How to Invest a Small Amount of Money in Cryptocurrencies

📋 En bref (TL;DR)

- You can start investing in cryptocurrency with as little as €10—cryptocurrencies are fractional, unlike traditional stocks

- Use dollar-cost averaging (DCA): invest fixed amounts monthly to reduce volatility impact

- Diversification is key even with small amounts—spread across multiple assets

- Choose a platform registered with financial authorities (PSAN in France) for security

- Only invest what you can afford to lose entirely

Cryptocurrencies have become a hot topic in the investment world, attracting attention from both beginners and experts. For those looking to invest a small amount of money, cryptocurrencies offer fertile ground—though often intimidating—to start sowing the seeds of financial growth. In this article, we’ll explore the essential steps to invest professionally in cryptocurrencies, even with a modest sum at your disposal.

Understanding Cryptocurrencies and Investment

Cryptocurrencies are digital forms of money that operate on blockchain technology, offering secure and decentralized transactions. The cryptocurrency market is expanding rapidly, comparable to the early days of the internet. Allocating a portion of your savings to this new asset class appears to be a good opportunity. However, “cryptos” can see their prices fluctuate rapidly, both up and down. It’s therefore important to start by defining a budget before making your first investment.

Setting a Budget to Start Investing Small Amounts Gradually

With a small sum to invest, establish a clear and realistic budget. Only invest what you can afford to lose—this is the first rule of any investment.

For a sound investment, we recommend “smoothing your investment,” which means placing a fixed amount of your budget each month. This helps minimize risks associated with market fluctuations.

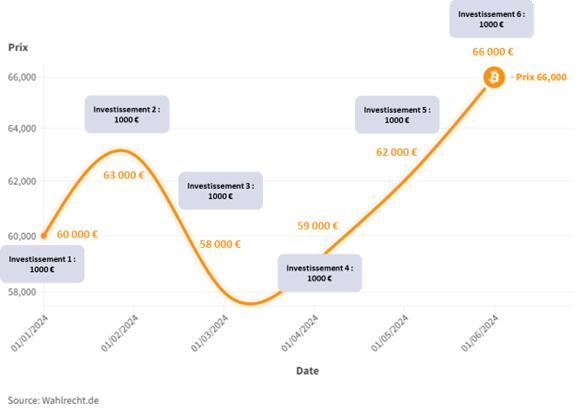

Example of dollar-cost averaging:

You want to invest €6,000 in total. It’s preferable to invest €1,000 each month for 6 months instead of €6,000 all at once.

When the crypto price varies during this period, the investor automatically acquires more cryptocurrency when prices are low and less when prices are high. This strategy can potentially reduce the average cost per asset over time, allowing the investor to smooth their entry price.

👉 Only invest what you can afford to lose

Diversifying Your Investment

The second fundamental principle of the smart investor is to diversify investments.

A key advantage of investing in cryptocurrencies is that, even with a modest sum, it’s simple to diversify your investment. Indeed, cryptos are “fractional,” meaning you can buy a small piece of a cryptocurrency. Thanks to this, you can buy a portion of Bitcoin with just a few euros.

In contrast, if you choose to invest in the stock market through individual stocks, you cannot fractionalize these purchases. That is, it’s not possible to invest in a portion of a stock. If a share costs €600, you’ll need €600 to obtain the asset—quite constraining for diversifying your savings!

If you already own some more traditional investment products like life insurance or ETFs, it becomes even more interesting to diversify your investments through cryptocurrencies. The benefits are twofold: energizing and diversifying your investments.

🍳 Don’t put all your eggs in one basket. Diversify your cryptocurrency portfolio to reduce risks.

Choosing an Investment Platform for Your Cryptocurrencies

This section is certainly the most important for investing a small sum in cryptocurrencies.

