What Is Bitcoin? Complete Guide 2026

📋 En bref (TL;DR)

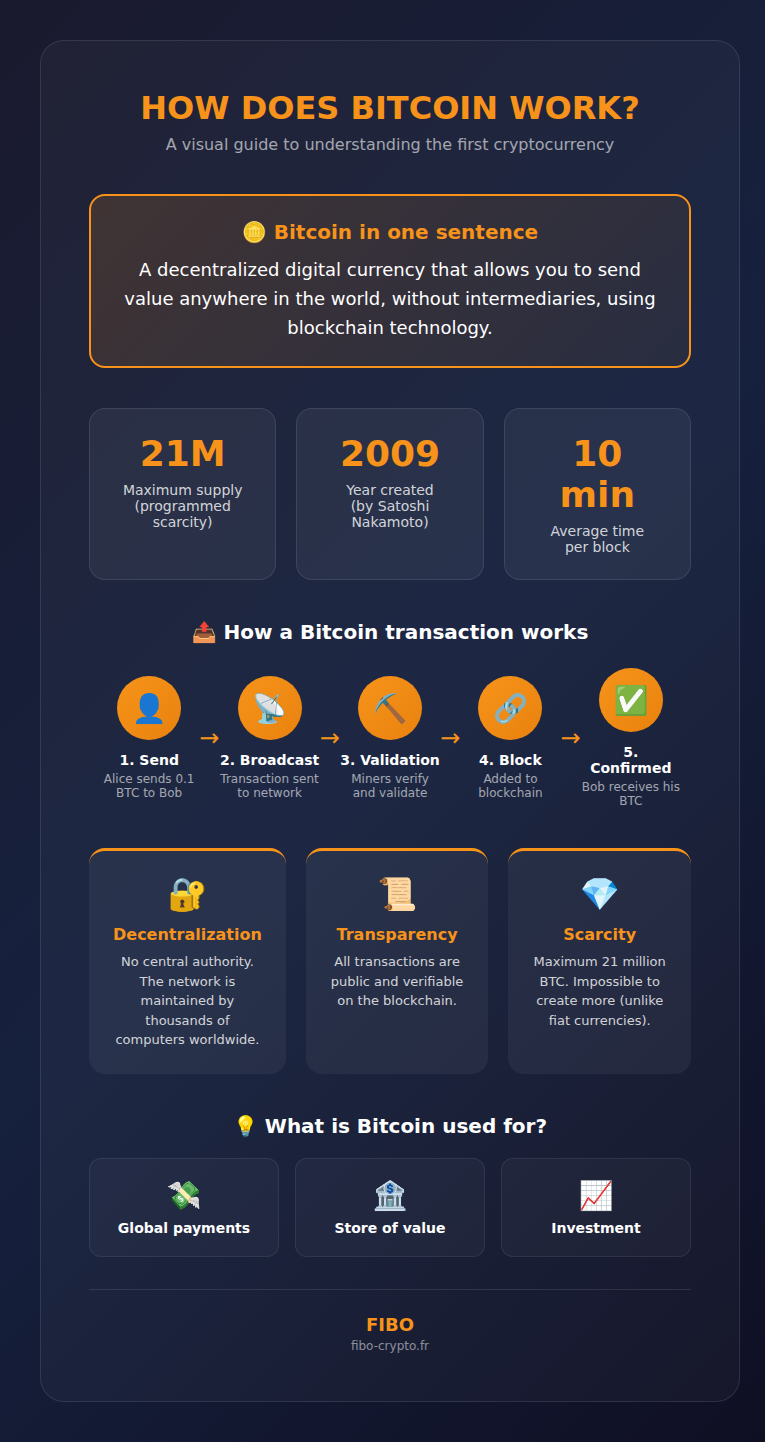

- Definition: Bitcoin is a decentralized digital currency that enables value transfer without banking intermediaries, powered by blockchain technology

- Creator: Invented in 2008 by Satoshi Nakamoto (pseudonym), launched in January 2009 with the mining of the first block

- Programmed scarcity: Supply is capped at 21 million units, with ~19.6 million already in circulation

- Security: The network is protected by the proof-of-work mechanism, where thousands of miners validate every transaction

- Use cases: International payment method, store of value (« digital gold »), investment asset and portfolio diversification tool

- Storage: Bitcoins are kept in digital wallets, either connected (hot) or offline (cold) for enhanced security

What exactly is Bitcoin?

