never spoken directly to Trump and that Binance has since gradually converted this investment out of USD1.

For its part, World Liberty Financial issued an unambiguous statement: “WLFI is not a political organization and had no role in the pardon process. To suggest otherwise is dangerous and false.”

Implications for U.S. crypto regulation

This case raises crucial questions about the Trump administration’s crypto policy. Legal experts have described the UAE transaction as a potential violation of the Emoluments Clause of the U.S. Constitution.

Another troubling case: Justin Sun, a Chinese-born billionaire and founder of Tron, invested $75 million in WLF and was named an advisor. Shortly after Trump’s inauguration, the SEC dropped its investigation into Sun’s companies.

These elements fuel a broader debate about potential conflicts of interest and their impact on developing fair crypto regulation in the United States.

Key takeaways from this case

The New York Times investigation highlights a complex network of financial relationships between Binance, World Liberty Financial, and foreign interests, all revolving around the presidential family.

Whether one views these relationships as mere business coincidences or as blatant conflicts of interest, one thing is certain: this case will have lasting repercussions on the perception of the crypto industry and on the American regulatory debate.

For investors, these developments are a reminder of the importance of closely monitoring the political evolution of the sector, as regulatory decisions will shape the future of cryptocurrencies well beyond American borders.

📚 Glossary

- Binance : The world’s largest cryptocurrency exchange by trading volume, founded in 2017 by Changpeng Zhao.

- CZ (Changpeng Zhao) : Founder and former CEO of Binance, pardoned by Trump in October 2025 after his conviction for anti-money laundering violations.

- World Liberty Financial : Decentralized finance company created by the Trump family in 2024, issuer of the USD1 stablecoin.

- USD1 : Stablecoin launched by World Liberty Financial in March 2025, backed by the U.S. dollar and Treasury bonds.

- Stablecoin : A cryptocurrency whose value is pegged to a fiat currency (usually the dollar) to reduce volatility.

- Presidential pardon : Constitutional power of the U.S. president allowing them to erase or reduce federal convictions.

- Emoluments Clause : Provision of the U.S. Constitution prohibiting federal officials from receiving gifts or payments from foreign governments.

- MGX : Abu Dhabi sovereign fund that invested $2 billion in Binance through the USD1 stablecoin.

Frequently Asked Questions

Why did Trump pardon the Binance founder?

Trump granted CZ a presidential pardon in October 2025, claiming he was “a victim of the Biden administration.” Critics, however, point to the financial ties between Binance and World Liberty Financial, the Trump family’s crypto company, as a potential motivation.

What is World Liberty Financial?

World Liberty Financial (WLF) is a decentralized finance company founded by the Trump family in 2024. The family owns 60% of the company and receives 75% of token sale revenues. WLF launched the USD1 stablecoin in March 2025.

What is the connection between Binance and the USD1 stablecoin?

Binance helped develop the technology behind USD1 and actively promotes this stablecoin. In May 2025, a $2 billion investment in Binance by MGX (Abu Dhabi) was settled entirely in USD1, directly enriching World Liberty Financial.

Are there conflicts of interest in this case?

Many legal experts and lawmakers (including Elizabeth Warren and Maxine Waters) denounce potential conflicts of interest. The secret sale of 49% of WLF to the United Arab Emirates for $500 million and the SEC dropping investigations against certain WLF investors fuel these accusations.

What impact on the crypto market?

This case reinforces uncertainties around U.S. crypto regulation. It could influence future regulatory decisions and affects how the general public and institutional investors perceive the industry.

📰 Sources

This article is based on the following sources:

- New York Times – Binance Gives Trump Family’s Crypto Firm a Leg Up

- CNBC – Pardoned Binance founder Zhao says his business relationship with the Trumps was ‘misconstrued’

- Wall Street Journal – ‘Spy Sheikh’ Bought Secret Stake in Trump Company

- Forbes – Everyone Pardoned By Trump With Political Or Financial Ties To White House

- Wikipedia – World Liberty Financial

Comment citer cet article : Fibo Crypto. (2026). Binance and Trump: The Disturbing Ties Between the Crypto Giant and World Liberty Financial. Consulté le 22 February 2026 sur https://fibo-crypto.fr/en/blog/binance-trump-world-liberty-financial-ties-pardon-cz