Security and Reliability

First, select a secure exchange platform to buy and store your cryptocurrencies. The crypto sector is filled with scams, with jurisdiction still under construction. Thus, it’s imperative to choose your investment platform carefully to avoid any future problems. Here are some boxes to check to judge a crypto investment platform’s security and reliability:

✅ Company registered as PSAN with the AMF (Digital Asset Service Provider)

You can check registered PSANs on the official AMF website. With a PSAN company, you avoid problems with fraudulent and dishonest sites. In short, PSAN is a registration that companies can obtain from the AMF (the AMF is essentially the financial police). This registration requires, among other things, the implementation of anti-money laundering and terrorism financing procedures, reliable IT systems, and asset custody systems that comply with security standards. This registration is mandatory for any French company wishing to operate in the cryptocurrency sector.

✅ Easily reachable support

How easily can you access support? It’s interesting to see if you can easily contact the platform’s teams, whether by phone or message.

✅ MPC technology for asset custody

Asset custody is a central topic for judging a platform’s reliability. In terms of security in this area, MPC technology is one of the most secure. In very schematic terms, we can draw an analogy between MPC technology and the horcruxes from the Harry Potter saga: the password protecting your assets is divided into several pieces. Each of these pieces is stored and locked on a server.

Red Flags

Now that we’ve seen the important points in terms of security and reliability, let’s observe the signs that can warn you of a fraudulent platform.

❌ Extraordinary returns

If the displayed returns seem disproportionate and no notion of risk is put in parallel with these returns, it’s probably a scam—stay away!

❌ Guaranteed returns

Just like extraordinary returns, if you’re promised a guaranteed return, red flag! Today, no crypto product can guarantee you a financial return. Additionally, it’s illegal.

❌ Company created in a tax haven

Generally, favor companies whose statutes are in your country or reputable jurisdictions. Avoid companies located in Cyprus, the Grenades Islands, the Bahamas, Samoa Islands, etc.

Crypto Investment Options for Everyone

There are two possibilities for investing small sums in cryptocurrencies when you’re new to the field.

Using an exchange platform like Binance

Binance is the most widespread centralized exchange platform to date. This type of centralized platform isn’t a good solution when you don’t know the cryptocurrency sector well. Indeed, while experts can invest small amounts in cryptocurrencies without too much difficulty, newcomers will easily get lost on these exchanges where more than 10,000 products are offered.

Additionally, there’s temptation to invest in assets highlighted by the platform. These cryptos often have momentum for 24 hours and display impressive returns but are rarely good long-term investments. They’re most often a passing hype in the crypto ecosystem.

Managed solutions for beginners

For those who want a simpler approach, managed investment solutions offer a turnkey option. These services create diversified asset portfolios aligned with your investor profile to meet your objectives and preferences.

Conclusion

Investing a small sum of money in cryptocurrencies is an excellent way to diversify and energize your savings. If the price variations in this sector and scams scare you, if you lack time to understand the ecosystem, or if you’re simply not interested in how it works, then don’t hesitate to start building your crypto wealth with a trusted, regulated platform. Let the experts handle the complexity while you benefit from the growth potential.

Frequently Asked Questions

What is the minimum amount to invest in crypto?

There’s no real minimum—you can start with as little as €1 or $1 on most platforms. Cryptocurrencies are fractional, meaning you can buy a tiny portion of any coin. However, consider platform fees when investing very small amounts.

What is dollar-cost averaging (DCA)?

Dollar-cost averaging is an investment strategy where you invest a fixed amount at regular intervals (weekly, monthly) regardless of price. This reduces the impact of volatility and eliminates the stress of trying to time the market.

Can I make money with a small crypto investment?

Yes, it’s possible to grow a small investment over time, especially using strategies like DCA and long-term holding. However, remember that all investments carry risk, and you should never invest more than you can afford to lose.

Is €100 enough to start investing in crypto?

€100 is a perfectly reasonable amount to start your crypto journey. It allows you to diversify across 2-3 different cryptocurrencies and learn how the market works with real money at stake, without risking significant capital.

📰 Sources

This article is based on the following sources:

Comment citer cet article : Fibo Crypto. (2026). How to Invest a Small Amount of Money in Cryptocurrencies. Consulté le 4 February 2026 sur https://fibo-crypto.fr/en/blog/how-to-invest-small-amount-money-cryptocurrencies