Bitcoin is the world’s first decentralized digital currency. Unlike the euro or dollar, it’s not controlled by any central bank, government, or corporation. It operates through a global network of computers that validate and record every transaction in a public ledger called the blockchain.

In practical terms, Bitcoin lets you send money to anyone in the world, within minutes, 24/7, often with fees lower than traditional international wire transfers. No bank account needed, no permission required: just an internet connection.

Technical definition: Bitcoin (BTC) is a peer-to-peer payment protocol and digital unit of account, whose issuance and transactions are secured by cryptography and validated in a decentralized manner by a network of nodes.

Who created Bitcoin and why?

Bitcoin was created by a person (or group) using the pseudonym Satoshi Nakamoto. On October 31, 2008, Nakamoto published a 9-page technical document — the famous white paper — titled « Bitcoin: A Peer-to-Peer Electronic Cash System. »

This document laid the foundation for a revolutionary system: a currency that works without trusted third parties, where users can exchange value directly with each other.

The context matters: we were in the midst of the 2008 financial crisis. Banks were collapsing, governments were bailing them out with public money. Trust in the traditional financial system was at rock bottom. Bitcoin emerged as a response to this distrust — an alternative where no one can manipulate the currency or freeze your funds.

On January 3, 2009, Nakamoto mined the first block of the Bitcoin blockchain, called the Genesis Block. He embedded a now-famous message: « The Times 03/Jan/2009 Chancellor on brink of second bailout for banks » — a direct reference to The Times newspaper headline that day about UK bank bailouts.

How does Bitcoin work? (Simple explanation)

Imagine a giant accounting ledger, viewable by everyone, where every transaction is permanently recorded. That’s the blockchain: a chain of blocks containing the complete history of all Bitcoin transactions since 2009.

Here’s what happens when you send bitcoin:

- You sign the transaction with your private key (a secret code only you possess)

- The transaction is broadcast to the global network of Bitcoin nodes

- Miners verify it and group it with other transactions into a « block »

- The block is added to the blockchain after network validation

- The transaction is confirmed and becomes irreversible

This process takes an average of 10 minutes for the first confirmation, with a few additional confirmations recommended for larger amounts.

Why does Bitcoin have value?

Bitcoin’s value rests on several fundamental pillars:

1. Programmed scarcity

There will never be more than 21 million bitcoins. It’s written in the code, impossible to change. Today, approximately 19.6 million are already in circulation. The last ones will be mined around 2140.

This scarcity contrasts with traditional currencies: central banks can print as many euros or dollars as they want, mechanically diluting the value of your savings.

2. Decentralization

No single entity controls Bitcoin. Tens of thousands of nodes around the world independently validate every transaction. To « hack » Bitcoin, you’d need to control over 50% of global computing power — a technically and economically near-impossible feat.

3. Network effect

The more Bitcoin is adopted, the more useful and valuable it becomes. Millions of people hold it, thousands of merchants accept it, publicly traded companies like Tesla and MicroStrategy hold it in their treasuries.

Mining: how are new bitcoins created?

Mining is the process by which new bitcoins are put into circulation and transactions are secured.

Miners use specialized computers to solve complex mathematical problems. The first to find the solution can add a new block to the blockchain and receives a bitcoin reward.

The halving: approximately every 4 years, this reward is cut in half. It was 50 BTC in 2009, then 25, 12.5, 6.25, and since April 2024, it’s 3.125 BTC per block. This mechanism creates decreasing and predictable inflation.

What is Bitcoin actually used for?

Global payment method

Bitcoin enables instant money transfers anywhere in the world without going through a bank. It’s particularly useful for:

- International transfers (cheaper and faster than Western Union or SWIFT wires)

- The unbanked (1.4 billion adults worldwide don’t have a bank account)

- People living under authoritarian regimes or in countries with hyperinflation

Store of value (« digital gold »)

With its limited supply and censorship resistance, Bitcoin is often compared to gold. Some investors use it as protection against inflation and central banks’ expansionary monetary policies.

Investment asset

Bitcoin has become an asset class in its own right. Bitcoin ETFs are now listed in the United States, allowing traditional investors to access it through their regular brokerage accounts.

How to buy and store your bitcoins?

Where to buy Bitcoin?

You can buy bitcoin on regulated exchanges like Coinbase, Kraken, or Binance. The process is straightforward:

- Create an account and verify your identity (KYC)

- Deposit funds via bank transfer or credit card

- Buy BTC (you can buy fractions — no need for a whole bitcoin)

How to store your bitcoins securely?

Your bitcoins are controlled by a private key. Whoever holds this key owns the bitcoins. Hence the saying: « Not your keys, not your coins. »

Hot wallets (connected wallets): mobile apps or software like MetaMask, Trust Wallet. Convenient for small amounts and daily use, but vulnerable to hacks.

Cold wallets (offline wallets): physical devices like Ledger or Trezor. Your keys are never exposed to the internet. Recommended for securing significant amounts.

Risks to know before investing

Bitcoin isn’t without risks. Before investing, you need to understand:

- Extreme volatility: the price can swing 10%, 20%, sometimes 50% within weeks. This isn’t a « set and forget » investment.

- Loss risk: if you lose your private key or seed phrase, your bitcoins are gone forever. No customer service can recover them.

- Regulatory risk: governments could tighten regulations, impacting Bitcoin’s use or value.

Golden rule: only invest what you’re prepared to lose entirely.

Conclusion: Bitcoin, a monetary revolution

In 15 years of existence, Bitcoin has evolved from a cryptographers’ experiment to an asset valued at hundreds of billions of dollars, adopted by individuals, corporations, and even nations (El Salvador adopted it as legal tender in 2021).

Whether you see it as a monetary revolution, a speculative asset, or a technological curiosity, Bitcoin has become impossible to ignore. Understanding how it works is now a useful skill for navigating the 21st-century financial landscape.

📚 Glossaire

- Bitcoin (BTC) : First decentralized cryptocurrency, created in 2009 by Satoshi Nakamoto. Operates on a peer-to-peer network without central authority.

- Blockchain : Distributed and immutable digital ledger that chronologically records all Bitcoin transactions. Each block is cryptographically linked to the previous one.

- Satoshi Nakamoto : Pseudonym of Bitcoin’s anonymous creator. Published the white paper in 2008 and mined the first block in 2009. Identity remains unknown.

- Mining : Process of validating transactions and creating new bitcoins. Miners use computing power to secure the network.

- Halving : Halving of miners’ reward every 210,000 blocks (~4 years). Programmed supply reduction mechanism.

- Private key : Secret cryptographic code that allows signing transactions and proving ownership of your bitcoins. Never share it.

- Wallet : Software or device for storing your private keys and interacting with the Bitcoin network.

- Proof-of-work : Consensus mechanism where miners must prove they’ve performed computational work to validate a block.

Questions fréquentes

Is Bitcoin legal?

Yes, Bitcoin is legal in most countries including the US, UK, and EU. You can freely buy, hold, and sell it. Capital gains are typically subject to taxation. Regulations vary by jurisdiction, so check your local laws.

Can you buy a fraction of bitcoin?

Yes, absolutely. One bitcoin is divisible to 8 decimal places. The smallest unit, called a « satoshi » (named after the creator), equals 0.00000001 BTC. You can buy $10, $50, or any amount you choose.

Is Bitcoin anonymous?

No, Bitcoin is pseudonymous, not anonymous. All transactions are public and traceable on the blockchain. Your identity doesn’t appear directly, but analysis can sometimes link addresses to individuals. For more privacy, other solutions exist (Lightning Network, mixers).

Can Bitcoin go to zero?

Technically possible but highly improbable. For Bitcoin to go to zero, no one in the world would have to assign it any value — yet millions of people and institutions hold it. Its network has been running for 15 years without major interruption.

What's the difference between Bitcoin and other cryptocurrencies?

Bitcoin is the first and most decentralized cryptocurrency. Other projects like Ethereum have different goals (smart contracts, decentralized applications). Bitcoin focuses on one mission: being a digital currency resistant to censorship and inflation.

Is Bitcoin mining bad for the environment?

Mining does consume energy, but the debate is nuanced. According to several studies, over 50% of global mining now uses renewable energy. Additionally, mining can utilize otherwise wasted energy (flared gas, excess hydroelectric).

📰 Sources

Cet article s'appuie sur les sources suivantes :

Comment citer cet article : Fibo Crypto. (2026). What Is Bitcoin? Complete Guide 2026. Consulté le 5 février 2026 sur https://fibo-crypto.fr/en/blog/what-is-bitcoin-complete-guide